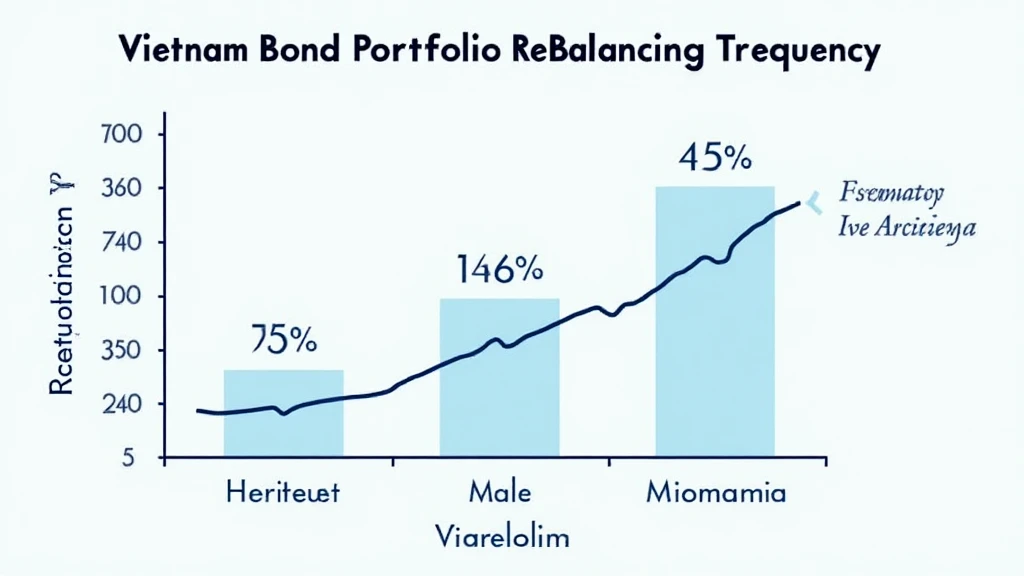

HIBT Vietnam Bond Portfolio Rebalancing Frequency: Your Essential Guide

As we navigate the complexities of today’s financial landscape, one question stands out: how often should we rebalance our investment portfolios? In the world of cryptocurrencies and blockchain technology, the frequency of portfolio rebalancing, especially with instruments like bonds, can be the difference between risk mitigation and missed opportunities. In this article, we’ll dive deep into the HIBT Vietnam bond portfolio rebalancing frequency guides.

According to recent insights, alignments between various asset classes are crucial for achieving optimal returns. One notable statistic to consider is that in 2024 alone, approximately $4.1 billion was reportedly lost due to DeFi hacks. Understanding how to navigate investment strategies like bond rebalancing can significantly mitigate risks associated with these financial tools.

Understanding Bond Portfolio Rebalancing

Rebalancing involves modifying the weighting of assets in a portfolio in response to changes in market conditions or the investor’s personal circumstances. This is especially relevant in regions like Vietnam, where interest rates and economic indicators can fluctuate dramatically. Could regular rebalancing actually influence financial stability? Yes, it can!

By maintaining an ideal allocation of assets, investors can ensure their portfolios are aligned with their risk tolerance and investment goals. In Vietnam, users are increasingly seeking guidance on bond investment strategies amidst rising popularity, with a reported user growth rate exceeding 25% in the past year.

When to Rebalance Your Bonds

So, when should an investor consider rebalancing? The answer is not always straightforward and often depends on various factors:

- Market Volatility: Significant fluctuations, including those caused by political instability or economic downturns, could necessitate a reassessment of your bond portfolio.

- Target Allocation: Revisiting your ideal asset allocation in line with your risk profile is another reason to rebalance.

- Performance Metrics: Monitoring the performance of specific bonds in your portfolio can unveil opportunities for optimization.

The Importance of Frequency in Rebalancing

Experts agree that the frequency of rebalancing should be strategically planned. Some recommend monthly or quarterly intervals, while others advocate for an annual review. Here are some benefits of more frequent rebalancing:

- Capitalizing on Market Trends: Frequent rebalancing can help capture gains in rapidly changing markets.

- Reducing Risk: Adjusting your portfolio more regularly can keep asset concentrations in check, lessening exposure to any single investment.

- Better Alignment with Goals: As personal circumstances change, frequent rebalancing can ensure your portfolio remains aligned with evolving life goals.

Factors Influencing Rebalancing Frequency

It’s crucial to recognize that several factors should influence decisions around rebalancing frequency:

- Transaction Costs: Consider how costs associated with buying and selling bonds might impact your overall returns.

- Market Conditions: Keep an eye on the broader macroeconomic environment in Vietnam or globally, as external factors can necessitate a quick adjustment.

- Your Investment Horizon: Long-term versus short-term investing will dictate how often you should review and rebalance your portfolio.

Recommended Strategies for Efficient Rebalancing

To maximize the efficacy of your rebalancing efforts, consider the following strategies:

- Set Thresholds: Establish thresholds to trigger rebalancing, for instance, a 5% deviation from your target allocation.

- Performance Review: Evaluate bond performance against benchmarks regularly to identify whether rebalancing is needed.

- Utilize Technology: Incorporate investment tools or platforms that offer automated rebalancing options.

Conclusion: Navigating Your Bond Portfolio

In summary, understanding the HIBT Vietnam bond portfolio rebalancing frequency guides can be a game-changer for any investor. Remember that successful investing isn’t just about the assets you hold but how effectively you manage them. The importance of rebalancing frequency cannot be understated in this rapidly evolving financial ecosystem.

As you consider your next investment moves, keep in mind that the right rebalancing strategy can elevate your portfolio’s performance while safeguarding against market risks. Explore more about this in-depth strategy at hibt.com.

For local investors in Vietnam, staying attuned to economic trends and adapting your strategy accordingly will place you ahead of the curve. If 2025’s market outlook holds potential, there has never been a better time to strategize your investment approach!

Disclaimer: This article is not financial advice. Please consult with local financial advisors before making investment decisions.