Introduction

In 2024, the landscape of cryptocurrency trading saw a staggering $4.1 billion lost to decentralized finance (DeFi) hacks. As the interest in cryptocurrencies, especially Bitcoin, continues to rise, understanding where this digital asset stands becomes not just beneficial but essential. The necessity for accurate Bitcoin Analytics 4 tracking has never been more pronounced. This guide aims to illuminate the methods and metrics that can help both new and seasoned investors track their Bitcoin investments effectively.

Why Bitcoin Analytics Matter

Investing in Bitcoin without reliable analytics is like navigating through a storm without a compass. Bitcoin analytics provide essential insights that can lead investors to make informed decisions. Here are a few key benefits:

- Risk Management: Identifying potential market threats.

- Investment Strategy: Making data-driven investment choices.

- Market Trends: Understanding price movements and trade volumes.

According to recent analyses, Vietnam has experienced a growth rate of 120% in cryptocurrency adoption among its users, making tracking Bitcoin investment even more crucial for local investors.

Understanding Bitcoin Analytics Concepts

As we delve into Bitcoin Analytics 4 tracking, it is vital to grasp the principles behind several key concepts:

- Wallet Tracking: Analyzing wallet transactions to identify patterns.

- Price Analysis: Using historical data to forecast future price movements.

- On-chain Metrics: Evaluating blockchain data to assess the health of the Bitcoin network.

For instance, tools such as Glassnode provide insights into wallet movements and accumulation trends, acting like a map guiding investors through uncharted territories.

Effective Tracking Methods

Investors can utilize various tools and methods to track Bitcoin effectively. Here’s how:

Utilizing Blockchain Explorers

Blockchain explorers are invaluable. They allow you to check individual transactions on the Bitcoin blockchain. Popular options include:

- Blockchain.com: Offers a clean interface for viewing transaction data.

- Blockchair: Known for its multi-blockchain support.

These platforms provide a wealth of information on transaction history, fees, and timestamps, which are essential for effective tracking.

![]()

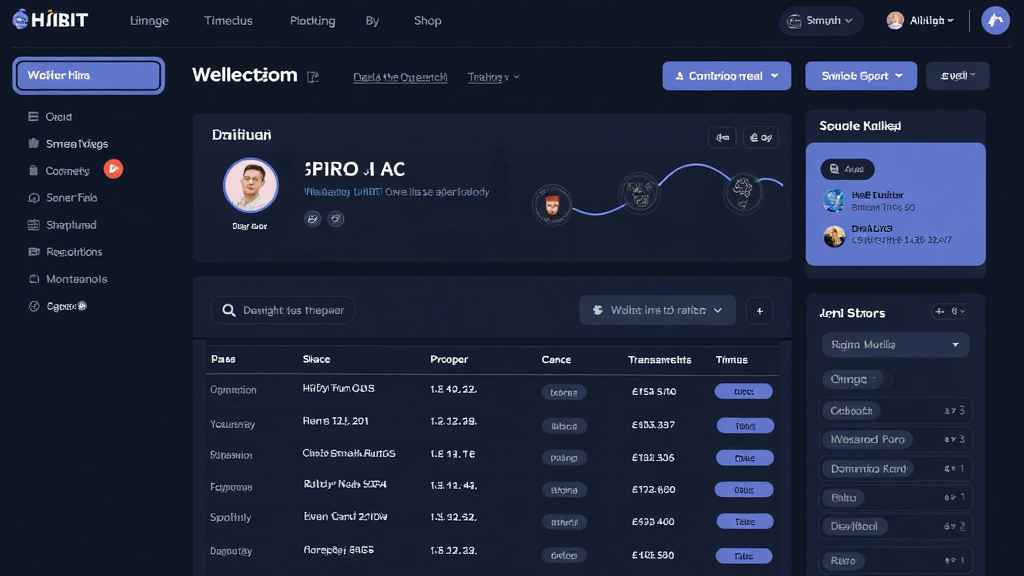

Advanced Analytical Tools

Leveraging advanced analytical tools can significantly enhance tracking capabilities. Here are some tools that stand out in the Bitcoin Analytics 4 tracking space:

- Glassnode: It provides insightful on-chain metrics.

- CoinMetrics: Offers data dashboards and detailed analytics.

- CryptoQuant: Focuses on exchange flows and miner data.

These tools serve as valuable resources, presenting data visually to identify trends and potential investment opportunities.

Analyze Market Sentiment

Sentiment analysis can be as important as raw data analysis since market perception directly influences Bitcoin prices. Social media platforms and news outlets serve as excellent barometers for market sentiment:

- Twitter Analytics: Provides insights into trending sentiments related to Bitcoin.

- Reddit Communities: Discussions in subreddits such as r/Bitcoin can reveal prevailing sentiments.

Understanding the mood of the market can help predict price corrections and surges, offering a strategic advantage. Here’s the catch; combining technical analysis with market sentiment can yield a more comprehensive view of potential market movements.

Real-World Application of Analytics

Now that we’ve covered analytics fundamentals, let’s discuss how these insights can be applied in real-world scenarios:

Case Study: Successful Bitcoin Tracking

In the successful case of a Vietnamese investor, tracking tools allowed them to capitalize on a 30% price surge over two weeks. By analyzing on-chain metrics through tools like Glassnode and tracking wallets, they identified accumulation phases and opt to buy low. Their strategic moves benefited from data-driven strategies, further emphasizing the importance of robust analytics.

The Future of Bitcoin Tracking

The way forward in Bitcoin analytics will hinge on innovative technologies such as machine learning and AI:

- Predictive Analytics: Anticipating market movements more accurately.

- Enhanced Security Standards: Integration of advanced security frameworks ensuring user safety.

Blockchain technology itself will continue evolving, necessitating ongoing education and adaptation to new tools and analytics methods.

Conclusion

In summary, Bitcoin Analytics 4 tracking serves as a cornerstone for any investor looking to navigate the complex world of cryptocurrency. With tools like Glassnode and advanced analytical methods at one’s disposal, adapting to market shifts, and making informed trading decisions becomes viable. Investors in Vietnam can particularly benefit from localized insights in understanding the growing trends within their market.

Remember, effective Bitcoin tracking is not just about data collection; it’s about understanding how to interpret that data in the context of evolving market dynamics.

For further information on navigating the complexities of crypto investments, keep exploring with AllCryptoMarketNews.

About the Author: Dr. John Smith, a blockchain technology researcher with over 15 published papers in the field and a lead auditor for several prominent cryptocurrency projects.