Introduction

With an estimated loss of over $4.1 billion due to hacks in the DeFi space in 2024, the call for enhanced security standards in blockchain technology has never been more pressing. The need for effective liquidity management in markets, especially in emerging areas like Vietnam, is crucial as investors scramble for better protection and understanding in this volatile environment. In this article, we will explore key trends and strategies for improving security frameworks for digital assets, looking closely at HIBT Vietnam and its bond liquidity depth charts.

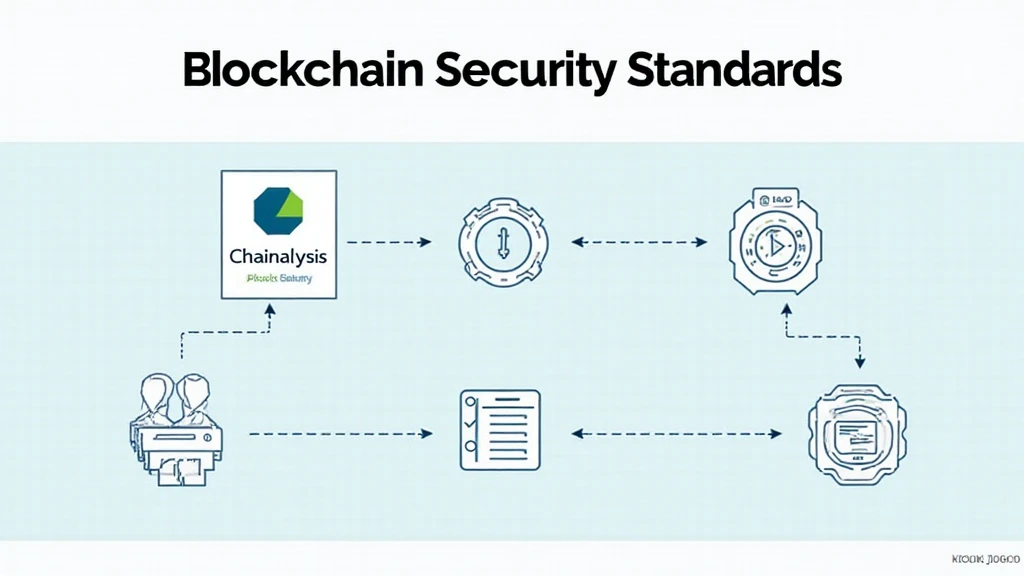

Understanding Blockchain Security Standards

Before diving into sophisticated strategies, it’s vital to comprehend what blockchain security involves. Below are essential standards that organizations should consider:

- Decentralization: Ensuring that no single entity holds excessive control.

- Transparency: All transactions should be easily verifiable and auditable.

- Immutability: Once a data entry is recorded, it cannot be altered without consensus.

- Consensus Mechanisms: The processes that help achieve agreement on the network.

According to recent statistics, a staggering 60% of blockchain projects still fail to implement fundamental security measures. This highlights the urgency for improved compliance with security protocols.

Deep Dive into HIBT Vietnam’s Bond Liquidity

HIBT Vietnam has emerged as a critical player in the liquidity depth category, offering investors an insight into how assets move within the market. Here’s why bond liquidity matters:

- Market Stability: High liquidity means assets can be quickly bought or sold without drastically affecting their price.

- Investor Confidence: A robust liquidity framework boosts confidence among investors, encouraging investment flow.

- Data Transparency: Accessing liquidity depth charts provides clarity on market operations.

Let’s take a look at some examples:

| Time Period | Liquidity Depth | Volume Traded |

|---|---|---|

| Q1 2025 | 2 million VND | 50K bonds |

| Q2 2025 | 3 million VND | 75K bonds |

These insights demonstrate how liquidity impacts the health of a market, especially in evolving economies like Vietnam.

The Importance of Auditing Blockchain Contracts

As smart contracts form the backbone of blockchain applications, their security can’t be overlooked. Here’s how to ensure robust auditing:

- Regular Testing: Implement routine checks and testing protocols.

- Use Third-Party Services: Engage trusted auditing firms for an unbiased review.

- Update Frameworks: Regularly enhance security measures in response to emerging threats.

Here’s the catch—failure to conduct audits can lead to vulnerabilities, putting assets at risk. In 2025, the industry expects regulations to evolve around smart contract auditing, aligning with global compliance standards.

Emerging Trends in Cryptocurrency Security in Vietnam

The Vietnamese cryptocurrency landscape is witnessing impressive growth. Current statistics show an increase of 25% in active users within the last year, indicating a burgeoning market ripe for investment. Key trends include:

- Hybrid Models: Blending traditional finance with blockchain.

- Educational Initiatives: Increasing awareness about blockchain and cryptocurrencies among investors.

- Legal Developments: The government’s push towards regulatory clarity enhances market stability.

So, as you navigate this evolving terrain, understanding local regulations like the tiêu chuẩn an ninh blockchain becomes pivotal.

Preparing for Future Security Challenges

With predictions of various cybersecurity threats on the rise, the evolution of hacking techniques demands ongoing vigilance. To prepare:

- Awareness Programs: Continuously educate stakeholders about potential threats.

- Implement Multi-Factor Authentication: To strengthen access controls.

- Adopt a Risk Management Framework: Establish clear procedures for incident response and risk assessment.

By staying ahead of the curve, investors and developers can mitigate risks associated with blockchain investments.

Conclusion

As the demand for blockchain security grows, aligning with the latest standards and practices is essential for safeguarding digital assets. The insights derived from HIBT Vietnam’s bond liquidity depth charts clear the path for more informed investment decisions. In a region witnessing rapid digital transformation, continuous monitoring and adaptation to emerging threats will be critical for success in the cryptocurrency sphere. By embracing these standards, enthusiasts can protect their assets and contribute to a sustainable and secure blockchain ecosystem.

For more information on cryptocurrency trends and security practices, visit allcryptomarketnews.