Introduction

With a staggering $4.1 billion lost to DeFi hacks in 2024, understanding market sentiment has never been more critical. Tracking Bitcoin market sentiment, especially in relation to HIBT, can provide essential insights for investors navigating the complex world of cryptocurrencies.

This article delves deep into the HIBT Bitcoin market sentiment tracking, explaining its significance, tools, and potential for enhancing your trading strategies.

Why Market Sentiment Matters

- Market psychology drives price movements.

- Sentiment analysis can predict potential market trends.

- Tracking shifts in sentiment helps manage risk.

The cryptocurrency market is notorious for its volatility. In regions like Vietnam, the user growth rate is increasing swiftly, with a 45% surge in local crypto adoption reported in 2023. Such dynamics make sentiment tracking essential for staying ahead.

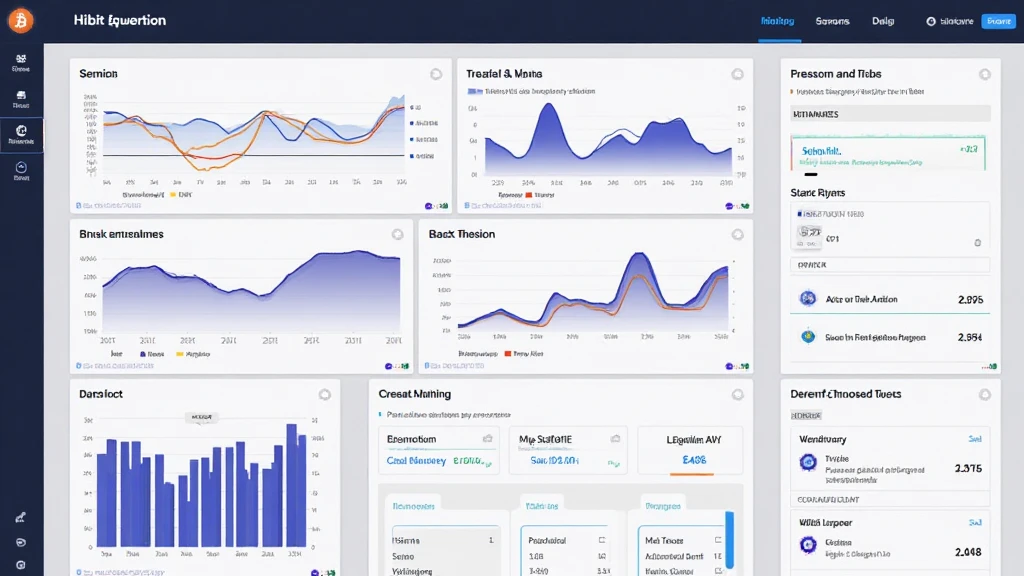

Understanding HIBT Bitcoin Market Sentiment Tracking

HIBT Bitcoin market sentiment tracking focuses on the insights derived from investor emotions, opinions, and behaviors regarding Bitcoin and HIBT technology. Here’s how it works:

- Data Collection: Gather data from various sources such as social media, forums, analytics tools, and market surveys.

- Sentiment Analysis: Employ natural language processing (NLP) to analyze qualitative data and categorize it as positive, negative, or neutral.

- Market Indicators: Utilize metrics such as the Fear & Greed Index, trading volumes, and price trends to gauge overall market sentiment.

Much like a weather forecast helps you plan for the day, market sentiment tracking acts as a guide for crypto traders, aiding them to make informed decisions. For instance, during bullish cycles, positive sentiment usually leads to increased investments.

The Tools for Tracking Bitcoin Sentiment

Numerous tools and platforms assist in tracking Bitcoin sentiment. Here are some that stand out:

1. Social Media Analytics

Platforms that aggregate social media sentiment often provide unparalleled insights. Tools like HIBT allow users to monitor Twitter, Reddit, and other social channels, capturing real-time public sentiment.

2. Market Analysis Platforms

Dedicated crypto analytics platforms offer comprehensive sentiment analysis, presenting easy-to-understand graphs and charts. Websites like CoinDesk frequently publish sentiment reports that can be invaluable for traders.

3. Custom Web Scraping Tools

For those tech-savvy individuals, developing custom web scrapers can provide tailored sentiment data specifically relevant to their investment priorities.

Effective Strategies for Utilizing Sentiment Tracking

Knowing how to read the signals can set successful traders apart:

- Combine Data Sources: Use multiple tools to obtain a comprehensive view of sentiment.

- Identify Patterns: Learn to recognize how sentiment affects price changes over time.

- Stay Updated: Regularly monitor sentiment metrics, especially during major news cycles.

For example, if you track a bullish sentiment trend alongside increasing trading volumes, it signals a potential upsurge in Bitcoin prices. Conversely, a sudden drop in sentiment might warrant caution.

Real-World Applications of HIBT Bitcoin Market Sentiment Tracking

The implications of Bitcoin market sentiment tracking extend well beyond personal trading:

Investment Funds: Many hedge funds and investment firms are leveraging sentiment analysis to optimize their crypto portfolios.

Market Predictions: Analysts utilize trends derived from sentiment data to predict market behavior effectively.

Risk Management: Traders can better manage their positions by understanding when to exit based on shifts in sentiment.

Researchers have even found that sentiment analysis can predict price fluctuations with an accuracy rate approaching 75% when appropriately applied.

Challenges in Bitcoin Market Sentiment Tracking

While sentiment tracking offers valuable insights, there are hurdles to overcome:

- Noise in Data: Social media can produce misleading sentiments, often influenced by bots or misinformation.

- Short-lived Trends: Sentiment can change rapidly, leading to potential misinterpretations if one doesn’t act quickly.

- Regulatory Concerns: Many markets still struggle with clear regulations surrounding the use of sentiment data.

Key Takeaways

Despite these challenges, many traders have found success by:

- Cross-checking sentiment data with technical indicators.

- Adapting strategies based on market conditions.

- Practicing continuous learning and adaptation.

Conclusion

HIBT Bitcoin market sentiment tracking is an essential tool for anyone looking to navigate the crypto landscape effectively. With the potential for significant returns comes the responsibility of understanding market dynamics. As we witness incredible growth in regions such as Vietnam, where crypto adaptation is skyrocketing, sentiment tracking remains at the forefront of trading strategies.

By combining various data sources and employing smart strategies, investors can reap the potential profits while minimizing risks in this highly volatile market. Stay informed, stay smart, and make your trading decisions based on well-rounded data.

For further insights into the HIBT Bitcoin market sentiment tracking, continue exploring our resources at allcryptomarketnews.

Written by Dr. Nguyen Tran, a blockchain technology expert with 12 published papers in the field and the lead auditor for several well-known crypto projects.