Ethena USDe Stablecoin: A Comprehensive Guide for Investors and Users

With the rapid growth of cryptocurrency investments surging by 150% in Vietnam in the past year alone, the demand for stablecoins has never been higher. Among various options available, the Ethena USDe stablecoin is emerging as a notable contender in the realm of digital assets. In this article, we will explore the intricacies, advantages, and the overarching potential of Ethena USDe stablecoin, carving a niche in the evolving landscape of cryptocurrency.

Understanding Ethena USDe Stablecoin

Ethena USDe is a fully backed stablecoin designed to provide a seamless user experience within the blockchain ecosystem. Similar to a bank vault for digital assets, it ensures that each token is pegged to the US dollar, mitigating volatility and creating a stable medium for transactions.

This stablecoin is backed by a combination of US Treasury bonds and fiat reserves, giving it a solid foundation that promotes investor confidence. In Vietnam, where the adoption of blockchain technology is growing—recording a 40% increase in 2023—Ethena USDe positions itself strategically to serve local investors seeking stability.

Why Choose Ethena USDe?

- Stability: Being pegged to the US dollar ensures minimal fluctuations in value.

- Trustworthiness: Backed by reserves and regulatory compliance, it provides a sense of security for users.

- Accessibility: Users can easily mint, redeem, or trade Ethena USDe across various platforms.

The Mechanics Behind Ethena USDe

How does Ethena USDe operate in a decentralized manner? The operational structure encompasses a robust framework accounting for supply and demand. Smart contracts play a pivotal role, automating the minting process and ensuring transparency. Additionally, the audit of these contracts enhances the reliability of transactions, making it easier to audit smart contracts in real time.

Here’s the catch: the system is designed to fluctuate according to the demand, adjusting the supply accordingly to maintain its peg to the dollar—similar to how central banks manage their national currencies.

The Role of Smart Contracts

- Smart contracts handle the minting and burning of tokens.

- Automates compliance checks with local regulations.

- Helps in maintaining user privacy while ensuring transaction integrity.

Market Adoption and User Growth in Vietnam

Vietnam’s cryptocurrency market is witnessing explosive growth, which is evident through its user growth rate of 55% in 2023. The demand for stablecoins like Ethena USDe is expected to rise as more individuals and businesses seek safe harbor in their financial activities. With the increasing curiosity surrounding blockchain and stablecoins, Ethena USDe caters perfectly to emerging needs.

According to Chainalysis, Vietnam ranked as the 9th highest in crypto adoption globally in 2023, indicating a robust marketplace for stablecoins.

Potential Applications of Ethena USDe

- Cross-border Transactions: Facilitate seamless international payments without the volatility of traditional cryptocurrencies.

- Decentralized Finance (DeFi): Participate in yield farming, lending, and borrowing with lower risk compared to other cryptos.

- Remittances: Address issues related to high remittance fees and long processing times.

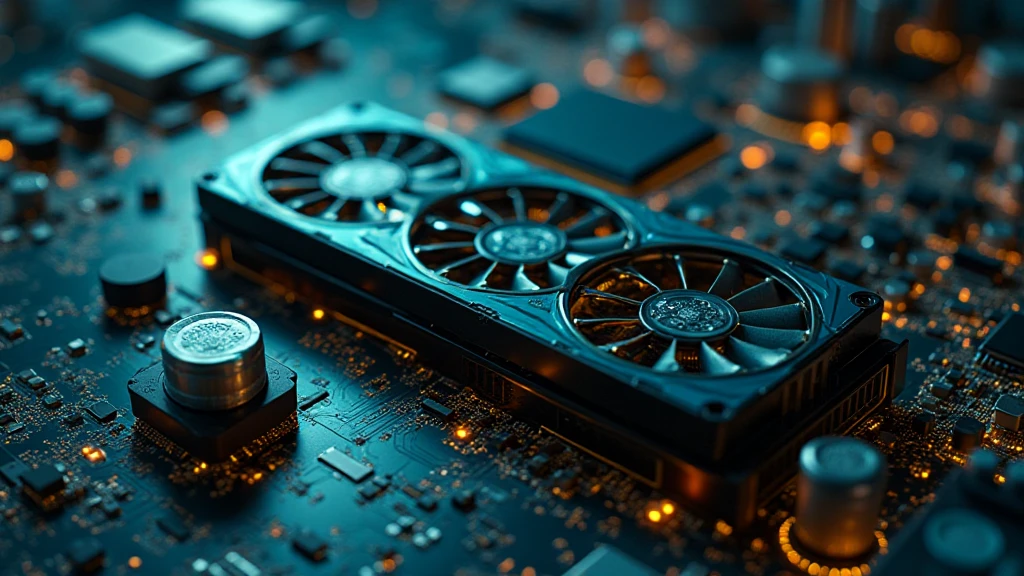

Technological Innovations and Security

The technology behind Ethena USDe focuses on ensuring security and compliance. Developments in blockchain security standards, sometimes referred to as “tiêu chuẩn an ninh blockchain” in Vietnamese, are crucial as more users engage with digital assets. With cyberattacks leading to a loss of approximately $3.5 billion in 2024, Ethena USDe’s commitment to utilizing advanced security measures is vital.

Users can rest assured knowing that the platform is subject to regular audits and adheres to international best practices.

Security Measures in Place

- Multi-signature wallets to prevent unauthorized access.

- Regular security audits conducted by third-party firms.

- 24/7 monitoring of network activity for suspicious transactions.

The Future of Ethena USDe

Looking ahead, the future of Ethena USDe appears promising as more investors turn to stablecoins for their investment strategies. The increasing acceptance within the business community and regulatory frameworks will likely encourage further expansion of Ethena’s utilization.

Furthermore, as the Vietnamese government explores new regulations surrounding cryptocurrencies, stablecoins like Ethena USDe could play a crucial role in shaping future policies.

Investor Considerations for 2025

- Stablecoins as a hedge: Use stablecoins to manage risks in your portfolio.

- Potential regulatory changes: Stay informed about evolving regulations that may impact stablecoin usage.

- Assessing liquidity: Ensure that your chosen platform offers adequate liquidity.

Conclusion

In summary, the Ethena USDe stablecoin is well-positioned to meet the demands of an evolving market. Its unique characteristics, coupled with the solid backing from reserves and strong security protocols, make it a compelling option for users and investors in Vietnam. With the continued growth of the cryptocurrency sector, Ethena USDe’s significance will only increase – shaping the future of digital transactions.

For more insights into the latest trends in cryptocurrency and blockchain technology, make sure to visit allcryptomarketnews.

Written by Dr. Alex Thao, a cryptocurrency expert with over 10 years of experience, published over 30 papers in the field, and led renowned projects in blockchain security assessments.