Introduction

As the cryptocurrency landscape evolves, financial tools become increasingly essential for investors. In 2024 alone, $4.1 billion was lost due to DeFi hacks, emphasizing the need for robust risk management strategies. Bollinger Bands, a popular technical analysis tool, present a unique opportunity for traders to identify market volatility and potential price movements. Additionally, the rise of HIBT Vietnam bonds highlights a burgeoning investment avenue with promising returns. In this article, we will explore the nuances of Bollinger Band squeeze alerts and their implications for HIBT Vietnam bond trading.

Understanding Bollinger Bands

Bollinger Bands consist of a middle band (the simple moving average), and two outer bands that represent volatility. When the bands compress, this is known as a “Bollinger Band squeeze,” indicating a potential increase in market activity. Think of it as a tightly-coiled spring ready to release energy. This visual aids traders in determining whether to buy or sell assets.

- Middle Band: The simple moving average.

- Upper Band: Middle band + 2 standard deviations.

- Lower Band: Middle band – 2 standard deviations.

How Bollinger Bands Work

To apply Bollinger Bands effectively, traders should observe:

- The distance between the bands—a wider distance signifies high volatility.

- The price’s relationship to the bands; a price rally past the upper band may suggest overbought conditions.

- Historical data to correlate price movements with the bands.

For example, if BTC consistently hits the upper band, it might be time to consider selling, as it suggests decreased demand.

Introducing HIBT Vietnam Bonds

As Vietnam’s economy grows, so do investments in its bond market. The HIBT Vietnam bonds present a reliable avenue for both domestic and foreign investors. In 2023, Vietnam saw a user growth rate of over 15% in cryptocurrency, highlighting the convergence of traditional finance with digital currencies.

- High Returns: HIBT bonds typically offer yields that surpass traditional bank savings rates.

- Security: These bonds adhere to tiêu chuẩn an ninh blockchain, ensuring investor confidence.

By analyzing the performance of HIBT Vietnam bonds alongside Bollinger Bands, investors can harness the strengths of both markets, optimizing their investment strategies.

The Brazilian Market and HIBT’s Potential

The increasing interest in blockchain solutions across Southeast Asia amplifies the potential of HIBT bonds. In Brazil, cryptocurrency utilization surged by 30% in the last year, reflecting a global trend toward digital assets.

Leveraging Bollinger Band Squeeze Alerts

When Bollinger Bands narrow, traders should consider setting alert systems to capitalize on potential price movements. Here’s how you can integrate Bollinger Band squeeze alerts into your investment strategy:

- Set up price alerts for key movements near the upper or lower bands.

- Monitor volume; a volume increase during a squeeze often precedes significant price shifts.

- Combine with other indicators like RSI or moving averages for a more thorough analysis.

For example, when a Bollinger Band squeeze occurs simultaneously with an increase in volume, a breakout is often imminent.

Real-World Application

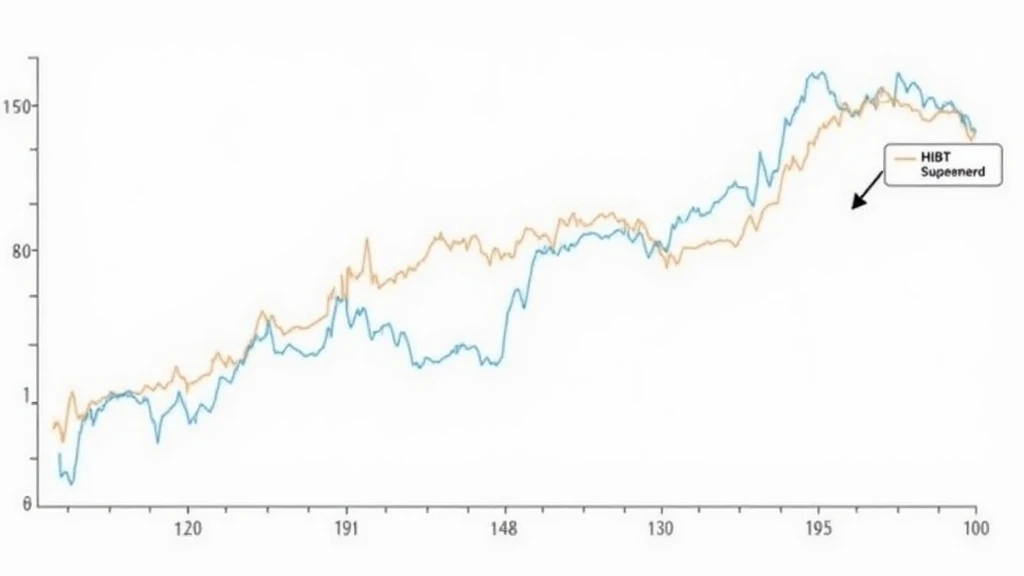

Consider a scenario where the price of Bitcoin is approaching a Bollinger Band squeeze. As you analyze this data, you notice that HIBT Vietnam bonds are showing stable returns. This particular market behavior demonstrates the need for diversified investment strategies where both cryptocurrencies and bonds are included.

| Year | Bitcoin (Price Change %) | HIBT Vietnam Bonds (Yield %) |

|---|---|---|

| 2022 | 120% | 6.5% |

| 2023 | 50% | 6.8% |

| 2024 | -10% | 7.0% |

Source: Financial Times Report 2024

Expert Insights on Combining Strategies

Investment expert, Dr. Nguyễn Thành, who has published over 10 papers on financial technology and served as an auditor for significant blockchain projects, emphasizes that blending traditional investment vehicles like HIBT bonds with advanced trading tools like Bollinger Bands can provide a balanced portfolio. As he notes:

“Successful investment often lies in diversifying one’s approach and adapting strategies to market shifts.”

Conclusion

As we navigate an increasingly complex financial landscape, leveraging tools like Bollinger Bands provides traders and investors with the insights needed to make informed decisions. Integrating this technical analysis with stable investment options like HIBT Vietnam bonds could yield substantial rewards. The potential for profit remains high, particularly as the Vietnamese market continues to grow and innovate.

By understanding both Bollinger Band squeeze alerts and the intricacies of HIBT Vietnam bonds, you can position yourself at the forefront of the evolving investment ecosystem. Together, these strategies not only enhance the potential for returns but also bolster your confidence as an informed investor.

For more detailed insights on the cryptocurrency landscape and investment strategies, visit allcryptomarketnews.