HIBT: Staying Disciplined Investment Strategies in Vietnam

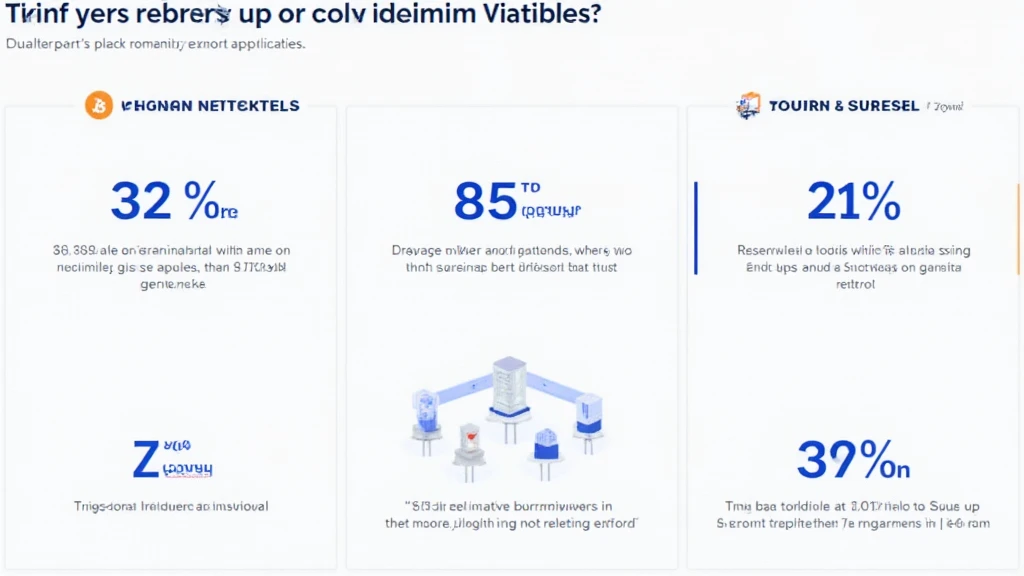

With the rise of cryptocurrencies, the Vietnamese market has witnessed significant growth, particularly in decentralized finance (DeFi). In 2024 alone, a staggering $4.1 billion was lost to DeFi hacks globally. This alarming statistic underscores the need for disciplined investment strategies, especially in a rapidly evolving environment like Vietnam.

As the Vietnamese crypto community expands, understanding staying disciplined investment strategies is essential. This article aims to provide you with insights into effective investing, focusing on HIBT – an exciting cryptocurrency initiative – and relevant strategies tailored for Vietnam’s unique market environment.

Understanding the HIBT Ecosystem

Borne from a need to enhance investment approaches, HIBT stands out as a pioneering cryptocurrency aiming to stabilize and secure digital assets. The focus on investment strategies within the HIBT ecosystem empowers both novice and seasoned investors.

Key Features of HIBT

- Security: HIBT adopts cutting-edge security measures, ensuring that users can trade with confidence.

- Transparency: All transactions are recorded on the blockchain, providing full traceability.

- User-Centric: The design caters to the needs of the Vietnamese market, incorporating local preferences.

As digital currencies continue to gain traction, platforms like HIBT play a critical role in shaping a reliable investment landscape. Their focus on security and transparency addresses some of the key concerns prevalent among Vietnamese investors, enhancing trust.

The Evolution of Cryptocurrency in Vietnam

According to estimates from CoinMarketCap, Vietnam ranked 12th globally in terms of crypto adoption in 2023, with a remarkable growth rate of 72.5% in the number of active users. This fast-paced growth presents both opportunities and challenges—especially in formulating investment strategies that prioritize discipline.

Driving Factors Behind Adoption

- Technological Infrastructure: Vietnam has made significant advancements in its tech landscape, paving the way for cryptocurrency transactions.

- Young Populace: With over 50% of the population below 30, there is a growing interest in crypto investments among the youth.

- Government Stance: Initially skeptical, the Vietnamese government is now exploring regulatory frameworks to better govern cryptocurrency activities.

Strategies for Staying Disciplined in Investment

Investing in cryptocurrencies can be volatile, and having effective strategies is crucial. Here are some staying disciplined investment strategies that can help mitigate risk:

1. Set Clear Goals

Before entering the market, define your investment objectives. Are you investing for short-term profit or long-term growth? Having clear goals will help you remain disciplined during market fluctuations.

2. Diversification

Don’t put all your eggs in one basket. Diversifying your portfolio can buffer against market volatility. Consider allocating your assets across different cryptocurrencies and blockchain-based projects like HIBT.

3. Continuous Learning

The crypto market is constantly evolving. Continuous education about market trends, technological advancements, and regulatory changes can provide investors with a competitive edge.

4. Risk Management

Implement risk management strategies by setting stop-loss orders or limiting your exposure to high-risk assets. Tools like Ledger Nano X can reduce the risk of hacks, reducing vulnerabilities in your portfolio.

5. Stick to Your Plan

It’s easy to get swayed by market hype. A disciplined approach means resisting the urge to sell or buy impulsively based on emotions. Stick to your predefined investment strategy.

Real-life Application of Investment Strategies in Vietnam

The practical application of disciplined strategies has been observed in the Vietnamese market. A local investor, Nguyen, began investing in cryptocurrencies a year ago, focusing on HIBT.

- Initial Investment: 100 million VND

- Diversification: Allocated 30% to stablecoins, 50% to HIBT, and 20% to emerging projects.

- Outcome: Despite market downturns, Nguyen reported a 15% growth over the year through disciplined strategies.

Future of HIBT in Vietnam’s Crypto Landscape

As we look towards the future, the trajectory of HIBT remains encouraging. With increasing user adoption in Vietnam, predictions indicate a potential surge in market engagement and transaction volumes.

Regional Growth and Variability

While there are exciting prospects, it is essential to factor in regional differences in investment behavior. In cities like Ho Chi Minh City and Hanoi, digital currency adoption rates have surpassed those in rural areas, leading to varied experiences across demographics.

Market Trends to Watch in 2025

- Increased Regulations: Expect further clarity from regulatory bodies as they implement laws governing cryptocurrency trading.

- Adoption of Blockchain Technology: Industries beyond finance, such as agriculture and supply chain, are exploring blockchain integrations.

- Emerging Altcoins: Investors should keep an eye on potential altcoins gaining popularity, like Celo and Solana alongside stable choices like HIBT.

In conclusion, staying disciplined investment strategies in Vietnam, particularly in the context of HIBT, can pave the way for sustainable and secure investment. As the Vietnamese crypto landscape matures, disciplined approaches will be essential in navigating this dynamic environment.

**Allcryptomarketnews**: Stay informed on the latest trends and strategies in the cryptocurrency market by subscribing to our updates.

**Author:** Dr. Le Quang, a financial analyst with over 15 years of experience in blockchain technology. Dr. Quang has authored more than 10 papers on cryptocurrency investments and has led audits for leading crypto projects in Southeast Asia.