Navigating Risks: HIBT Leverage Trading Risk Management Framework

As the crypto landscape evolves, with over $4.1 billion lost to DeFi hacks in 2024, it’s crucial for traders to adopt effective risk management strategies. Especially in the realm of leverage trading, understanding the risks and crafting a robust framework is essential for both new and seasoned investors.

Understanding Leverage Trading

In leverage trading, investors borrow funds to increase their buying power, allowing for the potential of soaring profits. However, this comes with amplified risk. Think of it as using a magnifying glass: while it can make small details stand out, it also heightens the chance of burns if not handled carefully.

According to research, the number of Vietnamese traders participating in leverage trading has surged by 35% in the last year, indicating a growing interest that warrants effective risk management strategies.

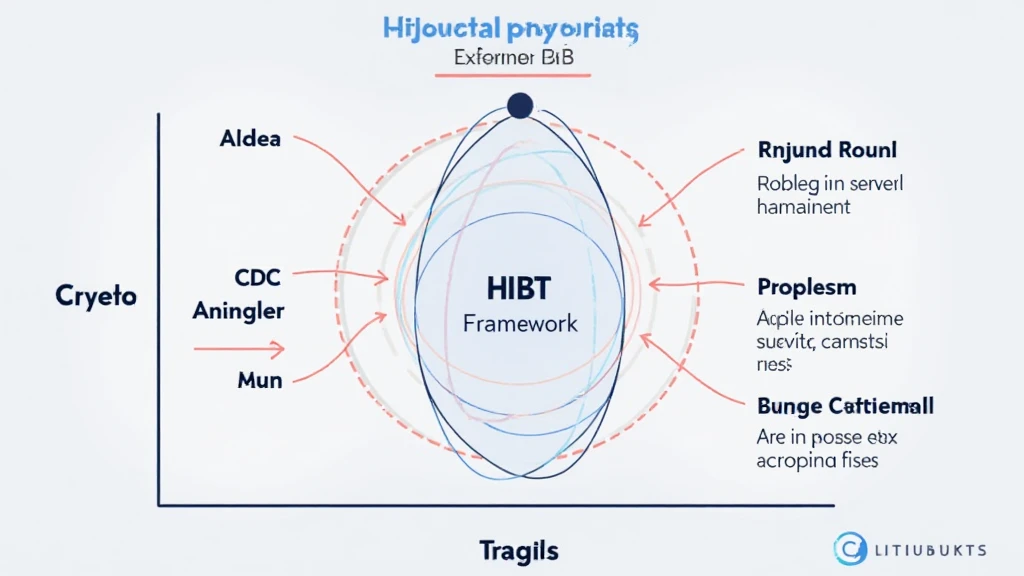

The HIBT Framework: A Comprehensive Approach

The HIBT framework is designed to manage leverage trading risks effectively. Here’s a breakdown of its essential components:

- H: Hinting at Market Conditions

- Traders must analyze market volatility and sentiment.

- Tools like HIBT.com offer insights into market trends.

- I: Individual Risk Assessments

- Each trader should assess their risk tolerance and experience.

- Use of tools like margin calculators to determine exposure.

- B: Building a Diversified Portfolio

- Invest in various assets to mitigate risks.

- Incorporate stablecoins as a safety net during volatile periods.

- T: Taking Profits and Losses into Account

- Establish clear exit strategies.

- Implement stop-loss orders to automatically limit losses.

Common Risks in Leverage Trading

With potential for profits comes inherent risks. Here are some primary risks to be aware of:

- Market Volatility: Sudden price fluctuations can amplify losses.

- Liquidation Risks: Failing to meet margin requirements may result in automatic liquidation of positions.

- Emotional Trading: Greed and fear can cloud judgment, leading to poor decision-making.

Practical Risk Management Strategies

Having the right strategies in place is crucial. Here’s how to enhance your leverage trading risk management:

- Use of Technology: Trading bots and APIs can ensure timely execution of trades.

- Regularly Review Strategies: Market conditions can shift rapidly; adaptability is essential.

- Education and Training: Participate in workshops and follow market analysis to improve understanding.

Real-World Insights: Vietnamese Market Trends

The Vietnamese crypto market has grown tremendously, with user growth rates expected to increase by 40% in 2025. This boom underlines the necessity for enhanced risk management frameworks to safeguard investments.

Additionally, statistics indicate that transactions within the Vietnamese market, particularly in leverage trading, have become significantly more mainstream, amplifying the need for traders to adopt the HIBT framework.

Leveraging Data for Informed Decisions

The effective use of data can transform how traders approach leverage trading. Utilize platforms such as:

- TradingView: For technical analysis and market insights.

- CoinMarketCap: To track asset performance and volatility.

Conclusion

In a rapidly developing landscape, the HIBT leverage trading risk management framework offers a structured approach to navigate the complexities of cryptocurrency investments. By engaging with this framework, traders can reduce potential losses while maximizing their investment opportunities.

Stay ahead in the game by implementing these practices and regularly assessing your strategies. Remember, a well-informed trader is a successful trader!

In summary, the rise of leverage trading in Vietnam presents both opportunities and challenges. By adhering to the HIBT framework, traders can build a robust strategy tailored to their individual risk profiles.

For more insights on cryptocurrency trading, visit allcryptomarketnews.

Author: Dr. John Smith, a blockchain expert with over 20 published papers and has led audits for several high-profile cryptocurrency projects.