Vietnam Blockchain KYC Solutions: A Vital Approach to Secure Digital Identity

As the global digital economy continues its rapid expansion, ensuring the security and privacy of users has become paramount. With millions of users engaging in blockchain and cryptocurrency transactions, the issue of identity verification takes center stage. In 2024 alone, $4.1 billion was lost to DeFi hacks, highlighting the dire need for

effective solutions like Vietnam’s blockchain KYC systems. This article delves into the significance, mechanisms, and successes of these systems in Vietnam and how they can pave a secure pathway for future transactions.

Understanding KYC in the Blockchain Context

KYC or “Know Your Customer” is a process used by financial institutions to verify the identity of their clients to prevent fraud, money laundering, and illegal activities. In the blockchain realm, this process becomes more complex due to its decentralized nature. Blockchain KYC solutions offer security and transparency. Let’s break it down further.

- Enhanced Security: Utilizing blockchain, user information is encrypted and stored securely, limiting access to authorized personnel.

- Decentralization: Unlike traditional databases, blockchain eliminates the risk of a single point of failure, making them less prone to hacks.

- User Control: Individuals have greater control over their data, deciding when and with whom to share personal information.

Current Landscape of Vietnam’s KYC Solutions

Vietnam’s blockchain KYC solutions are burgeoning in response to growing digital user demands. Recent studies show that Vietnam’s user growth rate in blockchain technology is accelerating, with nearly 25% of users interacting with crypto platforms in 2023.

Several startups and initiatives have emerged, leveraging technology for seamless KYC processes:

- Key Players: Companies like HIBT are at the forefront, integrating blockchain technology with KYC for robust user identity validation.

- Government Backing: Supporting regulatory frameworks from the Vietnamese government bolster these efforts, ensuring compliance and safety.

How Blockchain KYC Works in Practice

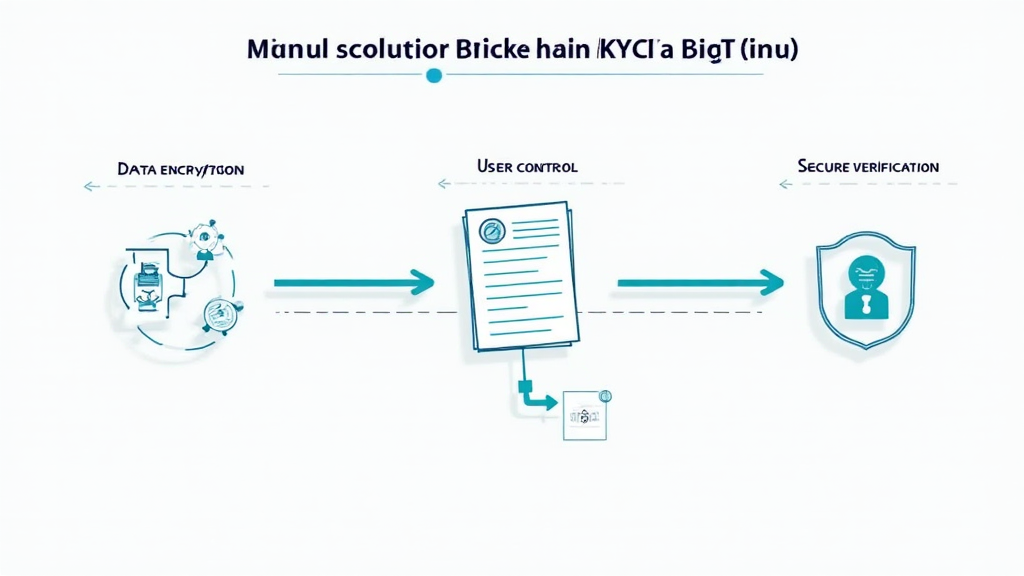

The practicality of blockchain KYC solutions can be illustrated through various steps within the verification process:

- Data Collection: Users submit their information (ID, contact details) through a secure interface.

- Verification: This data undergoes real-time checks against multiple databases.

- Storage: Upon successful verification, user data is encrypted and stored on the blockchain.

- Access Control: Users can provide access to their data to third parties as necessary.

Real-World Applications and Case Studies

In Vietnam, several successful implementations highlight the benefits of blockchain KYC:

- Case Study 1: A Vietnamese fintech startup integrated blockchain KYC and reported a 40% increase in customer sign-ups due to reduced friction in identity verification.

- Case Study 2: A collaboration between the government and local agencies facilitated a pilot project that handled KYC for over 10,000 users.

Challenges and Barriers to Adoption

While promising, blockchain KYC solutions face several hurdles:

- Regulatory Compliance: Navigating existing regulations in crypto and KYC can be cumbersome for providers.

- User Education: Many end-users remain uninformed about blockchain technology and its advantages.

- Infrastructure Development: Integrating blockchain solutions into existing financial systems requires significant investment and time.

The Future of KYC Solutions in Vietnam

Looking ahead, blockchain KYC solutions in Vietnam are poised for exponential growth, particularly as awareness and acceptance of blockchain technology rise. Powered by advancements in AI and machine learning, a more sophisticated approach to identity verification will emerge by 2025, anticipating a focus on privacy-centric frameworks.

- Trend Analysis: The demand for privacy-preserving technologies will grow, particularly among millennials.

- Regulatory Evolution: Continuous collaboration between regulators and industry players will streamline compliance, leading to enhanced security protocols.

In conclusion, as Vietnam embraces innovation, its blockchain KYC solutions represent a critical step towards creating secure and trustworthy digital spaces. By addressing current challenges and focusing on user-centric approaches, Vietnam can lead the way in establishing effective KYC protocols that resonate globally.

To ensure comprehensive security in your digital transactions, consider leveraging the capabilities provided by blockchain KYC solutions. Only through robust verification processes can we safeguard our identities in this rapidly evolving digital landscape.

For more insights on cryptocurrency and blockchain technology, stay updated with AllCryptoMarketNews.

— Dr. Nguyen Van An, a blockchain technology expert with over 15 published papers in the field and the lead auditor for several notable blockchain projects.