Introduction

In the ever-evolving landscape of cryptocurrency, Bitcoin Halving countdown timer serves as a critical marker for both investors and enthusiasts. With more than $4.1 billion lost to DeFi hacks in 2024, understanding the intricacies of Bitcoin’s halving is crucial for making informed decisions. The next halving is expected to occur in 2024, igniting discussions about its implications for market dynamics and investor psychology.

So, what is Bitcoin halving, and why is the countdown such a hot topic in the crypto community? The halving process reduces the block reward miners receive, thereby decreasing the supply of new Bitcoins entering circulation. This restriction on supply, especially coupled with increasing demand, has historically led to price surges. In this article, we will delve deep into the Bitcoin halving, explore its significance, and outline why you should keep an eye on the Bitcoin Halving countdown timer.

Understanding Bitcoin Halving

To comprehend the importance of Bitcoin halving, we first need to grasp how it operates within the blockchain ecosystem. When Bitcoin was created in 2009, the block reward was set at 50 Bitcoins per block. This reward halves approximately every four years or every 210,000 blocks. Currently, the reward is 6.25 Bitcoins per block, and the next halving will reduce it to 3.125 Bitcoins.

Here’s how the halving affects Bitcoin’s market:

- Reduced Supply: As fewer Bitcoins are issued, scarcity increases.

- Price Impact: Historical patterns show that halving events often precede bull markets.

- Market Sentiment: Anticipation of halving can create bullish sentiment among investors.

Why Should You Track the Bitcoin Halving Countdown Timer?

Investors should be aware of the Bitcoin Halving countdown timer for several reasons. With each halving, the market dynamics shift, potentially setting the stage for price increases. Tracking the countdown timer allows investors to strategize better and make informed decisions.

The Vietnam market has seen significant growth in cryptocurrency adoption. According to a recent report, the number of cryptocurrency users in Vietnam increased by 75% in 2023 alone. This growth indicates a rising interest in Bitcoin and other cryptocurrencies, making understanding the halving even more vital for local investors.

Historical Overview of Bitcoin Halving Events

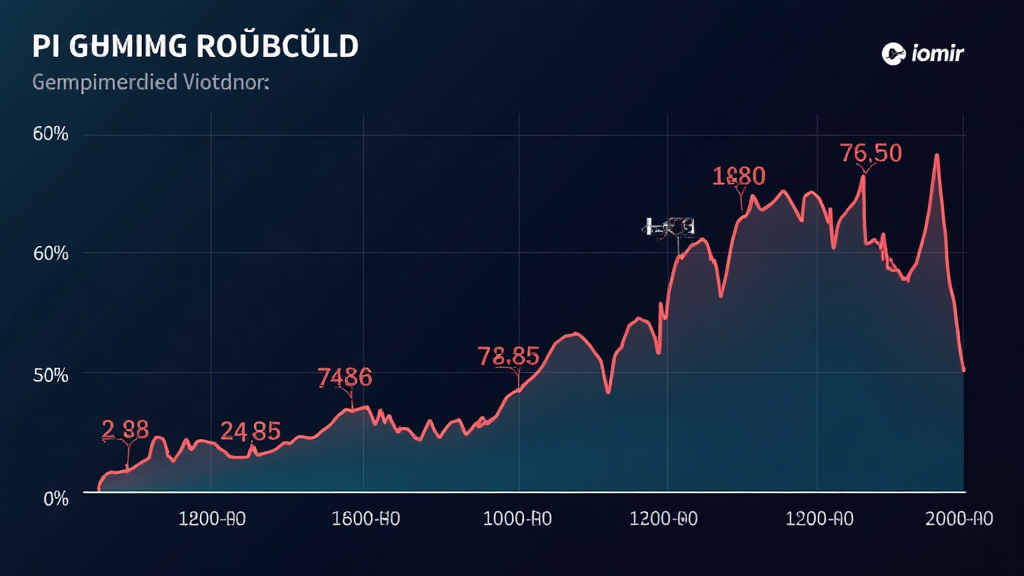

Let’s breakdown the past halving events and the subsequent market behaviors:

- First Halving (2012): Block reward reduced from 50 to 25 Bitcoins. Following this, Bitcoin’s price surged from around $12 to over $1,100 within a year.

- Second Halving (2016): Block reward reduced from 25 to 12.5 Bitcoins. The price rose from about $450 to nearly $20,000 in the following 18 months.

- Third Halving (2020): Block reward reduced from 12.5 to 6.25 Bitcoins. The price jumped from about $9,000 to over $60,000 by April 2021.

Market Volatility Around Halving Dates

The lead-up to a halving event has historically been marked by significant market volatility. This volatility presents both opportunities and risks. Some investors may choose to capitalize on the hype, while others may adopt more cautious strategies.

The Future of Bitcoin Post-Halving

As we approach the next halving in 2024, many are curious about what the post-halving landscape will look like. Some analysts believe that the trends observed in previous halvings will continue, resulting in upward price movements, while others remain skeptical.

- Potential Price Surge: Given the historical correlation between halving and price increases, many expect Bitcoin to experience significant growth.

- Increased Media Attention: As past halvings have generated media buzz, the 2024 halving is likely to draw similar attention, further driving public interest.

- Market Saturation: With more institutional investors entering the Bitcoin market, how they react will significantly impact post-halving trends.

Strategies for Investors Ahead of Halving

Tracking the Bitcoin Halving countdown timer isn’t just important; it also requires strategic planning. Here are a few tips for investors:

- Diversification: Don’t put all your eggs in one basket. Consider diversifying among various altcoins to mitigate risks.

- Research: Stay informed about the latest market trends and forecasts.

- Dollar-Cost Averaging: Instead of making a single large investment, gradually invest over time to reduce the impact of price volatility.

Conclusion

The Bitcoin Halving countdown timer is more than just a clock; it represents a significant event in the cryptocurrency space. With a history of price surges following previous halvings, understanding this phenomenon is essential for anyone involved in the crypto market. As the event approaches, it provides a valuable opportunity for investors to strategize and prepare for what lies ahead in the dynamic realm of Bitcoin.

In conclusion, whether you are a seasoned investor or a newcomer building your crypto portfolio, paying attention to the Bitcoin halving is prudent—especially in rapidly growing markets like Vietnam. Make sure to stay updated, monitor the countdown timer, and engage with knowledgeable communities to navigate this exciting yet volatile journey.

Allcryptomarketnews aims to keep you informed on all developments in the crypto world. For further insights, check out more of our articles on Bitcoin and other leading cryptocurrencies.

**Author:** Dr. Nguyen Huy Hoang, leading researcher in blockchain technology, has published over 20 papers in this field, focusing on security measures and compliance in crypto markets.