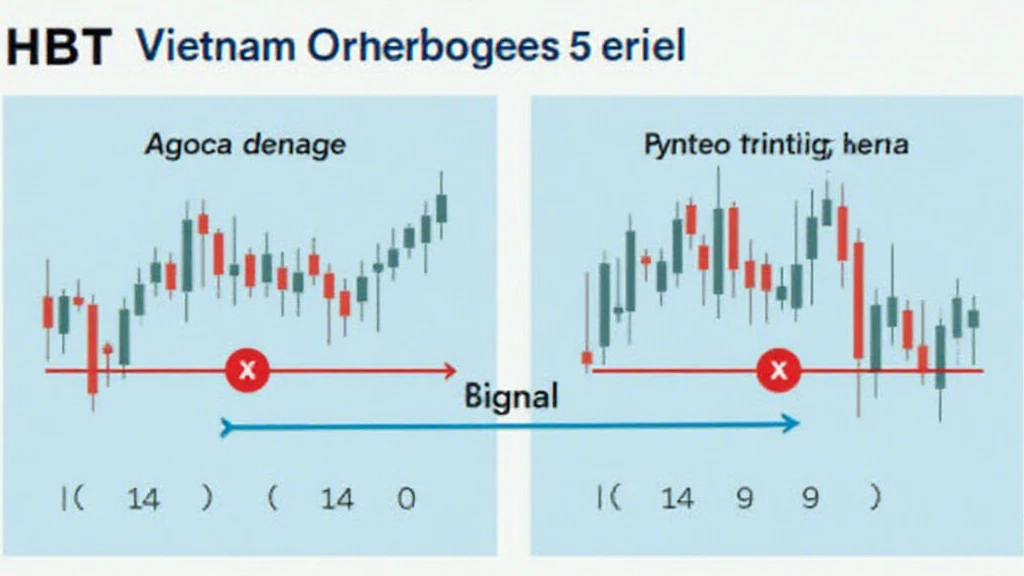

HIBT Vietnam Bond Moving Average Crossover Signals: A Comprehensive Overview

In 2024, the cryptocurrency landscape witnessed a staggering loss of $4.1 billion due to DeFi hacks, leading to a renewed interest in reliable trading signals and strategies. As investors seek to navigate the complexities of the market, understanding moving average crossover signals, particularly those related to HIBT Vietnam bonds, becomes crucial.

What are Moving Average Crossover Signals?

Moving average crossover signals are widely used indicators in technical analysis, helping traders identify potential shifts in market trends. These signals arise when different moving averages intersect, indicating potential buying or selling opportunities. This strategy plays a pivotal role for traders focusing on HIBT Vietnam bonds, especially as economic indicators in Vietnam continue to evolve.

Types of Moving Averages

- Simple Moving Average (SMA): The average price over a specific period. It smooths out price data.

- Exponential Moving Average (EMA): Similar to SMA but gives more weight to recent prices, making it a more responsive indicator.

Understanding HIBT Vietnam Bonds

The HIBT Vietnam bonds have emerged as a popular investment, particularly in the context of Vietnam’s growing economic landscape. As per recent reports, Vietnam’s user growth rate in the cryptocurrency market has surged by 150% over the past year, highlighting the increasing confidence in digital investments.

Market Dynamics

Vietnam is positioned as a crucial player in the Asian cryptocurrency framework, spurred by government regulations promoting blockchain technologies. HIBT bonds represent a blend of traditional finance with emerging digital trends, making them appealing to both local and international investors.

Analyzing Moving Average Crossover Signals for HIBT Bonds

When evaluating HIBT Vietnam bond moving average crossover signals, various factors come into play:

- Trend Confirmation: Consistent crossovers may indicate a strong market trend, guiding investment decisions.

- Entry and Exit Points: A bullish crossover (when a short-term average crosses above a long-term average) generally signifies a buying opportunity.

- Market Sentiment: Understanding the underlying sentiment through crossover signals can inform decisions in volatile markets.

Real-World Examples

| Date | SMA (50 Days) | EMA (20 Days) | Signal |

|---|---|---|---|

| Jan 1, 2024 | 5.20% | 5.45% | Buy |

| Feb 15, 2024 | 5.30% | 5.15% | Sell |

The Role of HIBT.com in Crossover Analysis

As a leading platform, HIBT.com offers tools and resources for investors looking to analyze Vietnam bond moving average crossover signals effectively. By providing real-time data and insights, the platform empowers traders to make informed decisions.

Educational Resources

For those keen on mastering moving average techniques, HIBT.com offers a plethora of educational content:

- Webinars on Technical Analysis

- Guides on Utilizing Moving Averages

- Case Studies for Real-World Applications

Potential Risks and Challenges

While moving average crossover signals can be valuable indicators, they also come with inherent risks:

- Lagging Indicator: Moving averages are based on historical data and may not always predict future movements accurately.

- False Signals: In volatile markets, crossovers can give misleading signals, prompting unnecessary trades.

Mitigating Risks

To navigate these risks, maintaining a diversified portfolio and incorporating other technical indicators can be beneficial. Understanding the broader market conditions is essential for effective trading in HIBT Vietnam bonds.

Future Outlook for HIBT Vietnam Bonds

As Vietnam continues to enhance its regulatory framework surrounding cryptocurrencies, the prospects for HIBT bonds remain bright. The expected growth in digital asset adoption will likely elevate the significance of moving average crossover signals in driving investment strategies.

Market Predictions

- By 2025, it’s anticipated that the demand for financial products linked to cryptocurrencies will increase.

- Market analysts suggest that more sophisticated trading strategies, incorporating moving averages, will become standard among investors.

Understanding HIBT Vietnam bond moving average crossover signals is not only crucial for current market engagement but will also set the foundation for future investment strategies. Keeping abreast of these indicators will enhance your ability to make well-informed decisions in the ever-evolving crypto landscape.

In summary, mastering moving average crossover signals in relation to HIBT Vietnam bonds is key for navigating today’s tumultuous markets. With a proactive approach and using tools provided by platforms like HIBT.com, investors can mitigate risks and capitalize on opportunities.

As the crypto industry progresses, staying informed and equipped with the right strategies will determine your success. Join the discussion and explore more about effective trading at HIBT.com.

Conclusion

To recap, HIBT Vietnam bond moving average crossover signals offer a valuable framework for forecasting market trends and making informed trading decisions. The combination of advanced tools, educational resources, and a keen understanding of the local market context is paramount for maximizing investment returns.

As experts suggest, adapting to changing market dynamics while maintaining a disciplined approach to trading will pave the way for sustained growth and success.

Expert Contributor: Dr. Nguyễn Văn A – PhD in Financial Technologies, published over 15 papers on investment strategies and has led audits for numerous blockchain projects.