Bitcoin Heatmap Visualization: Understanding Market Trends

In a fast-paced world where Bitcoin dominates the conversations around digital currency, understanding where the action is happening becomes increasingly critical. In 2024 alone, the cryptocurrency market witnessed a staggering $4.1 billion lost due to hacks, making secure techniques like Bitcoin heatmap visualization vital in shaping investment strategies. In this article, we will explore how heatmaps can enhance your understanding of market dynamics, identify buying opportunities, and help you navigate the ever-changing landscape of cryptocurrency.

The Importance of Visualization in Cryptocurrency

As the cryptocurrency market continues to grow exponentially, the challenges of understanding vast amounts of data also increase. Traditional charts and tables can often overwhelm investors, making it difficult to discern patterns and trends. Bitcoin heatmap visualization simplifies this complexity by presenting data in an intuitive, color-coded format. Here’s how:

- 1. Clarity: Heatmaps use colors to indicate price levels, making it easier for investors to identify areas of support and resistance at a glance.

- 2. Insightful Data: Visualization turns raw data into useful insights, helping users understand market sentiment and liquidity.

- 3. Quick Decision-Making: By analyzing a heatmap, traders can quickly pinpoint levels for entry or a potential exit with better precision.

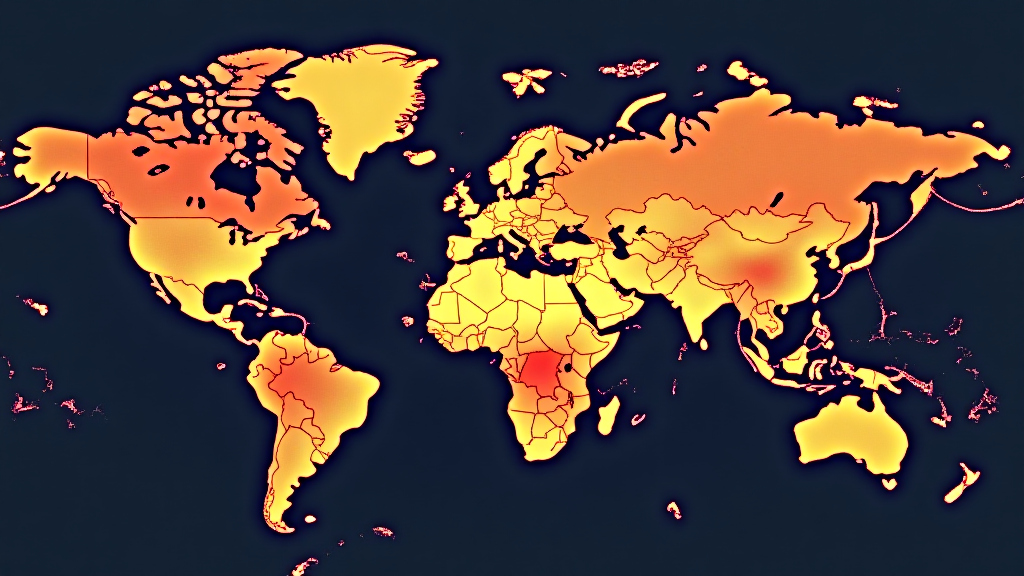

Understanding Bitcoin Heatmap Visualization

At its core, a Bitcoin heatmap displays the trading volume of Bitcoin at various price levels across a specific timeframe. Colors range from red, indicating high selling activity, to green, representing a significant buying interest. Here’s a breakdown of how to interpret it:

- High Volume Areas: When areas of the heatmap are painted red, it often indicates high selling pressure, whereas green areas signify potential buying pressure.

- Price Gaps: Inconsistent color concentrations may illustrate price gaps, suggesting volatility or lack of liquidity at particular levels.

- Trends Over Time: Observing heatmap changes over days or weeks can give traders insights into overarching market trends.

Real-World Application of Bitcoin Heatmap

Consider a scenario where the Bitcoin price is fluctuating between $45,000 to $50,000. As an investor, you want to buy during a downturn. By analyzing a heatmap:

- You may notice a significant concentration of green around $45,500, suggesting strong buying interest in that range.

- Simultaneously, a substantial red area may be forming above $50,000, indicating that many traders are likely selling at that price point.

This data empowers you to make informed decisions about when to enter the market and when to secure profits.

Case Study: The Rise of Heatmap Utilization in Vietnam

Vietnam has seen an explosive growth rate of cryptocurrency users, with estimates suggesting an annual increase of 40%. Many Vietnamese investors are now turning to innovative tools like Bitcoin heatmap visualization for trading. According to a recent survey by hibt.com, over 60% of cryptocurrency investors in Vietnam use heatmaps to analyze market conditions.

A Deep Dive into the Vietnamese Market

Understanding regional growth can help local investors optimize their strategies. Here’s how:

- Local Trends: Certain price levels may show different buying behaviors due to cultural or economic factors.

- Better Timing: Heatmap visualizations can help Vietnamese investors pinpoint better market entry points during peak trading times.

The Future of Bitcoin Heatmap Visualization

The future looks promising for Bitcoin heatmap visualization. With advancements in AI and machine learning, we can expect even deeper insights from analytical tools. As the technology develops, real-time data feeds will optimize decision-making. However, investors must remain vigilant about security risks associated with online platforms.

Here’s the catch – while these visualizations provide powerful insights, they should complement, not replace, traditional analysis methods.

Practical Tools for Better Visualization

- Trading Platforms: Ensure the platform you use incorporates real-time heatmap visualization.

- Wallet Security: Consider cold wallets, like the Ledger Nano X, which significantly reduce your risk of hacks.

- Analytics Tools: Leverage platforms that aggregate large amounts of trading data for more comprehensive visualizations.

Conclusion

Understanding Bitcoin heatmap visualization is becoming essential in effectively navigating the crypto market. By utilizing these visual tools, investors gain clarity and insight, helping to make better trading decisions and adapting their strategies according to market trends. As the landscape evolves, those embracing innovative data visualization methods will likely thrive.

In summary, Bitcoin heatmap visualization not only simplifies market data but also fosters better investment strategies. With the right tools and insights, traders can maximize their potential in a rapidly increasing market, especially in vibrant cryptocurrency ecosystems like Vietnam.

Disclaimer: This is not financial advice. Consult local regulators and conduct thorough research before making investment decisions.

Written by Dr. Alex Tran, a blockchain expert with over 30 papers in the field and led the audit of renowned projects, advancing the standards for data visualization in cryptocurrency.