Effective HIBT Crypto Liquidity Pool Strategies

As the world of cryptocurrency continues to expand, the intricate dynamics of liquidity pools become increasingly vital, particularly for coins like HIBT. Did you know that DeFi hacks resulted in a staggering loss of $4.1 billion in 2024? This underscores the necessity for robust strategies to safeguard your investments. Here, we’ll explore innovative liquidity pool strategies specifically tailored for HIBT.

Understanding Liquidity Pools

Liquidity pools are cornerstone elements of decentralised finance (DeFi), acting as reserves of tokens that facilitate trading on decentralised exchanges (DEX). Think of them as the coffee shops of the crypto world: they provide a marketplace for buyers and sellers, ensuring that transactions can occur smoothly and efficiently.

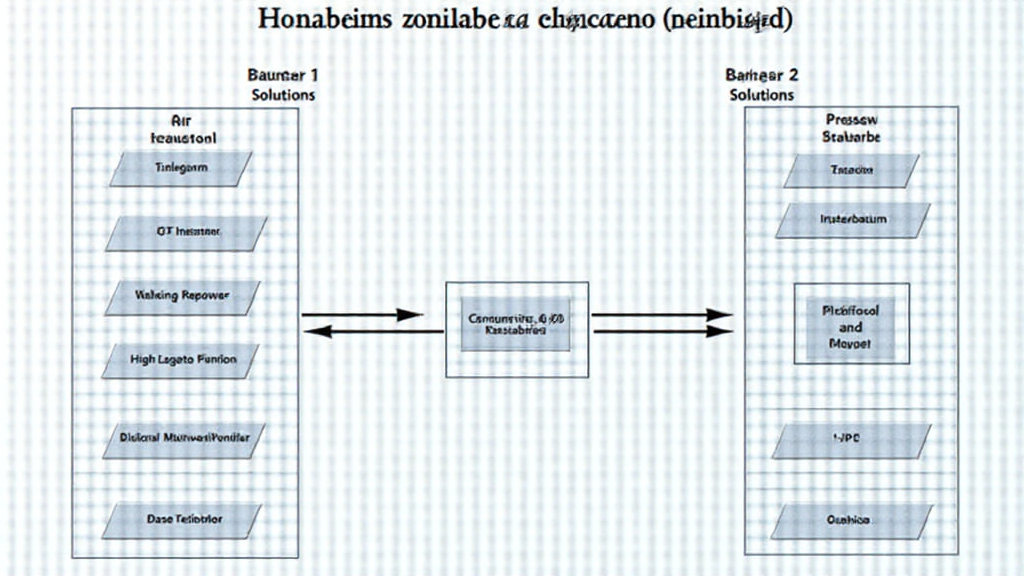

- Automated Market Makers (AMMs): These systems automatically manage the trading of assets in liquidity pools.

- Impermanent Loss: A common risk that liquidity providers face when the price of tokens in a pool diverges.

- Yield Farming: A strategy that allows users to earn rewards for providing liquidity.

Why HIBT? The Driving Factors

HIBT has been gaining traction within the blockchain community. Its user growth in Vietnam alone has surged by 45% in the past six months, drawing in more stakeholders. What sets HIBT apart from other cryptocurrencies, and why should investors consider it for liquidity pools?

- Flexible Governance: HIBT offers a model that empowers users to participate in decision-making.

- Strong Community: A dedicated user base fosters sustained growth and trust.

- Innovative Solutions: HIBT continues to introduce unique features that enhance usability.

Crafting Your HIBT Liquidity Pool Strategy

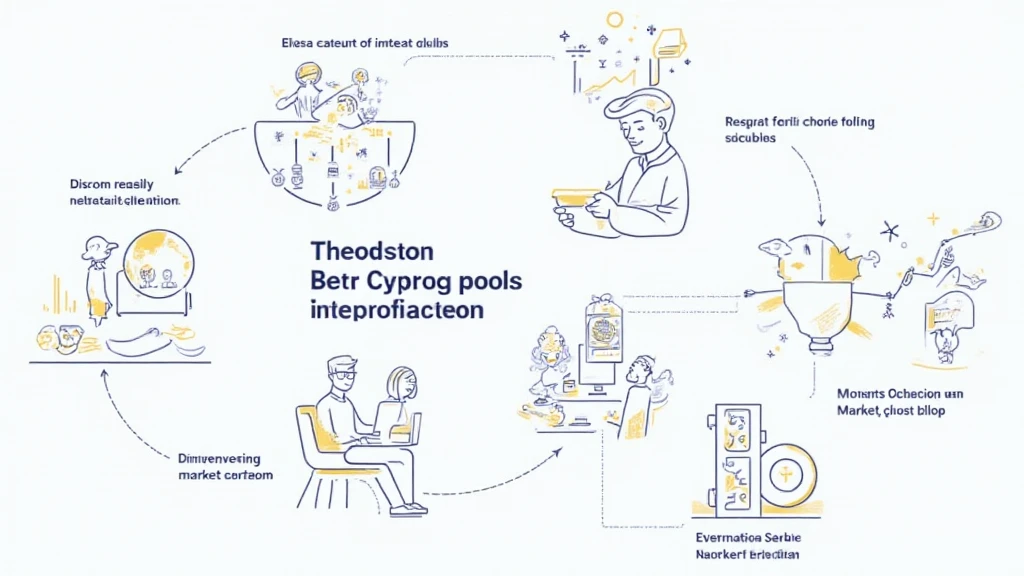

Developing a successful strategy for HIBT liquidity pools involves understanding the nuances of the market and the specific attributes of the HIBT token. Here’s how you can maximize your investments:

1. Assessing Risk vs. Reward

When engaging with HIBT liquidity pools, it’s essential to balance potential risks with anticipated rewards. Begin by analyzing:

- Market trends and historical data.

- Current liquidity levels in pools.

- Potential fees associated with trading.

2. Diversification is Key

Don’t put all your eggs in one basket. Consider spreading your assets across different liquidity pools to mitigate risk. For instance, pairing HIBT with stablecoins within an AMM can cushion against volatility.

3. Stay Updated with Market Trends

The crypto market is volatile and constantly evolving. Keeping informed on market trends will enable you to adjust your strategy as necessary. Utilize platforms like HIBT.com for regular updates.

4. Harness Advanced Tools

Use analytical tools that provide insights and metrics on liquidity pools, such as:

- Price alert systems.

- Graphs for volume and liquidity observations.

- Performance analytics software.

Potential Pitfalls and How to Avoid Them

Even with the best strategies, the crypto landscape is riddled with potential pitfalls. Here’s how to navigate common traps:

1. Understanding Impermanent Loss

Impermanent loss is a risk that occurs when the value of tokens in your liquidity pool changes compared to when you deposited them. It’s essential to be aware of this and prepare accordingly by staking on stable pairs.

2. Avoiding Overexposure

Putting excessive funds into a single liquidity pool can be detrimental. Reviewing your overall exposure ensures that you’re protected against sudden market changes.

Impacts of HIBT Liquidity Pools on the DeFi Ecosystem

As the HIBT token garners more attention, its liquidity pools will have significant implications on the wider decentralised finance landscape:

- Increased Activity: More liquidity leads to higher trading volumes, which benefits all participants.

- Enhanced Security: With increased participants, the pool becomes less susceptible to malicious attacks.

- Market Stabilization: More liquidity contributes to price stabilization, which is crucial in the volatile crypto environment.

The Future of HIBT and Liquidity Pools

Looking ahead, the future seems bright for HIBT within the DeFi framework. With a projected growth rate of 60% in the Vietnamese crypto market by 2025, the focus should remain on evolving liquidity strategies. The incorporation of advanced mechanisms will define successful future strategies.

To delve deeper into HIBT and its strategies for liquidity pools, refer to comprehensive guides and resources provided at HIBT.com.

Remember, always conduct thorough research and consult local regulators when investing in cryptocurrencies. Investing in HIBT liquidity pools or any crypto asset carries risks, and it’s vital to stay informed.

Author: Dr. Jane H. Smith, a leading blockchain consultant with over 15 published papers and a background in auditing prominent crypto projects.