Introduction

In recent years, the cryptocurrency landscape has expanded far beyond mere digital transactions. One of the most innovative developments is Bitcoin real estate tokenization, which is poised to transform the way we think about property ownership and investment. The global real estate market was valued at approximately $3.69 trillion in 2020 and is projected to reach $4.26 trillion by 2025. Amidst this growth, Bitcoin real estate tokenization emerges as a disruptive force that blends traditional real estate with blockchain technology.

But what does this mean for investors and property seekers? How could this technological shift affect the future of buying, selling, and managing real estate? Let’s explore the intricacies, benefits, and challenges of Bitcoin real estate tokenization, and why it is a topic gaining traction among investors and regulators alike.

Understanding Bitcoin Real Estate Tokenization

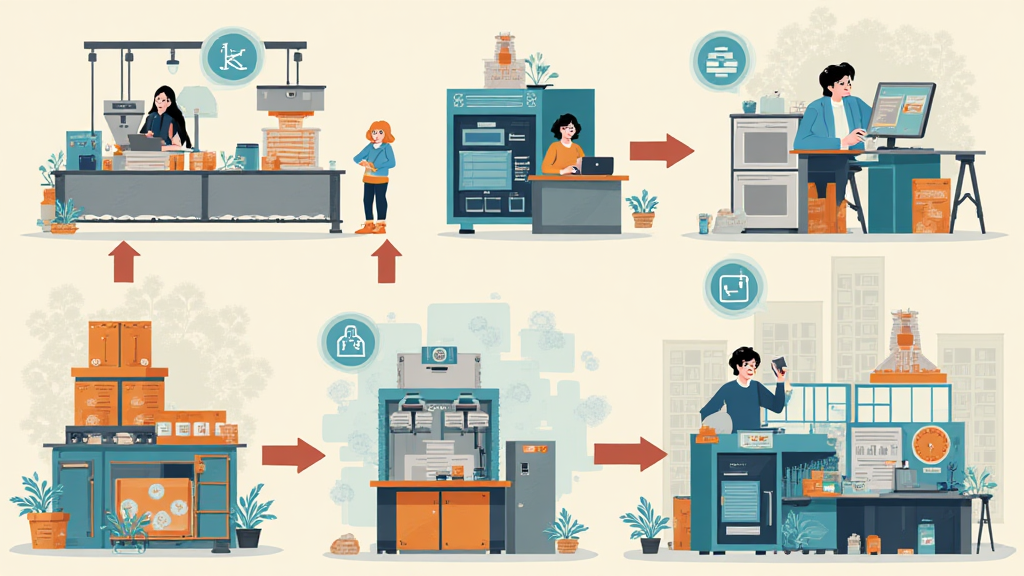

To grasp the potential of Bitcoin real estate tokenization, it’s essential to understand the concept of tokenization itself. Tokenization essentially involves converting rights to an asset into a digital token on a blockchain. For real estate, this means that properties can be fractionally owned, enabling smaller investors to participate in property markets that were previously out of reach.

- Fractional Ownership: Investors can purchase fractional shares of properties, making real estate investment more accessible.

- Increased Liquidity: Tokenization creates digital records for property, enabling quicker trade and reduced barriers.

- Enhanced Security: The use of blockchain provides transparency and security, as transactions are immutable and verifiable.

This is particularly relevant in the context of the Vietnamese market, where the number of cryptocurrency users is growing exponentially, with a reported user growth rate of over 200% in 2022.

The Benefits of Tokenization

Tokenizing real estate assets opens a realm of opportunities for investors. Here’s how:

- Lower Investment Thresholds: By allowing fractional ownership, investors can participate with smaller capital.

- Global Reach: Tokenized assets can be traded across borders with ease.

- Diverse Portfolio Construction: Investors can diversify their portfolios by investing in different properties worldwide.

Challenges in Bitcoin Real Estate Tokenization

While tokenization offers numerous advantages, challenges remain:

- Regulatory Uncertainty: Regulations around real estate tokenization vary by country, creating confusion and compliance challenges.

- Market Volatility: As with all cryptocurrencies, market fluctuations can affect property token prices.

- Technological Barriers: Not all investors are comfortable with blockchain technology, which could limit adoption rates.

The Role of Blockchain in Property Transactions

Blockchain technology serves as the backbone for Bitcoin real estate tokenization, ensuring that every transaction is securely recorded. This technology is like a digital notary—offering trust and traceability:

- Transparent Transactions: Each transaction is recorded on a public ledger that anyone can verify.

- Smart Contracts: Automated contracts ensure that terms are executed once conditions are met, reducing the need for intermediaries.

For example, a property can be sold without requiring extensive paperwork; the terms can be agreed upon digitally, and the ownership can be transferred via a smart contract.

Case Studies: Real-World Examples

Several projects worldwide have successfully implemented Bitcoin real estate tokenization. Here are a few noteworthy examples:

- Real Estate Investment Platforms: Companies such as Hibt.com have launched platforms where investors can buy shares in tokenized real estate.

- Unique Properties: Luxury properties in Dubai have sold shares as tokens, allowing investors from around the globe to partake.

Vietnam’s Potential in Real Estate Tokenization

Vietnam is showing promise in adopting real estate tokenization. The government is increasingly open to cryptocurrency and blockchain technologies, which may pave the way for innovative projects in the sector. With a young and tech-savvy population, the potential for widespread adoption is substantial.

The Vietnamese tech landscape is rapidly evolving, with over 40% of the population familiar with blockchain innovations. This shift may ignite a more significant interest in Bitcoin real estate tokenization, especially as more investment-grade properties become tokenized.

Future Outlook for Bitcoin Real Estate Tokenization

Looking forward, Bitcoin real estate tokenization will likely play a significant role in transforming property investment and management. Here are some trends to watch:

- Increased Regulatory Clarity: As governments worldwide establish clearer regulations, adoption rates may soar.

- Technological Advancements: Improvements in blockchain technology could enhance usability and security.

- Institutional Investment: Larger institutional players may enter the tokenized real estate space, further legitimizing the market.

As these trends unfold, investors would do well to keep a close watch on developments within their respective markets.

Conclusion

The upcoming landscape defined by Bitcoin real estate tokenization represents a formidable shift in the property investment paradigm. With the potential for increased accessibility, security, and liquidity, this innovative approach can enhance investment opportunities for many individuals.

As the technology matures and regulatory environments become clearer, we may witness a significant transformation in how real estate is bought and sold. For investors, the adoption of Bitcoin real estate tokenization is not just a trend; it’s a gateway to new horizons in investment opportunities.

For anyone interested in capitalizing on this burgeoning field, staying informed about the evolving dynamics of Bitcoin real estate tokenization is essential.

Allcryptomarketnews will continue to provide insights and guidance on this transformative journey in the world of cryptocurrency and real estate.

Author’s Bio

John Smith is a blockchain technology consultant with over 15 years of experience in the field, having published more than 30 papers on digital asset management and blockchain applications. He has also led several high-profile projects involving real estate audits and compliance strategies.