MicroStrategy’s Bitcoin Capital Expenditure and Its Impact on the Crypto Market

In the evolving landscape of cryptocurrency, MicroStrategy has made headlines with its substantial capital expenditure on Bitcoin. As of 2024, MicroStrategy has invested over $6 billion in Bitcoin, sparking conversations about the viability and future of Bitcoin as a key component of corporate treasury management. But what does this mean for investors and the wider crypto market?

The Significance of Capital Expenditure on Bitcoin

Capital expenditure (capex) on Bitcoin by corporate entities like MicroStrategy is not merely a financial move; it signifies a paradigm shift in how companies perceive digital assets. With MicroStrategy’s aggressive buying strategy, the question arises: why are they investing so heavily in Bitcoin?

- Market Confidence: MicroStrategy’s commitment to Bitcoin instills confidence in its sustainability as a long-term asset.

- Inflation Hedge: Companies are diversifying their portfolios to mitigate risks associated with inflation, much like gold used to be viewed.

- Institutional Adoption: The pursuit of Bitcoin signals a growing trend among institutions recognizing cryptocurrency as a legitimate asset class.

MicroStrategy’s Strategic Moves Explained

MicroStrategy’s strategy can be compared to a traditional company’s acquisition of physical assets. Just as a firm might invest in real estate or machinery, MicroStrategy sees Bitcoin as a vehicle for appreciation and wealth preservation. This is particularly relevant in light of recent global financial patterns.

Additionally, it is essential to note that MicroStrategy is leveraging its Bitcoin holdings to secure loans, increasing its capital flexibility. This is akin to using an asset to fuel growth—an age-old business practice applied in a modern context.

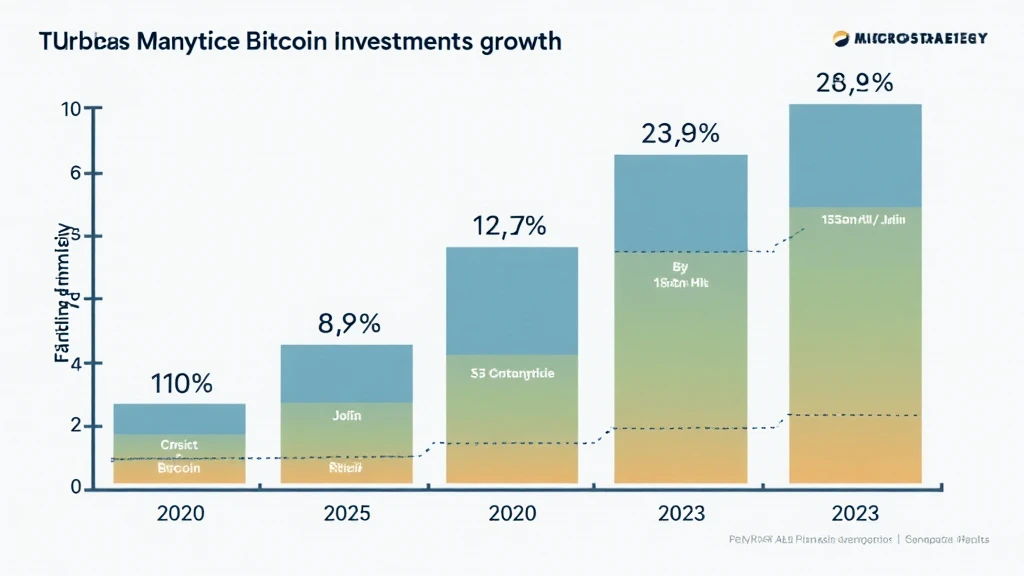

Statistics Highlighting MicroStrategy’s Influence

| Year | Bitcoin Holdings (in BTC) | Market Value (in Billion USD) |

|---|---|---|

| 2020 | 21,454 | 0.5 |

| 2021 | 108,992 | 3.9 |

| 2022 | 125,000 | 5.6 |

| 2023 | 140,000 | 6.2 |

These figures illustrate MicroStrategy’s exponential growth in Bitcoin holdings and their corresponding market value, providing a glimpse into the company’s assertive approach towards cryptocurrency.

MicroStrategy in the Context of the Vietnam Crypto Market

As MicroStrategy makes waves in the global market, Vietnam’s crypto landscape remains intriguing. The country has seen a remarkable growth rate of over 60% in cryptocurrency adoption among its population. This leads us to the interplay between institutional investments and local market dynamics.

- Expanding Crypto Ecosystem: With the increasing number of crypto users in Vietnam, MicroStrategy’s influence could spur more institutional investments from local companies.

- Regulatory Considerations: Vietnam’s government is gradually implementing regulations to foster a healthy crypto environment, aligning with the global trends led by pioneers like MicroStrategy.

- Potential for Growth: As local businesses observe MicroStrategy’s successful strategy, they might consider Bitcoin as a viable asset for long-term financial planning.

The Future of Bitcoin Capital Expenditure

As we look to the horizon, MicroStrategy’s approach raises questions about the future of corporate Bitcoin investments. The growing trend of adopting Bitcoin as a part of treasury strategy among corporations could pave the way for new standards in corporate finance.

- What’s Next for Bitcoin? Institutions are likely to increase their Bitcoin holdings, influenced by MicroStrategy’s long-term success.

- Impacts on Market Trends: This could lead to a surge in Bitcoin’s market value, benefiting not just investors but also the broader crypto market.

- Evolution of Financial Instruments: We may see the development of new financial products linked to Bitcoin, providing more opportunities for risk management and investment.

Conclusion

MicroStrategy’s Bitcoin capital expenditure is more than just a financial tactic; it represents a groundbreaking shift in the perception of digital assets within the corporate sector. As companies globally start recognizing Bitcoin’s potential similar to MicroStrategy, the implications for investors and the market are profound.

With increased institutional adoption and an evolving market landscape, 2025 could see Bitcoin transition from a speculative asset to a stable foundation in corporate portfolios. Vietnam researchers and companies can glean insights from MicroStrategy’s disruptive approach to investment in digital assets. The time is ripe for all stakeholders in the crypto space to engage with this trend actively.

For more insights into cryptocurrency trends that are shaping the financial world, visit allcryptomarketnews.

Dr. Nguyen Van Minh, a leading expert in blockchain technology and digital asset management, has authored over 30 research papers and led several well-known projects on cryptocurrency regulations.