Introduction

In the rapidly evolving world of cryptocurrency, understanding the order flow can be a decisive factor for investors. As of 2024, over $4.1 billion has been lost to various DeFi hacks, and the importance of analyzing crypto stock order flow has never been clearer. The HIBT crypto stock order flow analysis offers a pragmatic approach to dissect complex trading behaviors, enhancing your investment strategies.

This article aims to deepen your understanding of how order flow works within the HIBT framework, explore its implications, and ultimately guide your investment decisions.

What is HIBT Crypto Stock Order Flow Analysis?

At its core, HIBT crypto stock order flow analysis focuses on the dynamics of buy and sell orders in cryptocurrency markets. It uses real-time data to provide insights into market sentiment and liquidity, ultimately influencing price movements.

Understanding the Basics

Order flow refers to the sequence in which buy and sell orders are executed. Analyzing this flow gives investors a visual representation of supply and demand in the market. HIBT leverages advanced data analytics to break down this information. Let’s dive deeper into its components.

Components of Order Flow Analysis

- Volume: This indicates the number of shares or tokens traded over a specific period.

- Price Action: Observing how prices change in response to trading activity is critical.

- Order Book Dynamics: The order book displays current buy and sell orders, which can help predict future movements.

The Correlation with Market Sentiment

Market sentiment greatly influences trading behaviors. For instance, if the order flow shows a steep increase in buy orders for a specific token, it may indicate bullish sentiment among traders. Conversely, an increase in sell orders could point towards bearish sentiment. This predictive aspect of HIBT makes it a valuable tool for investors looking to make informed decisions.

Why Analyze HIBT Crypto Stock Order Flow?

With the increasing complexity of the crypto market, a thorough order flow analysis mitigates risks and uncovers opportunities. Let’s highlight some key reasons:

- Better Timing: Understanding when to enter or exit trades is vital to maximizing profits or minimizing losses.

- Market Predictions: Accurate predictions can lead to better investment strategies.

- Risk Management: Identifying patterns helps in setting appropriate stop-loss orders.

Applying HIBT Crypto Order Flow Analysis

Step-by-Step Approach

Here’s how you can effectively apply HIBT order flow analysis in your trading strategy:

- Collect Data: Use reliable platforms to gather real-time order flow data.

- Analyze Trends: Look for consistent patterns in volume and price movement.

- Set Alerts: Utilize trading tools to notify you of significant changes in order flow.

- Refine Strategy: Adapt your trading strategies based on the insights gained from your analysis.

Real-World Examples

To grasp the effectiveness of HIBT crypto stock order flow analysis, let’s consider a few scenarios:

Example 1: Identifying Bearish Sentiments

In a recent case, HIBT data revealed a surge in sell orders for Ethereum (ETH). This indicated a bearish sentiment, prompting many investors to short ETH and protect their investments. The price subsequently saw a decline, demonstrating the predictive power of order flow analysis.

Example 2: Spotting Potential Bull Runs

Conversely, during a period of rising buying pressure on Bitcoin (BTC), HIBT data signaled a bullish trend. Early investors capitalized on this momentum, resulting in substantial profits.

Order Flow Analysis Tools

To conduct effective HIBT crypto stock order flow analysis, consider utilizing the following tools:

- Order Flow Software: Platforms like HIBT provide powerful analytics tools for tracking order flow.

- Trading Bots: These automate the gathering and analysis of order flow data.

- Technical Indicators: Integrating order flow indicators with traditional technical analysis enhances decision-making.

Implications for Vietnamese Investors

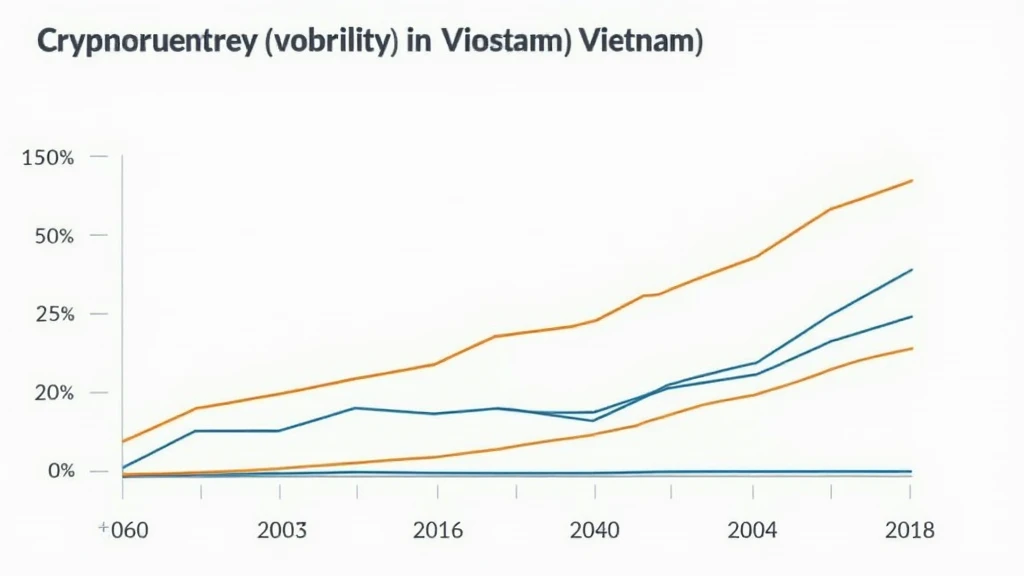

With the growing cryptocurrency user base in Vietnam, which has seen over 130% growth in the past year, understanding HIBT crypto stock order flow analysis is critical. As Vietnamese investors delve deeper into cryptocurrency, leveraging such methodologies will allow them to navigate the markets more effectively.

Local Trends and Insights

As per recent studies, Vietnamese traders are increasingly drawn to platforms that provide comprehensive order flow analytics. This aligns with the global trend of informed decision-making through data analytics. The emphasis on tiêu chuẩn an ninh blockchain is also becoming more prevalent.

Conclusion

In conclusion, understanding HIBT crypto stock order flow analysis stands as a crucial competency for any investor in today’s dynamic market. Its ability to translate order dynamics into actionable insights can elevate your trading strategies significantly. Embracing this analysis transforms chaotic market data into comprehensible trends—allowing for informed decision-making and improved financial outcomes.

Invest wisely and do your due diligence by analyzing order flow. Whether you are a seasoned investor or just starting your journey, the insights derived from HIBT crypto stock order flow analysis will steer you towards more informed choices.

Stay ahead in the game with all the tools and insights you need at allcryptomarketnews.