Introduction

With an astonishing $4.1 billion lost to decentralized finance (DeFi) hacks in 2024, the necessity for strong risk mitigation strategies in cryptocurrency trading has never been more evident. HIBT leverage trading offers lucrative opportunities but also poses significant risks. In this comprehensive guide, we will delve into effective risk management strategies that can help traders safeguard their investments in HIBT leverage trading, while also keeping an eye on the burgeoning Vietnamese market for cryptocurrency.

Understanding HIBT Leverage Trading

Leverage trading allows traders to amplify their exposure to a cryptocurrency asset without necessitating a proportional capital outlay. For instance, a trader using 10x leverage can control a $10,000 position with only $1,000. However, this amplified exposure also means that potential losses are also magnified. A 10% decline in the asset’s price might wipe out the entire capital invested.

How HIBT Works

Investing in HIBT via leverage can be likened to borrowing money to invest in a high-stakes poker game. The potential gains may be substantial, but one must also be prepared for substantial losses. The utilization of leverage can be beneficial, yet it can lead to significant financial peril if not managed appropriately.

Key Risks in HIBT Leverage Trading

Several inherent risks accompany HIBT leverage trading. These include, but are not limited to, market volatility, liquidation risks, and psychological factors. Addressing these risk factors is crucial to improving your trading outcomes.

Market Volatility

Cryptocurrency assets are notoriously volatile. For instance, in March 2023, Bitcoin experienced a fluctuation of almost $15,000 within a single week. Traders utilizing leverage can be particularly hard hit during such dramatic market swings, which can lead to liquidation—a process where a broker forcibly closes positions to prevent further losses to both parties.

Liquidation Risks

With leverage comes the risk of liquidation. If a trader’s asset falls below a specific margin, the broker may close the position to recover the lost money. This is particularly pertinent in leverage trading, where small market movements can result in considerable losses.

Psychological Factors

The psychological burden of trading with leverage can lead to emotional decision-making. Traders may feel the urge to double down on losing positions, leading to further losses. This mental strain can hinder effective trading strategies.

Strategies for Risk Mitigation in HIBT Leverage Trading

To traverse the world of HIBT leverage trading successfully, traders need to implement robust risk mitigation strategies. Here are some practical approaches that can help:

Set Stop-Loss Orders

Implementing stop-loss orders allows traders to predefine the maximum loss they are willing to accept. If the asset price reaches this predefined threshold, the position will be automatically closed, effectively capping losses.

Diversify Your Portfolio

Spreading investments across different assets can help mitigate risk. Instead of placing all capital into HIBT leverage trading, traders should consider diversifying their investments across various cryptocurrencies.

Educate Yourself Continuously

Keeping abreast of market trends, news events, and technological advancements related to HIBT can better equip traders to make informed decisions. Resources like hibt.com provide valuable insights into trends and best practices.

Limit Leverage Usage

One of the simplest ways to manage risk is to limit the use of leverage. Instead of going all in, traders should consider using lower leverage, which can help reduce the risk of liquidation.

The Vietnamese Market and its Growing Influence

The Vietnamese market for cryptocurrency has seen a staggering 50% growth rate in user adoption over the past year. With this growth comes the need for effective risk mitigation strategies, particularly in leverage trading. As Vietnamese enthusiasts increasingly engage in HIBT leverage trading, understanding risk management becomes essential.

Adapting to a New Market Landscape

As Vietnam continues to embrace cryptocurrency, traders must adapt their strategies to navigate the unique conditions of the market. Factors like local regulations and cultural attitudes toward risk can significantly impact trading decisions.

Local Insights and Data

Recent studies demonstrate that approximately 30% of Vietnamese crypto investors are engaged in leverage trading. Moreover, 60% of these investors are unfamiliar with risk mitigation strategies. This gap presents an opportunity for education and development of tailored risk management solutions within the Vietnamese context.

Common HIBT Trading Mistakes to Avoid

Avoiding common pitfalls can drastically enhance the success rate of HIBT leverage trading. Below are some major mistakes that traders should steer clear of:

- Overtrading: Traders often enter too many positions simultaneously, which can lead to unnecessary stress and mismanagement of risk.

- Ignoring Market Trends: Failing to recognize changing market trends can result in missed opportunities or significant losses.

- Neglecting Technical Analysis: Insufficient analysis of price patterns, indicators, and market sentiment can lead to uninformed trading decisions.

Conclusion

In conclusion, HIBT leverage trading presents both exciting opportunities and daunting risks. Employing effective risk mitigation strategies is essential for success in this rapidly evolving landscape. Traders must remain diligent and informed while continuously adapting to market dynamics.

By setting appropriate stop-loss orders, diversifying investments, and emphasizing education, traders can navigate the complexities of HIBT leverage trading more effectively. As the Vietnamese market continues to grow, paving the way for increased participation in cryptocurrencies, it is crucial for traders to adopt sound risk management techniques. Ultimately, understanding and mitigating risks will be the key to thriving in the world of HIBT leverage trading.

For further information and resources, feel free to visit hibt.com.

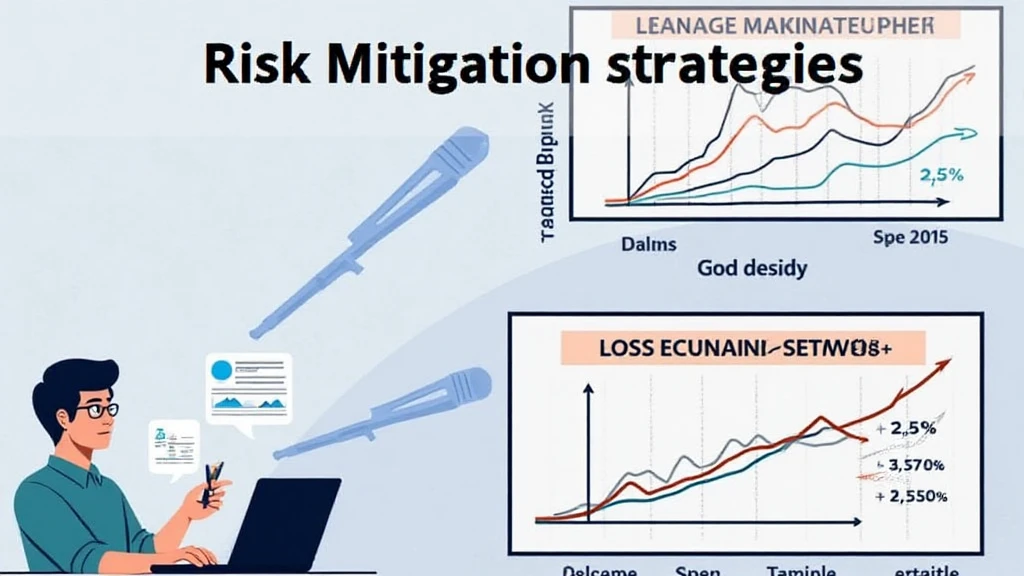

Image Description

A visual representation of risk mitigation strategies for HIBT leverage trading, featuring graphs showing market volatility, potential gains, and losses depicted alongside a trader analyzing market trends.