The Historical Significance of Bitcoin Halving

With various cycles of value fluctuation in Bitcoin, halving events have emerged as significant turning points in the cryptocurrency landscape. Did you know that the 2020 Bitcoin halving triggered a price surge that ultimately led to all-time highs? With these events shaping the market, understanding their historical significance has never been more crucial.

What is Bitcoin Halving?

Bitcoin halving refers to the event that occurs roughly every four years, or after every 210,000 blocks mined, where the reward for mining new blocks is cut in half. This mechanism is a foundational aspect of Bitcoin’s monetary policy designed to ensure scarcity, akin to precious metals like gold.

- First Halving: November 28, 2012 — Block reward dropped from 50 BTC to 25 BTC.

- Second Halving: July 9, 2016 — Reward decreased from 25 BTC to 12.5 BTC.

- Third Halving: May 11, 2020 — Block reward reduced from 12.5 BTC to 6.25BTC.

The Economic Principles Behind Halving

Bitcoin’s supply mechanism is driven by basic economic principles. Here’s the catch: as the number of new Bitcoins generated decreases, the supply tightens. This dynamic sets the stage for potential increases in value.

For instance, during the last halving, Bitcoin’s price skyrocketed from around $8,000 to nearly $64,000 in 2021. Such surges prompt institutional interest and retail investment.

Supply and Demand Dynamics

The effectiveness of Bitcoin halving can be illustrated through the basic principles of supply and demand. Greater demand coupled with decreased or fixed supply typically leads to price increases. Just like a limited edition product that becomes more desirable over time, Bitcoin’s scarcity contributes to its increasing value.

The Role of Speculation

Another core component influencing price movements during and after a halving is speculation. Traders and investors often bet on the future price of Bitcoin, triggering price volatility. According to data from Chainalysis, 2025 could see even more pronounced fluctuations as market sentiment wavers.

Impact on Miners and the Network

While Bitcoin halving is primarily discussed in the context of price, it also directly affects miners. As block rewards decrease, mining profitability may be challenged.

- Increased operational efficiency becomes crucial for miners.

- Higher Bitcoin prices post-halving can compensate for reduced rewards.

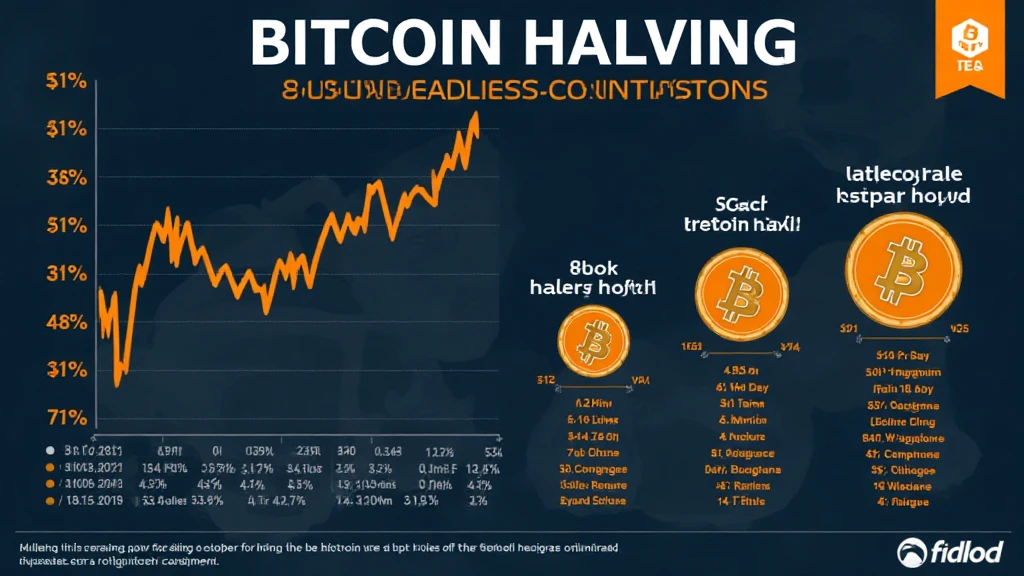

Historical Price Trends Post-Halving

Historically, Bitcoin experiences notable price jumps several months following halving events. Here’s an overview of how prices reacted in past halving years:

| Halving Date | Price Before ($) | Price After ($) | Price Increase % |

|---|---|---|---|

| 2012 | 12 | 1,200 | 10,000% |

| 2016 | 650 | 20,000 | 2,946% |

| 2020 | 8,000 | 64,000 | 800% |

Future Predictions: What Lies Ahead?

As we approach the next Bitcoin halving scheduled for 2024, many experts predict that the landscape will evolve further. The year 2025 might witness significant changes within the crypto market, making it essential for investors to remain informed. Will we see another dramatic rise in prices? Only time will tell.

- Analysts expect increased institutional investment in Bitcoin.

- The mining landscape is projected to become more competitive, prompting innovations.

Investing in Bitcoin: Opportunities and Risks

Investing in Bitcoin around halving events has historically proven lucrative, but it also carries inherent risks. Here are some important points to keep in mind:

- Market volatility often spikes; invest cautiously.

- Keep informed about global economic conditions and regulatory changes.

Conclusion

In summary, Bitcoin halving has shown profound historical significance, affecting not only the coin’s supply and price but also influencing the entire cryptocurrency market. As we look towards the next halving in 2024, understanding these fundamental events will be vital for anyone involved in the world of digital currencies. Insights surrounding Bitcoin halving can help you navigate potential investments and market speculations effectively. For more insights on cryptocurrencies and market dynamics, connect with us at allcryptomarketnews.

Author Bio

Dr. Alexander V. Moore is a leading blockchain researcher with over 20 published papers in the field of cryptocurrency economics and has led audits for prominent blockchain projects. His insights into Bitcoin halving and its implications offer invaluable guidance to both newcomers and seasoned investors alike.