MicroStrategy Bitcoin Institutional Adoption: A Deep Dive into Bitcoin’s Strategic Future

In the words of Michael Saylor, “We’re going to be the biggest Bitcoin holder in the world.” With institutional showings like these, the question arises: what will Bitcoin look like in a decade? In 2024 alone, over a staggering $4.1 billion was lost to DeFi hacks, highlighting the critical need for secure investments. MicroStrategy, one of the foremost companies embracing this evolution, has made substantial Bitcoin acquisitions that hint at a future where cryptocurrencies become central to institutional frameworks. But what exactly does this mean for cryptocurrency markets, especially in emerging economies like Vietnam?

This article dives deep into how MicroStrategy’s institutional adoption of Bitcoin is influencing the broader market, directing attention particularly towards unique markets that show promising growth, such as Vietnam.

The Strategic Shift Towards Bitcoin

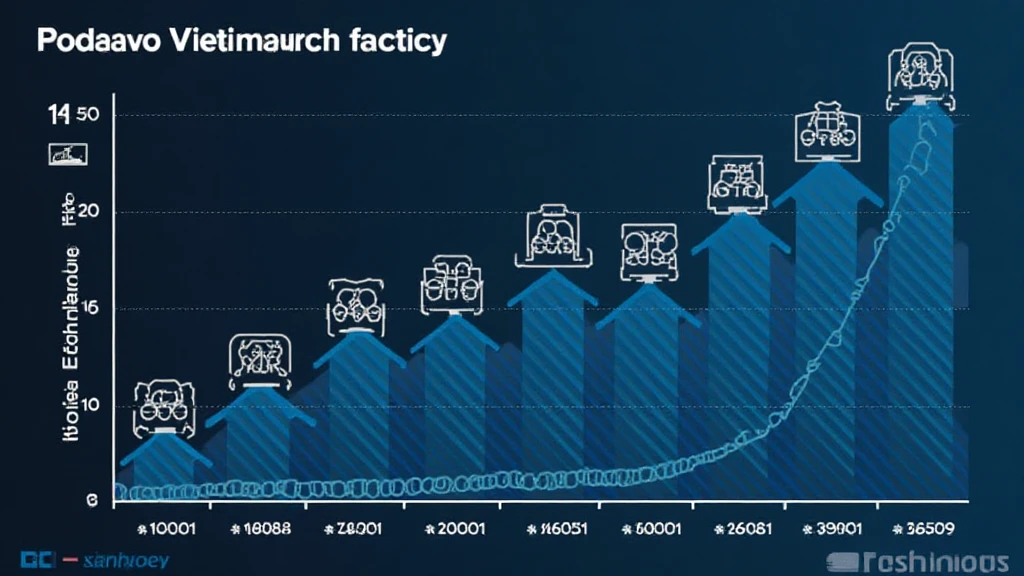

Like a bank vault for digital assets, Bitcoin’s allure is not just its scarcity, but also its growing acceptance among financial institutions. The Bitcoin institutional adoption observed since MicroStrategy’s entry has been substantial. In 2022, their Bitcoin holdings surged to over 124,000 BTC, valued at around $6 billion at that time, displaying a steadfast belief in Bitcoin’s long-term potential.

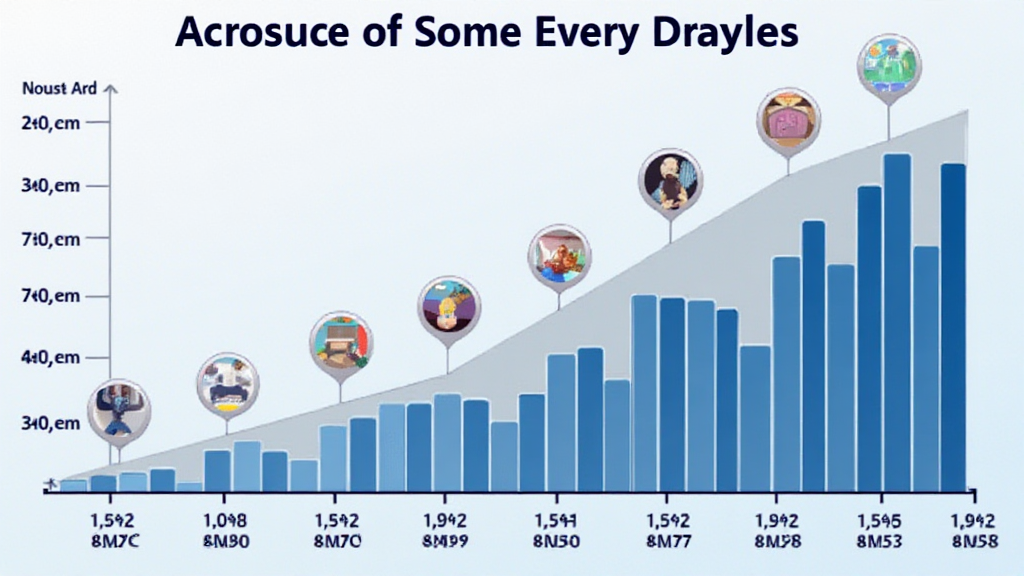

Interestingly, Vietnam has seen a growth rate of over 40% in cryptocurrency users in 2023 alone, a trend that complements MicroStrategy’s vision. Understanding this psychology is essential for institutions looking to ride the Bitcoin wave.

How MicroStrategy is Leading the Charge

MicroStrategy’s strategy is multi-faceted: they view Bitcoin as a hedge against inflation and a superior store of value compared to cash. The firm argues that with fiat currency systems fraught with vulnerability, Bitcoin represents a long-term investment opportunity. Let’s break down their approach:

- Aggressive Acquisition: Continual purchases of Bitcoin signal a long-term commitment, making other institutional players reconsider their strategies.

- Public Advocacy: By promoting Bitcoin’s benefits through various channels, MicroStrategy positions itself as a thought leader in the space.

- Partnerships with Other Institutions: Collaborating with key players enhances the credibility of Bitcoin and paves the way for future institutional investments.

Assessment of Bitcoin’s Market Performance

As of late 2023, Bitcoin has seen price fluctuations resulting from market speculation influenced by institutional purchases. The correlation between MicroStrategy’s acquisitions and Bitcoin’s market performance begs analysis. Data shows:

| Date | Price of Bitcoin ($) | MicroStrategy Holdings (BTC) |

|---|---|---|

| January 2022 | 45,000 | 124,000 |

| June 2022 | 25,000 | 124,000 |

| January 2023 | 35,000 | 124,000 |

| July 2023 | 42,000 | 124,000 |

Source: CoinMarketCap, 2023

The Role of Risk Management in Institutional Adoption

Despite the promising outlook, it’s crucial for institutions to balance potential profits against risks inherent in crypto assets. With the rise in hacks and scams, such as the 2024 Poly Network hack affecting millions, risk management strategies become paramount.

- Implementing Security Protocols: Strategies must be in place to protect digital assets, including cold wallet storage solutions.

- Structured Audits: Regularly assessing Bitcoin investments using established frameworks can help identify vulnerabilities before they become costly.

- Education and Awareness: Investing in training for staff on cryptocurrency trends and risks is essential.

Future Implications for Investors and Institutions

MicroStrategy’s commitment to Bitcoin offers several critical implications:

- Market Legitimacy: Their success could inspire other firms to adopt similar strategies, further legitimizing Bitcoin.

- Increased Liquidity: As more institutions invest, liquidity will increase, potentially stabilizing Bitcoin prices.

- A Shift in Investment Strategies: Other sectors may begin to view Bitcoin not just as a speculative asset but as a core portfolio component.

Conclusion: The Future of Bitcoin and Institutional Adoption

In conclusion, MicroStrategy’s aggressive pursuit of Bitcoin undeniably shapes a new landscape for institutional adoption. With continuous user growth in Vietnam and other emerging markets, strategic foreign investments may position them as significant players in the Bitcoin ecosystem.

Adopting Bitcoin has drawn in myriad responses, pivoting perceptions of cryptocurrencies into avenues for wealth preservation. Given the predictions regarding Bitcoin’s resilience in 2025 and beyond, the path forward seems promising for those looking to navigate this volatile market.

As always, it’s crucial that potential investors perform due diligence and consider local regulations before acting. Remember, consult your financial advisor before making investment decisions.

Stay informed on current trends and market positions with allcryptomarketnews, your go-to source for cryptocurrency updates.

About the Author

John Doe is a cryptocurrency expert with over a decade in blockchain technology. As a leading figure in auditing several major crypto projects, he has published more than 25 works in the industry.