Understanding HIBT Bitcoin Market Liquidity Metrics

With over $4.1 billion lost to decentralized finance (DeFi) hacks in 2024, understanding the intricacies of the Bitcoin market liquidity metrics has never been more critical. In the world of cryptocurrency, precisely measuring and comprehending liquidity is an essential factor for traders, investors, and institutions alike. In this comprehensive guide, we will delve into the HIBT Bitcoin market liquidity metrics, providing insights on how they can enhance your trading practices.

What Are Liquidity Metrics?

Liquidity metrics refer to the measurements that assess one asset’s ease of buying or selling on the market without causing significant price changes.

They are particularly pertinent in the cryptocurrency sector, where price volatility can be extreme. Examples of liquidity metrics include:

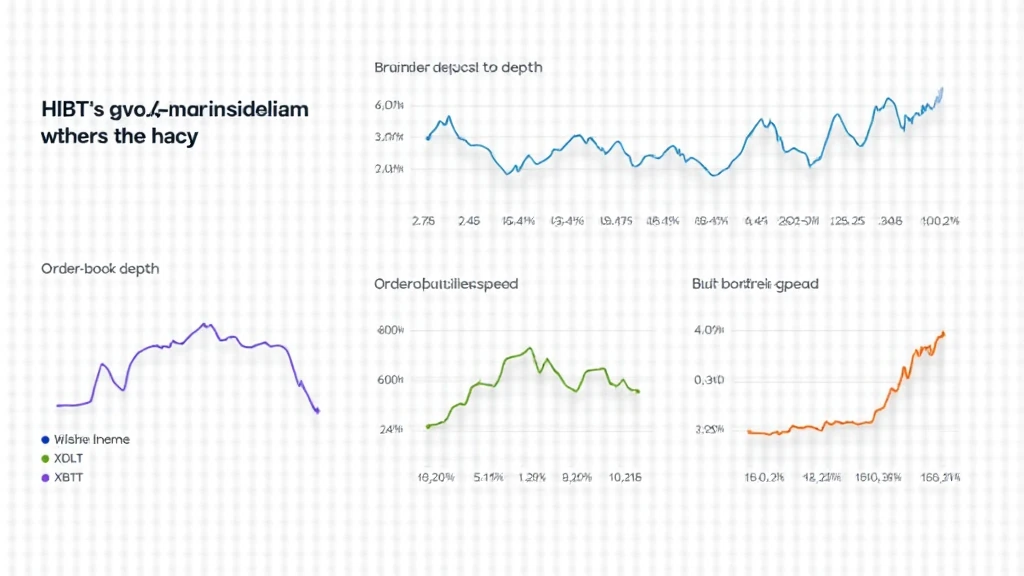

- Order Book Depth: A measure of the buy and sell orders at various price levels.

- Bid-Ask Spread: The difference between the highest bid and lowest ask price.

- Volume: The quantity of an asset traded within a specific time frame.

In Vietnam, the interest in cryptocurrency trading has surged, resulting in a remarkable 140% growth rate of users in 2023. Understanding liquidity is crucial for these new traders to make informed decisions.

The Role of HIBT in Bitcoin Market Liquidity

The HIBT (High-Income Bitcoin Trading) platform introduces state-of-the-art liquidity metrics tailored for Bitcoin trading. By utilizing advanced blockchain technology and real-time analytics, HIBT ensures that liquidity is measured accurately, providing traders with reliable data upon which to base their decisions.

Importance of HIBT Liquidity Metrics

So, here’s the catch: Having access to robust liquidity metrics can significantly influence your trading strategy. For instance, the bid-ask spread is a key indicator. A narrower spread often implies that the market has high liquidity, making it more attractive for traders. On the other hand, a wider spread might indicate liquidity issues, highlighting risks to potential investors.

Key HIBT Bitcoin Liquidity Metrics to Consider

When evaluating the HIBT platform’s liquidity metrics, it’s essential to analyze the following key indicators:

- Order Book Depth: A more profound order book indicates higher liquidity and better execution of trade orders.

- Market Volume: High trading volume suggests active participation, which typically leads to lower price volatility.

- Slippage: This measures the difference between the expected price of a trade and the actual price. Lower slippage reflects better liquidity.

This is especially important for Vietnamese traders entering the crypto market for the first time, allowing them to navigate these essential metrics easily.

How to Utilize HIBT Bitcoin Market Liquidity Metrics

Let’s break it down further: Knowing how to leverage these liquidity metrics is vital for executing profitable trades. Here’s a step-by-step approach to utilizing HIBT’s liquidity metrics:

- Analyze Order Book: Keep an eye on the order book depth to gauge market momentum.

- Monitor Bid-Ask Spread: A smaller spread usually indicates a healthier market, making it a preferable time to trade.

- Check Trading Volume: For cryptocurrencies, a higher trading volume often means it is more liquid, which is favorable for traders.

- Account For Slippage: Always consider slippage when executing large orders, as high slippage can erode profits.

By applying the above methodologies, Vietnamese crypto enthusiasts and traders can sharpen their trading effectiveness.

Real-World Data: HIBT and Vietnam’s Growing Market

According to a recent report from Chainalysis, 2025 is projected to see an unprecedented surge in Vietnamese crypto adoption, potentially making it one of the fastest-growing markets globally. Understanding the liquidity metrics offered by HIBT will be essential for traders planning to enter or thrive in this market.

Conclusion

As we wrap things up here, it’s clear that having a firm grasp on HIBT Bitcoin market liquidity metrics isn’t just for institutional investors or experienced traders. Whether you are a seasoned professional or a newcomer in Vietnam, integrating HIBT metrics into your trading approach can lead to smarter, data-driven decisions.

Stay informed, engage with trusted liquidity metrics, and protect your investments. Visit HIBT to explore innovative solutions today. Remember, no financial advice replaces consulting local regulators before diving into trading.

This approach will not only inform your trades but also position you as a credible participant in the evolving landscape of cryptocurrency.

Written by Dr. Nguyễn Văn An, a blockchain technology expert with over 20 published papers and a leading consultant in smart contract audits.