Coinbase Crypto Stablecoin Liquidity Pools: Your Ultimate Guide

With over $4.1 billion lost to DeFi hacks in 2024, ensuring liquidity provisions are both secure and reliable has never been more critical. This article delves into the significance of Coinbase crypto stablecoin liquidity pools and their role in the ever-evolving landscape of decentralized finance (DeFi). Whether you’re a seasoned investor or just beginning your crypto journey, understanding these liquidity pools is crucial in navigating the crypto market.

Understanding Liquidity Pools

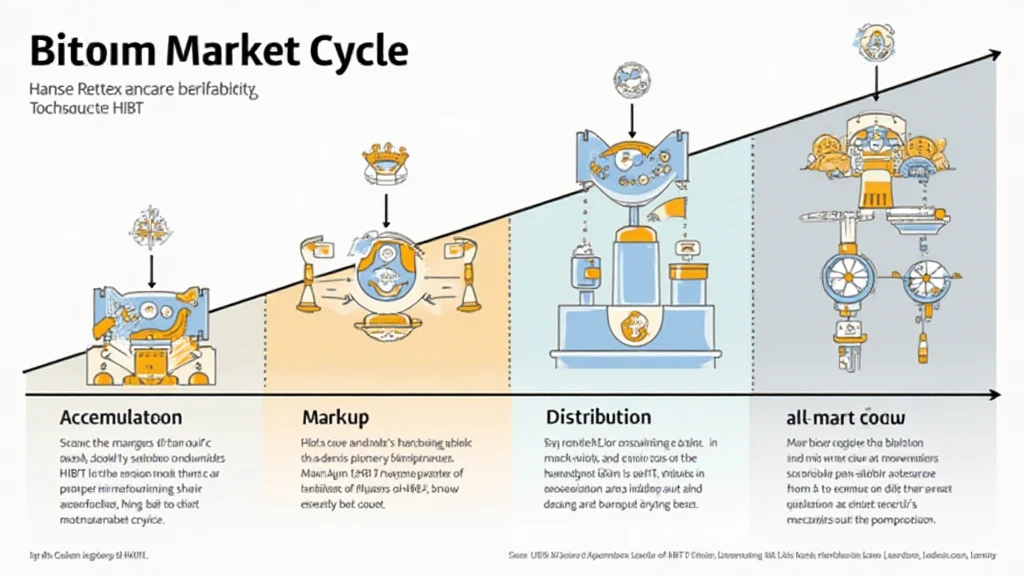

Liquidity pools are core components of DeFi platforms. They consist of smart contracts that hold funds in a decentralized setting, allowing users to swap various cryptocurrencies or tokens seamlessly. For instance, if you think of liquidity pools like community-driven bank accounts, they enable various users to pool their resources and facilitate transactions easily.

What Are Stablecoins?

Stablecoins are cryptocurrencies designed to minimize volatility by pegging their market value to some stable asset, typically fiat currency. The primary purpose of stablecoins in liquidity pools is simple: they provide stability in an otherwise volatile market.

- Examples include Tether (USDT), USD Coin (USDC), and Dai.

- These assets are crucial in providing liquidity in pools, ensuring trades can be made without significant price movements.

The Role of Coinbase in Liquidity Pools

Coinbase, one of the most recognized cryptocurrency exchanges in the world, plays a significant role in the stablecoin landscape. By offering liquidity pools that involve stablecoins, Coinbase aids in enhancing the trading experience, enabling quicker transactions, and providing users with more opportunities for yield farming.

Coinbase Liquidity Pools Mechanics

Liquidity pools on Coinbase operate using automated market-making (AMM) protocols. Here’s a breakdown of how these pools function:

- Users deposit pairs of tokens into the liquidity pool.

- In exchange for providing liquidity, users earn fees based on the number and value of transactions using those tokens.

- Liquidity providers gain interest, especially when stablecoins are involved, as they minimize the risk of impermanent loss.

Benefits of Using Stablecoins in Liquidity Pools

Utilizing stablecoins in liquidity pools offers multiple advantages:

- Reduced Volatility: Stablecoins provide a safety net against drastic market swings.

- Arbitrage Opportunities: They enhance arbitrage by maintaining price consistent with fiat currencies.

- Enhanced User Experience: Liquidity pools allow users to trade with minimal slippage, improving overall user satisfaction.

Challenges Faced by Liquidity Pools

Despite their benefits, there are challenges involved:

- Smart Contract Vulnerabilities: Bugs in smart contracts can lead to significant financial losses.

- Permanently Lost Funds: Providing liquidity might result in impermanent losses during extreme market movements.

- Regulatory Concerns: Stablecoins are drawing attention from regulators, which could impact their future use.

The Growing Market in Vietnam

Vietnam has seen a surge in crypto adoption. Recent data indicates a growth rate of 85% in crypto investments among Vietnamese users in the past year. As stablecoins gain traction, platforms like Coinbase are ensuring that liquidity pools remain accessible to this burgeoning market.

Stablecoins in Vietnam’s Crypto Landscape

With local fintech regulations evolving, Vietnamese users are increasingly engaging with stablecoins. This trend provides an excellent opportunity for liquidity pools:

- Stablecoins are seen as a more secure entry point for new investors.

- Local businesses are beginning to accept them for transactions, promoting their use.

The Future of Liquidity Pools and Stablecoins

As we look towards 2025, with projections indicating continued growth for the DeFi markets globally and specifically in Vietnam, it is crucial to keep an eye on:

- The Evolution of Market Regulations: Regulatory developments will shape how liquidity pools operate.

- Technological Improvements: Enhanced security measures for smart contracts will protect investors.

- User Adoption Rates: Continued education for users will influence the robustness of liquidity pools.

Conclusion

In summary, understanding the mechanics of Coinbase crypto stablecoin liquidity pools can significantly enhance your investment strategies in the dynamic world of crypto finance. As regulations evolve and the local market matures, stablecoins will likely play a pivotal role in the future of financial transactions. For those interested in diving deeper into crypto strategies and every aspect of trading in stablecoins, platforms like Coinbase are here to facilitate that journey.

Stay informed and equipped to navigate this ever-changing environment as you harness the benefits that liquidity pools can offer.

Author: Dr. Anh Nguyen, a blockchain security consultant with over 15 peer-reviewed publications and has led audits of prominent DeFi projects.