Understanding HIBT Exchange Leverage Ratio Requirements

With the increasing complexity of digital assets, trading has become a sophisticated venture. The global cryptocurrency market faced significant fluctuations in 2024, with $4.1 billion lost to DeFi hacks. Such volatility has brought attention to the importance of understanding exchange leverage, particularly on platforms like HIBT.

In this article, we explore the leverage ratio requirements of the HIBT exchange, focusing on their impact on traders. We also break down relevant insights unique to the Vietnamese market, where a growing number of users are entering the cryptocurrency space.

What is Leverage in Cryptocurrency Trading?

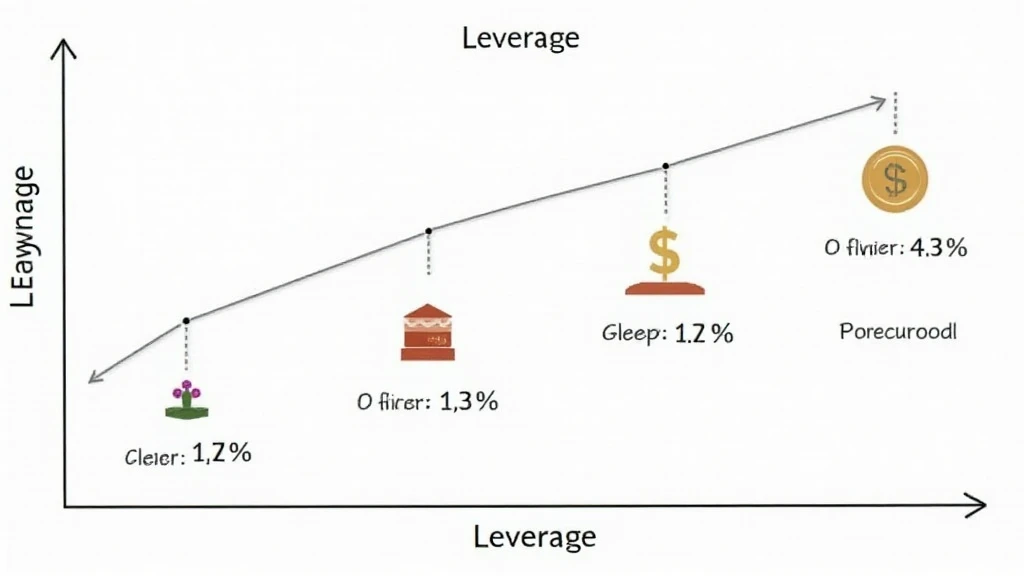

Leverage allows traders to open larger positions than their account balance would normally allow by borrowing funds from the exchange. Essentially, it amplifies both profit and loss. For instance, with a leverage ratio of 10:1, a trader can control $10,000 with just a $1,000 deposit.

- Leverage Ratio: Defines the amount of borrowed capital relative to your own.

- Margin: The amount of equity required to open a position.

Understanding HIBT Exchange’s Requirements

The HIBT exchange has set specific leverage ratio requirements to ensure that their platform remains secure and user-friendly. Knowing these can help traders make informed decisions.

Leverage Ratios Offered by HIBT

HIBT typically offers a variety of leverage options depending on the asset:

- Crypto-to-Crypto trading: Up to 20x

- Forex trading: Up to 50x

- Margin restrictions for volatile assets

These ratios are particularly pertinent to Vietnamese traders as the user base grows by an estimated 35% per annum, illustrating a rising interest in leveraged trading.

Understanding Margin and Risk

It’s crucial to grasp how margin and leverage intertwine to understand potential risks. Higher leverage means lower margin but increases the risk of liquidation. For example, a 20x leverage requires a 5% margin, meaning traders might face significant losses faster if the market moves against them.

Real-World Implications of HIBT’s Leverage Requirements

Let’s illustrate with a scenario: consider a trader with $1,000 in their account using HIBT’s 10:1 leverage to buy Bitcoin at $50,000.

- If Bitcoin rises to $55,000, the trader’s account balance could swell to $1,500.

- If Bitcoin drops to $45,000, their account could quickly drop to $500, risking liquidation.

This scenario emphasizes the duality of leverage; while it can amplify gains, it can equally heighten risks. Understanding HIBT’s leverage policies is thus critical.

Strategies for Safe Trading with HIBT

To maximize the benefits while minimizing risks, traders should employ strategies such as:

- **Hedging**: Protecting against potential losses in one position by taking opposite positions in another market.

- **Stop-Loss Orders**: Automatically selling assets at a predetermined price to minimize losses.

Using these strategies is essential for Vietnamese traders entering an expanding market, where knowledge of local trends can also impact trading actions.

Conclusion

Ultimately, understanding the HIBT exchange leverage ratio requirements is essential for any trader wishing to navigate the many complexities of cryptocurrency trading. The right leverage can offer immense opportunities but requires a deep understanding of both market conditions and personal risk appetite.

As the Vietnamese cryptocurrency user base continues to grow, staying informed will empower traders to engage confidently with platforms like HIBT. Always remember: leverage is not just about margin, it’s about managing risk effectively.

For more insights into cryptocurrency trading, visit HIBT and enhance your trading experience.

Author: Dr. Nguyen Hoang, a blockchain security expert with over 15 published papers in the field and significant experience auditing major cryptocurrency projects.