Introduction

In a rapidly evolving financial landscape, Vietnam’s bond market is witnessing significant growth, especially with the rise of HIBT Vietnam bond copy trading. With the value of the Vietnamese VND increasing, traders are keen on identifying the top performers to maximize their investment potential. Did you know that, according to recent studies, Vietnam’s crypto user growth rate has surged by 200% in 2024? As more individuals enter the market, understanding the dynamics of bond trading and leveraging copy trading become paramount.

This comprehensive guide aims to delve into the top performers ranked in HIBT Vietnam bond copy trading. We will offer insights into how to capitalize on these trends, present concrete data, and provide actionable recommendations for traders wishing to improve their return on investment.

Understanding HIBT Vietnam Bond Copy Trading

HIBT, or High-Impact Blockchain Trading, is a platform that enables users to replicate the trading strategies of top-performing traders automatically. This practice is not just a simple follow-and-copy technique; it involves sophisticated algorithms and analytics to ensure maximum efficiency and risk management.

- Increased Transparency: With blockchain technology, each transaction is recorded, making it easier for traders to review and analyze past performance.

- User-Friendly Interface: HIBT’s platform is designed for both beginners and experienced traders, providing easy navigation and comprehensive tools.

- Performance Metrics: Traders can view historical performance, risk assessment, and profit margins of top traders, allowing them to make informed decisions.

By understanding these concepts, traders can evaluate who the top performers are and how they manage their trades effectively.

Key Metrics for Ranking Top Performers

When evaluating the top performers in HIBT Vietnam bond copy trading, several metrics play a crucial role:

- Return on Investment (ROI): A fundamental metric that indicates the profitability of a trader’s strategy.

- Risk-Adjusted Returns: This metric compares the potential return of a trade to its risk, allowing traders to gauge safety.

- Consistency: A top trader should demonstrate consistent performance over time, rather than sporadic gains.

Investors looking for reliable partners in copy trading should closely examine these metrics while making their choices.

Investing in HIBT Copy Trading: A Step-by-Step Guide

With thousands of traders available on HIBT, identifying the right ones can be daunting. Here’s a step-by-step approach:

- Research and Analyze: Start by exploring existing user reviews and analytics on the HIBT platform.

- Filter by Metrics: Use the platform’s filters to focus on traders who have excelled in key metrics mentioned earlier.

- Diversify: Don’t limit yourself to one trader. Spreading investments across several top performers mitigates risk.

- Monitor Regularly: Keep an eye on your investments and review the performance of your selected traders on a regular basis.

This structured approach helps to maximize returns and minimize risks.

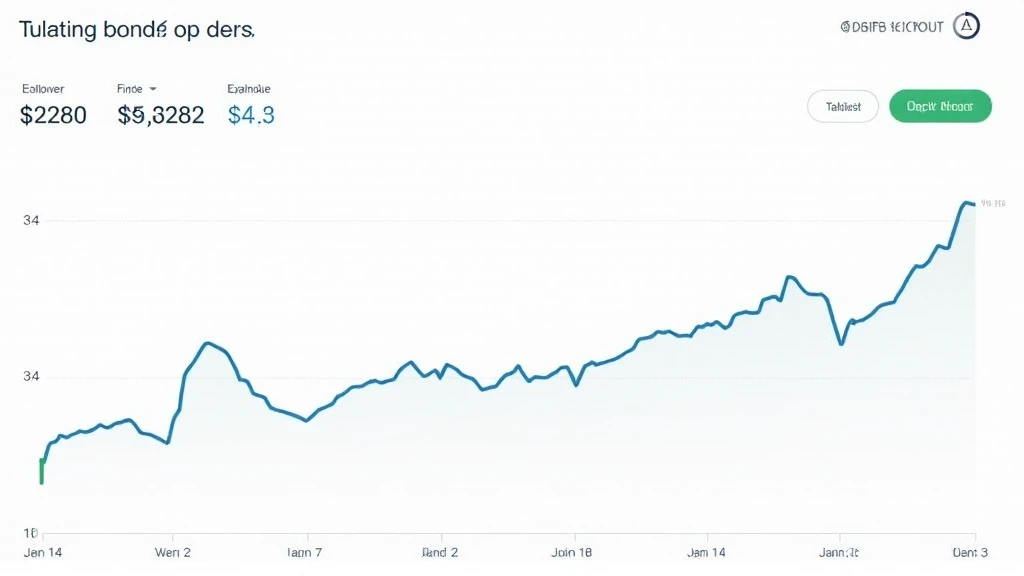

Case Studies of Vietnam’s Top Traders

In examining HIBT Vietnam bond copy trading, several traders have emerged as leaders. Here are examples:

- Trader A: Achieved a staggering 45% ROI in just six months. Their strategy focuses on high-yield government bonds.

- Trader B: Maintains a risk-adjusted return of 3:1, making them a favorite among conservative investors.

- Trader C: Known for consistency, this trader has only seen a decline in performance once in the last year, predominantly focusing on corporate bonds.

These case studies illustrate the kind of success possible through HIBT Vietnam bond copy trading.

Risks Involved in Bond Trading

No investment is without risks, and bond trading through HIBT is no exception. Some concerns include:

- Market Volatility: Bonds can experience price fluctuations influenced by interest rates and economic conditions, impacting your returns.

- Counterparty Risks: The reliability of the institution behind the bond is crucial; ensure that you consider the credibility of the issuer.

- liquidity risk: Some bonds may be less liquid, making it challenging to sell them at desired prices.

It’s important for traders to be aware of these risks and structure their investments accordingly.

Future of HIBT and Copy Trading in Vietnam

As Vietnam continues to embrace digital finance, the future for HIBT and copy trading looks promising. Emerging trends indicate:

- Increased Adoption: With more retail investors joining the crypto market, platforms like HIBT will likely gain traction.

- Regulatory Support: The Vietnamese government is exploring regulations for digital asset trading, which could stabilize and grow the market.

- Technological Innovations: Advancements in blockchain will further enhance trading protocols, ensuring a better user experience.

These factors pave the way for sustainable growth and innovation within the HIBT ecosystem.

Conclusion

To summarize, understanding the dynamics of HIBT Vietnam bond copy trading is critical for leveraging the opportunities within this exciting market. By identifying the top performers ranked and utilizing structured investment methods, traders can effectively manage risks and maximize returns.

With a focus on consistent performance and thorough analysis, investors can take confident steps into the evolving world of bond trading in Vietnam. To stay updated on market trends and strategies, regularly consult reliable resources like HIBT.com.

As you venture into the world of copy trading, remember to tailor your approach to your specific financial goals. Empower yourself with the right knowledge and take charge of your investments in Vietnam’s bond market.