Introduction

With Vietnam seeing a 20% increase in its crypto user base in the last year, understanding the financial instruments shaping this landscape has never been more crucial. The correlation between HIBT Vietnam bonds and macroeconomic factors could influence investment strategies significantly as we edge towards 2025. This article aims to unpack these correlations, offering insights that blend traditional finance with the dynamic world of cryptocurrency.

Understanding HIBT Vietnam Bonds

HIBT, or the Hanoi Interbank Bond Trading platform, offers various bonds that reflect Vietnam’s economic stability and growth potential. These bonds are often affected by multiple economic factors such as inflation rates, interest rates, and investor sentiment. In the context of cryptocurrency, such bonds can serve as a barometer for overall market health.

The Role of Bonds in Vietnam’s Economy

- Bonds provide funding for infrastructure and development projects.

- They influence interest rates, which affect both traditional and digital currencies.

- A stable bond market attracts foreign investments, which correlate with crypto market growth.

Macroeconomic Factors Influencing Bonds

Macroeconomic factors play a crucial role in determining bond prices and yields. Here are some key elements:

- Inflation Rate: A rising inflation rate typically leads to higher interest rates, making bonds less attractive. This has direct implications for crypto prices as investors seek more lucrative growth opportunities.

- Currency Exchange Rates: As Vietnam’s dong fluctuates against major currencies, this can affect the attractiveness of bonds and by extension, investor behavior in crypto markets.

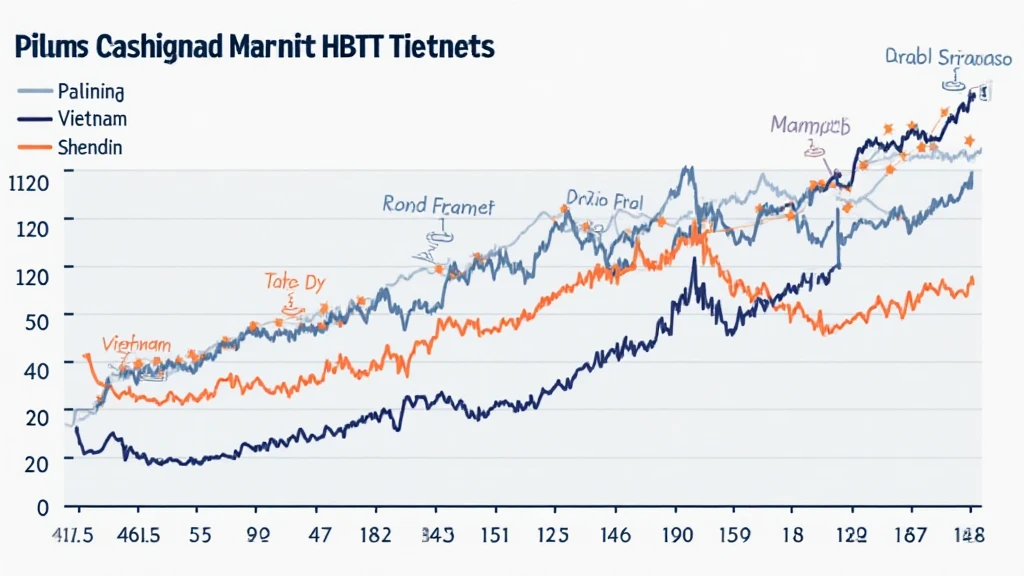

Historical Data on HIBT and Economic Indicators

Examining historical correlations can provide insights on future trends. For instance, the bond yields in 2022 reflected a gradual increase in international trade agreements that subsequently improved Vietnam’s economic outlook.

| Year | BOND YIELD % | GDP GROWTH % | INFLATION % |

|---|---|---|---|

| 2020 | 5.5% | 2.9% | 3.2% |

| 2021 | 6.5% | 3.8% | 3.8% |

| 2022 | 7.0% | 5.5% | 4.5% |

Correlation with Cryptocurrencies

The relationship between HIBT bonds and cryptocurrencies is intricate. For example, when bond yields rise, risk appetite may decrease, leading to a potential drop in crypto investments. Conversely, a stable bond yield might support crypto growth.

Factors Influencing Investor Behavior

Understanding why investors may pivot between HIBT bonds and cryptocurrencies involves analyzing:

- Market Sentiment: Positive sentiment towards economic stability can lead to higher bond investments, thus impacting available capital for crypto.

- Regulatory Changes: New regulations can either bolster or hinder the crypto market based on the perceived safety of traditional investments like bonds.

Future Projections and Emerging Trends

As we look ahead to 2025, the convergence of traditional and digital finance is likely to deepen. Factors such as:

- Technological advancements in blockchain

- Improved security standards (tiêu chuẩn an ninh blockchain) for digital assets

These will shape how bonds and cryptocurrencies interact in the Vietnamese market.

Practical Use Cases

Investors can develop strategies based on the relationship between HIBT bonds and macroeconomic indicators. For example:

- Hedging against volatility in the crypto market by allocating a proportionate investment in HIBT bonds.

- Utilizing macroeconomic forecasts to make informed decisions on when to shift allocations between bonds and cryptocurrencies.

Conclusion

The correlations between HIBT Vietnam bonds and macroeconomic factors highlight critical dynamics within the financial landscape of Vietnam. As national policies adapt and the crypto market matures, these bonds may offer valuable insights reflecting broader market trends. Understanding these correlations not only serves traditional investors but also enhances the strategic approach of those engaged in the digital asset sphere.

At allcryptomarketnews, we are committed to providing up-to-date analysis and insights that empower our readers to navigate the complexities of both the traditional and digital financial landscapes effectively.