Introduction

As the crypto landscape continuously evolves, the relevance of reports like the HIBT Ethereum bond volatility reports has never been more significant. In 2024 alone, over $4.1 billion was lost in DeFi hacks, highlighting the critical need for transparent and reliable market analytics.

Vietnam’s demonstrating growth in cryptocurrency adoption reflects a broader trend, with crypto users increasing by 32% in the past year. This forms the backdrop against which we analyze HIBT’s performance in relation to Ethereum bond volatility.

Understanding HIBT and Its Position in the Market

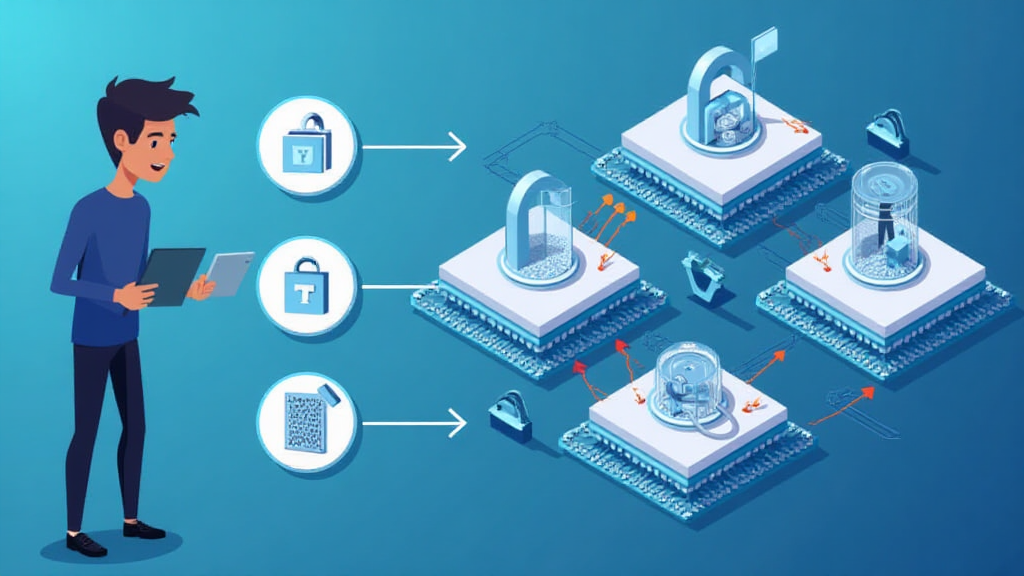

HIBT, or Hybrid Investment Bond Tracker, is an innovative financial product designed to stabilize returns in the volatile crypto market, specifically tied to Ethereum’s performance.

The need for hybrid investment products has surged due to the unpredictable nature of cryptocurrencies, emphasizing the demand for security standards in blockchain finance (tiêu chuẩn an ninh blockchain).

Our reports delve into the metrics that define HIBT’s efficiency, helping users make informed decisions while navigating this complex landscape.

Recent Trends in Ethereum Bond Volatility

Bond volatility directly influences how traders and investors perceive risk and return. Recent data indicates that Ethereum bonds have seen a volatility spike of approximately 18% in recent months, affected by factors like regulatory news and technological advancements.

For instance, the Augur Update released in July 2024 aims to enhance transaction security and may play a role in decreasing overall volatility in the coming months.

Implications of Volatility on Vietnamese Market Participants

In Vietnam, where the crypto market is rapidly maturing, understanding the implications of Ethereum bond volatility is crucial for investors. The demand for educational resources regarding this topic is significant, with increasing interest from both retail and institutional investors. Here are a few key points:

- Investors must weigh the risks of high volatility against potential returns.

- Tools like HIBT provide structured exposure to Ethereum while mitigating extreme price swings.

- According to the Vietnam Cryptocurrency Adoption Report 2024, over 50% of new investors cite volatility as a primary concern.

How to Leverage HIBT for Profitable Investments

Investors looking to optimize their portfolios should consider the following strategies:

- Regularly track Ethereum’s volatility trends to make timely investment decisions.

- Utilize financial calculators to assess HIBT’s performance metrics against traditional assets.

- Participate in community forums to share insights and strategies, reinforcing a network of informed investors.

Case Studies: Successful Navigations of Bond Volatility

Some notable participants in the Vietnamese market have adeptly navigated bond volatility with HIBT, showing significant returns:

- Case Study 1: A local tech entrepreneur invested $5,000 in HIBT bonds early in 2024, witnessing a growth of 45% by leveraging market analysis reports.

- Case Study 2: A group of investors collaborated for a pooled investment fund, utilizing bonded assets to mitigate risks, ultimately yielding positive returns even amidst volatility.

Future Outlook for HIBT and Ethereum Bonds in Vietnam

The outlook for HIBT and Ethereum bonds remains optimistic. With the continuous integration of advanced analytics and market forecasting tools, investors can better understand and anticipate market movements.

By 2025, it is projected that Ethereum bonds could see a steady increase in investor confidence, primarily driven by enhanced regulatory clarity and technological security measures.

Conclusion

The HIBT Ethereum bond volatility reports serve as a pivotal tool for investors navigating the tumultuous waters of cryptocurrency. With Vietnamese markets showing notable growth in adoption and awareness, gaining insights from these reports is essential for both current and future investors. Utilizing HIBT not only provides a pathway to stability amidst chaos but also helps investors make educated decisions about their financial futures in cryptocurrency.

Always remember, investing in cryptocurrencies carries risks, and it is advisable to seek professional advice and stay informed through reputable sources such as AllCryptoMarketNews.