Introduction: Understanding HIBT Bitcoin Price Target Adjustment Factors

As the cryptocurrency market continues to evolve, factors influencing price targets become crucial. Recent data indicates that in 2024 alone, $4.1 billion was lost due to DeFi hacks, which draws attention to the importance of cybersecurity in the blockchain space. A significant player within this ecosystem is HIBT (Horizon Blockchain Token), which has gained traction among investors looking toward the future. This article aims to break down the adjustment factors affecting HIBT Bitcoin price targets, providing a comprehensive understanding of what shapes these numbers.

Market Demand and Supply Dynamics

One of the primary factors affecting HIBT Bitcoin price targets is the balance of demand and supply in the market. When demand exceeds supply, prices tend to rise. Conversely, surplus supply with diminishing demand leads to price drops. This phenomenon can be likened to traditional economics, where both demand and supply steadily shift based on buyer behavior and investor sentiment.

- Increased Adoption: As more users enter the market, the demand for HIBT Bitcoin naturally increases.

- Investor Sentiment: Positive news can boost demand, resulting in upward price adjustments.

According to recent statistics, the number of crypto users in Vietnam has seen a growth rate of 120% over the past year. This surge is essential for local markets as it indicates a heightened interest in cryptocurrencies, including HIBT Bitcoin.

Technological Developments

Technological advancements within the blockchain and cryptocurrency arena play a significant role in shaping the HIBT Bitcoin price targets. Innovations such as scalability enhancements, security improvements, and user interface upgrades can lead to increased user trust and, consequently, greater demand.

- Scalability Solutions: Implementing faster transaction processes increases user satisfaction.

- Security Enhancements: Features that protect against hacking contribute to a positive market perception.

For example, a recent upgrade to the HIBT platform introduced smart contract capabilities, which have been well-received and could impact future price targets positively.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies is a double-edged sword that significantly influences price targets. Regulatory clarity can foster growth and attract institutional investors, while ambiguity or stringent regulations might deter potential buyers.

- Clear Guidelines: When governments outline acceptable practices, investor confidence often boosts.

- Tax Policies: Cryptocurrency tax regimes, especially in places like Vietnam, affect trading behavior.

For instance, the Vietnamese government’s stance on cryptocurrency trading and taxation directly impacts local interest in HIBT Bitcoin.

Market Competition

Competition among cryptocurrencies can significantly influence HIBT’s price targets. The presence of alternative tokens can either attract or detract investors from HIBT Bitcoin, depending on the latter’s perceived value. Market dynamics can be likened to a race; if competitors offer better features or stability, HIBT must adapt to maintain its relevance.

- Emerging Altcoins: Growth in other tokens can divert potential HIBT investors.

- Strategic Partnerships: Forming alliances can strengthen HIBT’s position against competitors.

In 2025, projected advancements in blockchain technology may lead new altcoins to garner user interest or loyalty, which could indirectly affect HIBT Bitcoin’s price targets.

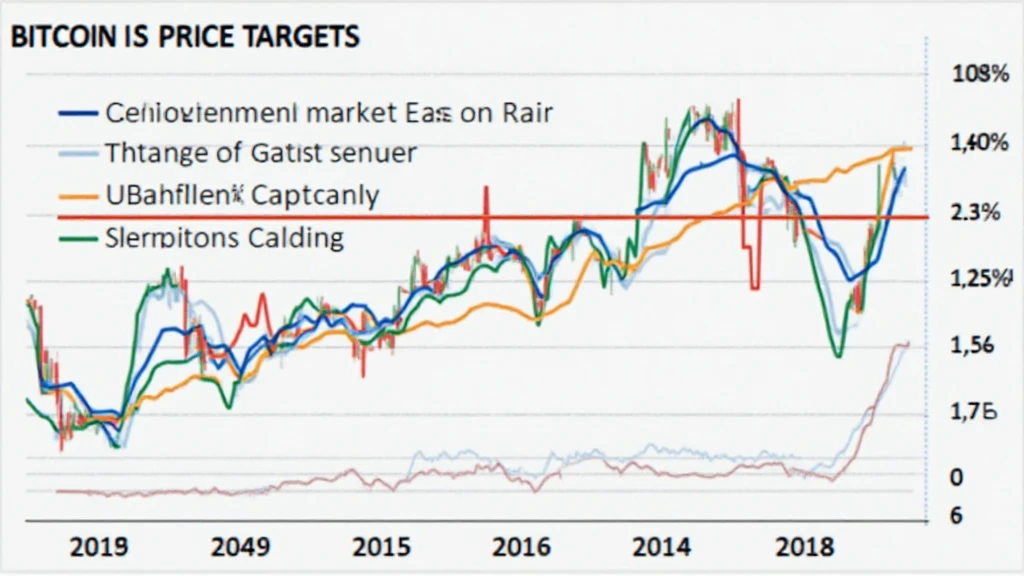

Market Sentiment and Analysis

Market sentiment, driven by social media trends and news outbreaks, can have dramatic impacts on HIBT Bitcoin price targets. In trading, emotions often rule market actions, leading to sudden price swings based on collective psychology.

- Social Media Influence: Viral trends or FOMO (Fear of Missing Out) can spike interest in investing.

- Market Predictions: Analysts’ forecasts can sway public perception and trading decisions.

As seen with Bitcoin, significant price movements are frequently correlated with social sentiment, making monitoring trends essential for accurate price target adjustments.

Conclusion: A Comprehensive Understanding of HIBT Bitcoin Price Target Adjustment Factors

In summary, understanding the key factors influencing HIBT Bitcoin price targets can provide investors with a more nuanced view of its potential movements. Market demand and supply, technological developments, regulatory landscapes, competition, and market sentiment play vital roles in shaping this cryptocurrency’s future. With the Vietnamese market expanding rapidly and gaining interest in cryptocurrencies, particularly HIBT Bitcoin, these factors will remain crucial as we approach 2025. Investors are encouraged to stay informed, consulting local regulations to navigate these adjusting factors effectively.

For further insights and real-time updates on cryptocurrency dynamics, visit hibt.com. Make sure to check our other articles, including Vietnam crypto tax guide and The Impact of Blockchain on Global Trade to stay ahead in your crypto journey.

Written by Dr. Alex Nguyen, a blockchain consultant with over 15 years of experience. He has published more than 30 papers on blockchain technology and led several major auditing projects.