Identifying HIBT Vietnam Bond Support/Resistance Levels: A Comprehensive Analysis

With the ongoing evolution of the cryptocurrency and blockchain landscape, it’s imperative to understand the intricacies involved in financial instruments like the HIBT Vietnam bond. As Vietnam positions itself as a growing hub for cryptocurrency and blockchain technology, recognizing how to identify support and resistance levels in HIBT bonds can benefit investors significantly. In this article, we’ll discuss methodologies for effective support and resistance identification, contextualize them within the broader Vietnamese market, and provide actionable insights for both novice and experienced traders.

1. Understanding Support and Resistance Levels

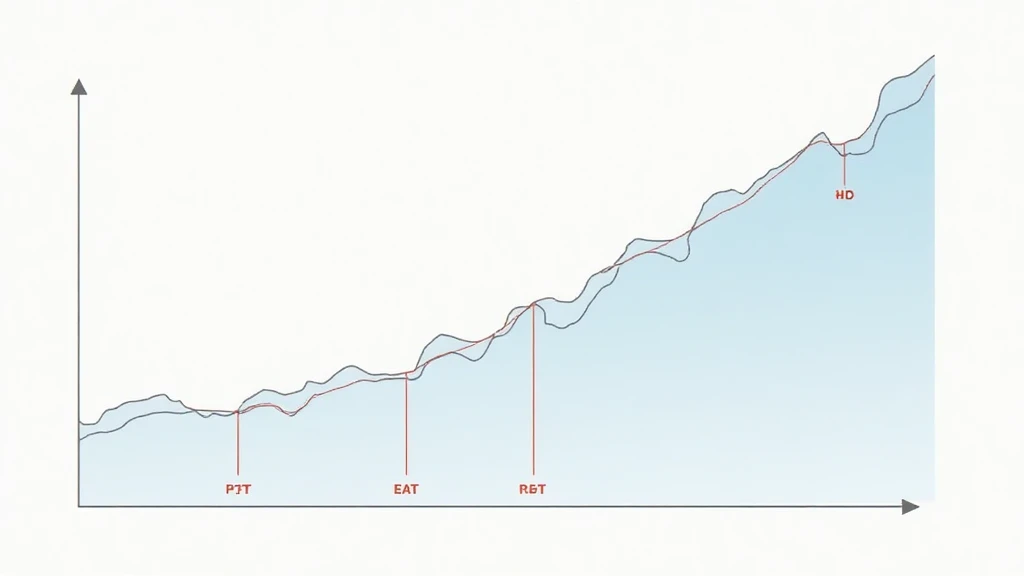

Support and resistance are fundamental concepts in technical analysis. Support levels indicate where an asset tends to halt its decline and reverse direction, while resistance levels signify where an asset typically stops rising and pulls back.

- Support Level: Think of it as the ‘floor’ for prices. When the HIBT bond falls to this level, many buyers believe the price is attractive enough to purchase.

- Resistance Level: This serves as the ‘ceiling’ on price movement. Sellers may step in and resist any further increases past this level.

In thị trường tài chính, identifying these levels can significantly impact trading decisions and strategies.

2. The Role of Technical Analysis in Identifying HIBT Levels

Technical analysis involves using historical data to forecast future price movements. For HIBT Vietnam bonds, traders often look at various charts and indicators to assess price trends and volatility. Some of the critical tools include:

- Moving Averages: These help smooth out price action and identify trends.

- Bollinger Bands: These provide insights into price volatility and can indicate potential reversal points.

- Volume Analysis: Trading volume can confirm whether a breakout through support or resistance is genuinely strong.

The application of these tools requires expertise in crypto trading, specifically with các chuẩn mực kỹ thuật unique to the Vietnamese market trends.

3. Recent Trends and Data in the Vietnamese Market

According to recent reports, the Vietnamese cryptocurrency market has seen an annual growth rate of 37% in user adoption since 2022. This growth trajectory not only highlights a burgeoning interest in digital assets but also influences financial instruments such as bonds.

| Year | Vietnam Crypto User Growth Rate | Market Size (Billion $) |

|---|---|---|

| 2022 | 25% | 1.2 |

| 2023 | 37% | 1.65 |

| 2024 | 45% | 2.4 |

This data indicates a growing acceptance and integration of crypto assets, which can dramatically impact the HIBT bonds’ support and resistance levels.

4. Practical Steps for Identifying HIBT Support/Resistance Levels

To effectively identify support and resistance levels on HIBT bonds, investors can consider the following steps:

- Analyze Historical data: Look at past price movements to identify consistent support and resistance points.

- Use Multiple Indicators: Employ various technical indicators, such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence), to confirm levels.

- Volume Confirmation: Observe trading volume at critical price points to ensure that breakouts are significant.

This methodology parallels auditing practices in smart contracts, emphasizing accuracy and precision when investing in volatile markets. Understanding these factors not only aids in comprehensive analysis but builds a foundation for making informed trading decisions.

5. Future Outlook for HIBT Bonds in Vietnam

The future for HIBT Vietnam bonds appears to be closely tied with Vietnam’s acknowledgment of the potential of blockchain technology and digital currencies. With evolving regulations and an increase in investment interest, support and resistance levels might be less volatile but more critical. As we approach năm 2025, the landscape looks promising, with potential impacts including:

- Increased Liquidity in the market

- Greater foreign investment opportunities

- Enhanced regulatory frameworks promoting secure investments

In conclusion, identifying HIBT Vietnam bond support/resistance levels is not just about numbers; it’s about understanding the entire ecosystem, including the underlying blockchain technology. This holistic approach allows for a better trading strategy, adapted to the unique characteristics of Vietnam’s growing crypto market.

As always, this analysis aims to guide financial decisions without substituting professional advice. For more on cryptocurrency trends in Vietnam, be sure to check out HIBT Vietnam.

For further reading, explore our article Vietnam Crypto Tax Guide.

About the Author: Dr. Minh Tran is a renowned financial analyst specializing in blockchain technology and digital assets. Having published over 20 papers in related fields and led audits for several prominent cryptocurrency projects, Dr. Tran provides unparalleled insights into the ever-evolving finance landscape.