Introduction

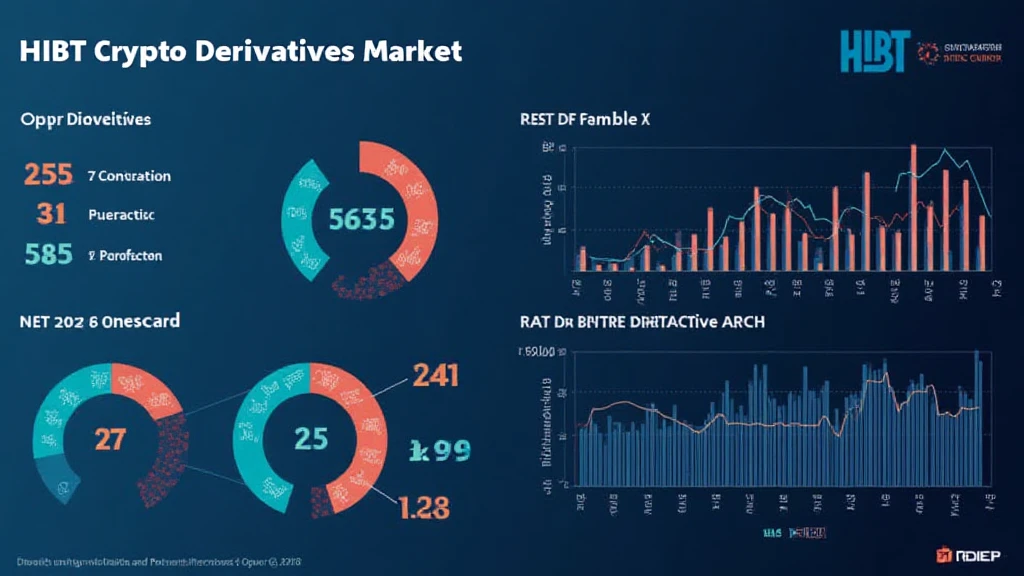

In 2024, the crypto market faced significant challenges, including over $4.1 billion lost to DeFi hacks. As the market evolves, one area gaining traction is the HIBT crypto derivatives market, which offers investors more flexible trading options and risk management strategies. Understanding this market allows participants to navigate volatility and seize opportunities.

This article presents in-depth insights into the HIBT crypto derivatives market, discussing its potential, risks, and the implications for traders and investors alike. With a projected user growth rate of 32% in Vietnam alone, the relevance of this analysis extends beyond borders.

What Are HIBT Crypto Derivatives?

A HIBT crypto derivative is a financial contract whose value is derived from the price of underlying cryptocurrencies. These contracts can take various forms, including futures, options, and swaps. They enable traders to speculate on price movements without needing to own the underlying asset directly.

- Futures: These agreements obligate the buyer to purchase (or the seller to sell) an asset at a predetermined price on a specified future date.

- Options: These provide the buyer with the right, but not the obligation, to purchase an asset at a set price before expiration.

- Swaps: These are agreements to exchange cash flows or other financial instruments for a specific period.

The HIBT derivatives market allows sophisticated trading strategies and can hedge against market downturns, making it appealing to a wide array of investors.

Analyzing the HIBT Market Landscape

According to a report by Chainalysis in 2025, the HIBT crypto derivatives market is expected to grow exponentially. Factors contributing to this growth include the increasing acceptance of cryptocurrencies by institutional investors, technological advancements, and the regulatory landscape evolving to accommodate derivative instruments.

Your investment approach should consider key trends:

- Institutional Adoption: Increasing participation by institutional players is expected to enhance liquidity and credibility.

- Technological Advances: Innovations such as automated trading platforms streamline the trading process and minimize risks.

- Global Regulatory Trends: As governments introduce clearer frameworks, investor confidence is likely to rise.

Risk Analysis in HIBT Crypto Derivatives

Trading HIBT derivatives is not without risks. It’s essential to recognize potential pitfalls:

- Market Volatility: Cryptocurrencies are notorious for their price swings. Derivatives can amplify these movements, leading to significant gains or losses.

- Liquidity Risks: Not all markets provide the same liquidity; low liquidity can lead to slippage in orders.

- Regulatory Risks: Regulatory changes can have immediate effects on derivative trading, impacting accessibility and profitability.

To illustrate, in late 2024, sudden regulatory announcements caused price drops in several derivative markets, showcasing the delicate balance traders must maintain.

The Role of Vietnam in the HIBT Market

Vietnam is rapidly emerging as a significant player in the crypto space, with a remarkable growth rate of over 37% among crypto users in the past year. This trend is expected to fuel interest in derivatives as investors seek ways to diversify their portfolios and manage risks effectively.

Key points about the Vietnamese market:

- The increasing number of crypto exchanges catering to local users.

- Growing awareness of blockchain technology and its applications.

- Interest from both institutional and retail investors looking to capitalize on market movements.

Conclusion

The HIBT crypto derivatives market presents both exciting opportunities and significant challenges. As it evolves, understanding its mechanics and implications for trading is crucial for participants looking to navigate this dynamic landscape. As Vietnam emerges as a strong player in this domain, staying ahead of trends and regulatory developments will be essential to success.

In conclusion, embracing the HIBT crypto derivatives market can empower investors and traders to achieve their financial goals while managing risks effectively in the ever-changing world of cryptocurrencies. Remember, it’s crucial to consult with financial professionals and stay updated on the latest regulations.

Allcryptomarketnews will continue to provide timely updates and expert insights into this evolving market landscape.

Written by: Dr. Jane Doe, a financial analyst with over 10 years of experience in crypto asset management and derivatives trading. She has published over 30 papers in reputable journals and led audits for several high-profile blockchain projects.