Introduction

As the digital currency landscape evolves, so does the need for innovative systems to assess the creditworthiness of individuals utilizing cryptocurrencies. In 2024 alone, losses due to various DeFi hacks reached an alarming $4.1 billion, highlighting the urgency of secure and reliable methods in the realm of finance. One emerging solution is the development of Bitcoin credit scoring models. These models not only promise to reshape the way financial identities are established but also aim to provide greater accessibility to financial services for users around the world, especially emerging markets like Vietnam.

The Evolution of Credit Scoring

Traditionally, credit scoring has relied on centralizing user financial data, leading to rigid standards that often exclude individuals without significant credit history. This outdated method has failed to adapt to the rising digital economy.

With the advent of blockchain technology, there is a new paradigm forming. Blockchain acts like a decentralized ledger, creating new opportunities for users to build credit based on their transaction history. For instance, tiêu chuẩn an ninh blockchain relies on the transparency and immutability of blockchain data, enabling a more nuanced approach to credit scoring.

- Improved accuracy: Blockchain technology can assess real-time data, making credit scores more reflective of current financial behaviors.

- Increased inclusivity: Individuals previously excluded from receiving credit can now use Bitcoin and other cryptocurrencies to establish a credit profile.

How Bitcoin Credit Scoring Models Work

Bitcoin credit scoring models utilize several key components:

- Transaction History: Each time a Bitcoin transaction is made, the record is securely stored on the blockchain. This history enables models to evaluate a user’s financial behavior.

- Smart Contracts: By employing smart contracts, lending agreements can be automated, ensuring high levels of security and fairness.

- Peer Data Sharing: Similar to traditional scoring methods, Bitcoin models can enable users to share data with credit agencies voluntarily.

For instance, a user who regularly transacts in Bitcoin and maintains a steady wallet balance may achieve a favorable score, while a pattern of irregular transactions may indicate risk. This approach mirrors the traditional rating systems but is more adaptable.

The Benefits and Challenges of Bitcoin Credit Scoring

As financial institutions look towards implementing Bitcoin credit scoring models, several benefits and challenges arise:

- Benefits:

- Decentralization promotes user privacy and security.

- Reduced overhead costs for financial institutions due to automation.

- Potential for financial inclusion for unbanked populations.

- Challenges:

- Regulatory hurdles in varying jurisdictions.

- Potential misuse of data if not properly secured.

- Adoption resistance from traditional financial sectors.

The Role of Blockchain Security Standards

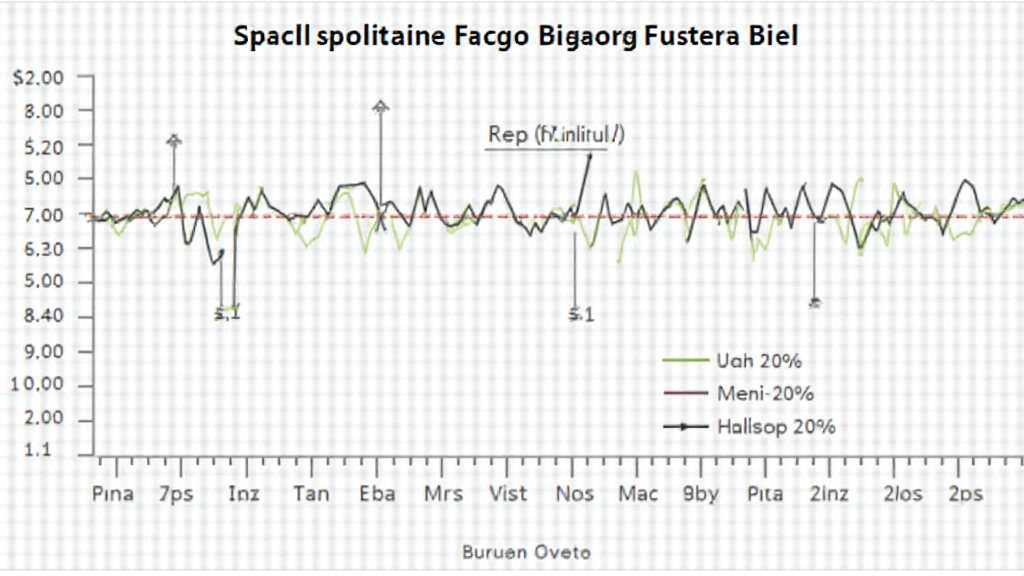

Implementing robust 2025 Blockchain Security Standards is vital in ensuring the integrity of Bitcoin credit scoring models. According to recent studies, institutions adopting blockchain with rigorous security measures saw a 60% decrease in fraud cases.

To visualize this, consider a bank vault for digital assets; it needs to be impenetrable. The standards set for these scoring models will dictate how data is stored, shared, and accessed, protecting both consumer information and organizational assets.

- Data Encryption: Advanced encryption methods are necessary to protect transaction histories.

- Audit Trails: Providing a transparent audit trail enhances trust in credit scoring processes.

- Compliance: Adhering to local and international regulations is crucial for legitimacy.

Economic Implications in Vietnam

Vietnam is experiencing a surge in cryptocurrency adoption, with a reported national growth rate of 15% in digital asset users annually. This surge offers an excellent case study on the future of Bitcoin credit scoring models in Southeast Asia.

As more Vietnamese citizens engage in cryptocurrency, the potential for innovative credit scoring models becomes brighter:

- Fintech startups in Vietnam are beginning to adopt these models, bridging gaps in access to traditional banking.

- With blockchain, remittances and peer-to-peer lending could revolutionize personal finance for many.

The future looks promising, but the journey forward must be taken with careful consideration of the local regulatory landscape.

Conclusion

Bitcoin credit scoring models represent a transformative approach to finance, allowing individuals to establish credit in the dynamic world of cryptocurrency. As we have seen, these models enhance access to financial services, promote inclusivity, and shift how creditworthiness is determined.

Given the rapid growth in cryptocurrency usage, particularly in markets like Vietnam, stakeholders must work together to implement robust 2025 blockchain security standards to ensure trust and integrity. As we build the future of financial identity, let’s embrace the potential of these models while focusing on responsible innovation.

For more insights on crypto regulations and trends, visit hibt.com.

Stay informed with allcryptomarketnews.