Introduction

With the cryptocurrency market experiencing a staggering $4.1 billion lost to hacks in 2024, understanding the market cycles is more crucial than ever. Bitcoin, as the leading cryptocurrency, serves as a barometer for the rest of the market. In this article, we will delve into the HIBT Bitcoin market cycle analysis, helping both new and seasoned investors navigate this volatile terrain.

The Importance of Market Cycles

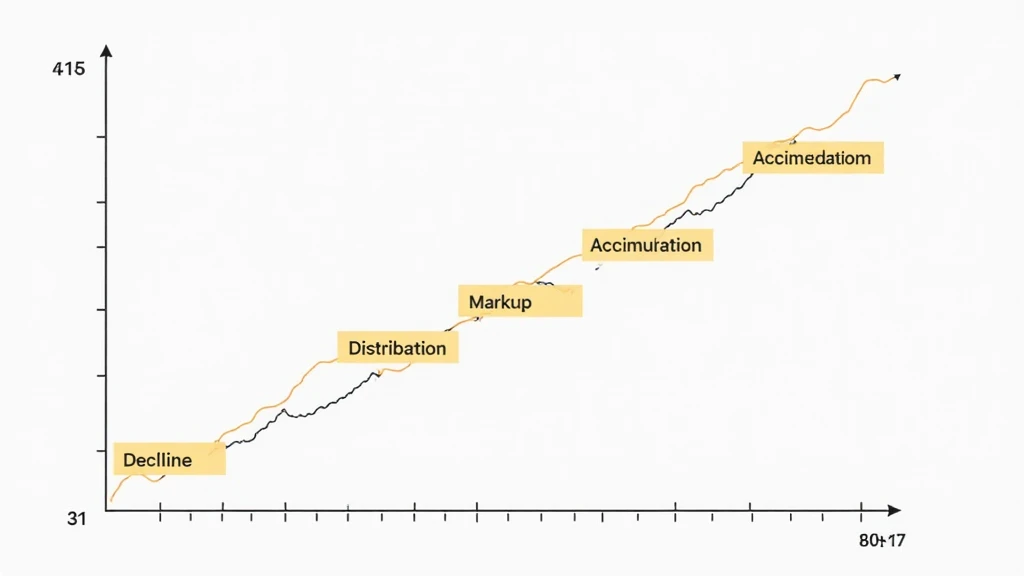

In financial markets, cycles refer to the fluctuation of prices over time. Each cycle typically consists of an accumulation phase, a markup phase, a distribution phase, and a decline phase. By understanding these cycles, traders can optimize their buying and selling strategies. Bitcoin’s market cycles follow a predictable pattern influenced by factors such as trader psychology, market conditions, and external events.

Understanding the HIBT Bitcoin Market Cycle

The HIBT (High-Interest Bitcoin Trading) model analyzes Bitcoin’s price movements through various market phases. This framework offers insights into when to enter or exit trades based on historical price trends and investor behavior.

- Accumulation Phase: After a market downtrend, smart investors begin to accumulate assets at lower prices.

- Markup Phase: As interest grows, prices rise rapidly due to increased buying pressure.

- Distribution Phase: Experienced traders start selling their holdings to lock in profits.

- Decline Phase: Prices eventually fall as demand decreases, often leading to a panic sell-off.

Current Trends in the Bitcoin Market

As of 2025, analysts observe that Bitcoin’s volatility typically increases during the year’s second quarter. This trend aligns with April tax deadlines, prompting less liquid markets. Additionally, the market has seen considerable growth in Southeast Asia, particularly in Vietnam, where crypto adoption has surged.

Vietnam’s Crypto Market Growth

According to recent statistics, Vietnam has witnessed a 200% growth in cryptocurrency users over the past year. This remarkable surge is driven by younger generations seeking alternative investment avenues. Furthermore, Vietnamese traders are increasingly adopting blockchain security standards (tiêu chuẩn an ninh blockchain) to enhance the safety of their transactions.

Psychological Factors Impacting Market Cycles

Understanding trader psychology is essential for comprehending market cycles. When prices rise, the fear of missing out (FOMO) often drives traders to buy without proper analysis, leading to market bubbles. Conversely, losses during a downtrend can result in panic selling, exacerbating price declines.

The Role of Sentiment Analysis

Utilizing sentiment analysis tools can help traders gauge market psychology. By assessing social media trends, news sentiment, and forums, investors can identify potential reversals in market trends. This technique aligns well with HIBT Bitcoin market cycle analysis, as it can pinpoint optimal entry and exit points.

Practical Trading Strategies During Market Cycles

Implementing effective trading strategies in alignment with recognized market cycles is essential for risk management and profit maximization. Here are some practical approaches:

- Dollar-Cost Averaging: Regularly invest a fixed amount, thereby mitigating the impact of volatility.

- Technical Analysis: Use price charts and indicators to determine potential price movements.

- Trend Following: Make trades based on the prevailing market trend, buying in uptrends and selling in downtrends.

- Risk Management: Set stop-loss orders to protect capital during unexpected price swings.

Conclusion

In summary, effectively analyzing the HIBT Bitcoin market cycle is vital for navigating the complexities of the cryptocurrency market. By recognizing historical patterns and understanding the psychological factors behind market movements, traders can develop tailored strategies to position themselves for success. The nuances of market cycles, particularly in dynamic regions like Vietnam, underscore the need for continuous learning and adaptation.

As we continue to see advancements and shifts within the cryptocurrency ecosystem, staying informed can make a significant difference in achieving investment goals.

For more insights into market trends and trading strategies, visit HIBT.