Exploring HIBT Vietnam Bond Yield Calculation Formulas

Introduction

In recent years, the Vietnamese economy has gained notable traction, with a growth rate of approximately 6.5% predicted for 2025. As a burgeoning market, understanding the financial mechanisms behind instruments such as bonds becomes crucial. For instance, with $4.1 billion lost to DeFi hacks in 2024, the importance of secure and robust financial calculations cannot be overstated. This article aims to equip you with the essential formulas for calculating bond yields in Vietnam, focusing on HIBT (High Investment Bond Trust) and how they relate to the growing cryptocurrency landscape.

Understanding Bond Yield Calculation

Bond yield calculation is fundamental for investors to evaluate the returns on bonds as fixed-income instruments. Here’s a simple breakdown of the common terms and their meanings:

- Face Value: The nominal value of the bond, which is the amount the issuer will pay at maturity.

- Coupon Rate: The interest rate that the issuer pays to the bondholders.

- Maturity: The date when the bond will mature and the issuer will pay the face value.

- Current Price: The price at which the bond is currently trading in the market.

Key Bond Yield Formulas

A few key formulas are essential for calculating bond yields:

- Current Yield:

Current Yield = (Annual Coupon Payment / Current Price) * 100

- Yield to Maturity (YTM):

YTM = [C + (F - P) / n] / [(F + P) / 2]

Where C = Annual coupon payment, F = Face value, P = Current price, n = Number of years to maturity.

- Yield to Call (YTC):

YTC = (C + (FV - P) / n) / [(FV + P) / 2]

Where FV is the value at the call, and the other variables are as previously defined.

Impact of Yield Calculation on Cryptocurrency Investments

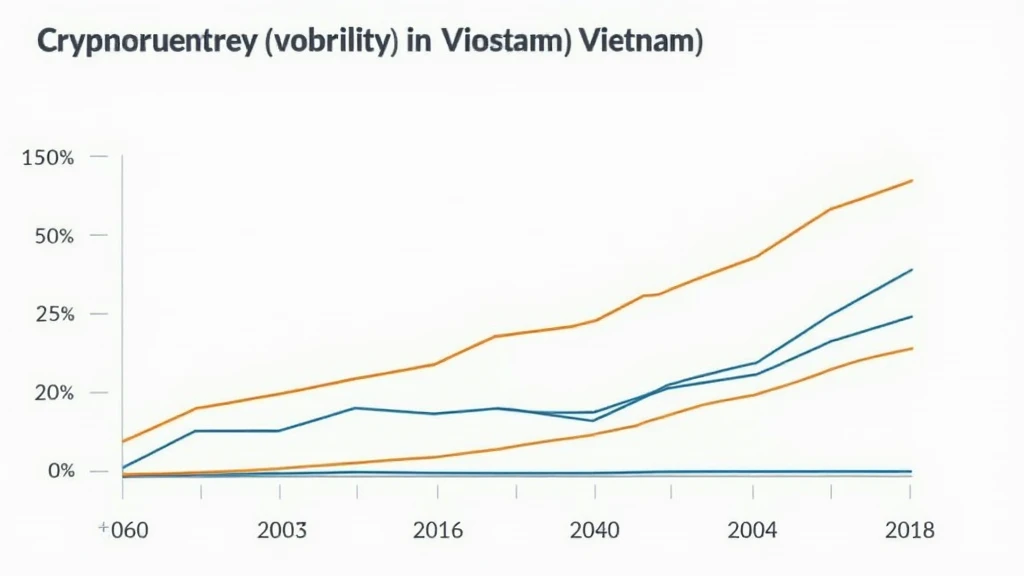

With the traditional bond yields calculated using the above formulas, investors are often tempted to explore the crypto realm where returns can be significantly higher. However, here’s the catch: the volatility in cryptocurrency can lead to high risks. In Vietnam, the user growth rate for cryptocurrencies has been increasing rapidly, currently estimated at 12% year-on-year as of 2024. This raises questions about the efficacy of bond yields as a benchmark for evaluating crypto investments.

Comparative Analysis: Bonds vs. Cryptocurrencies

Let’s break it down:

- Security: Bonds are perceived as safer investments, whereas cryptocurrencies involve a degree of risk.

- Returns: Cryptocurrencies can yield significant returns, often well above the fixed income provided by bonds.

- Liquidity: Cryptocurrencies generally offer higher liquidity compared to bonds, allowing for easier trading.

Investing in Vietnamese Bonds

For those considering investing in Vietnamese bonds, it’s crucial to understand the market dynamics and economic environment:

- Government Policies: Government support and policies affecting foreign investments can influence bond yields.

- Market Demand: The demand for bonds within Vietnam can affect pricing and yields, often enhancing the profitability of these investments.

- Economic Indicators: Keep an eye on economic data such as GDP growth, inflation rates, and interest rates that could impact bond dynamics.

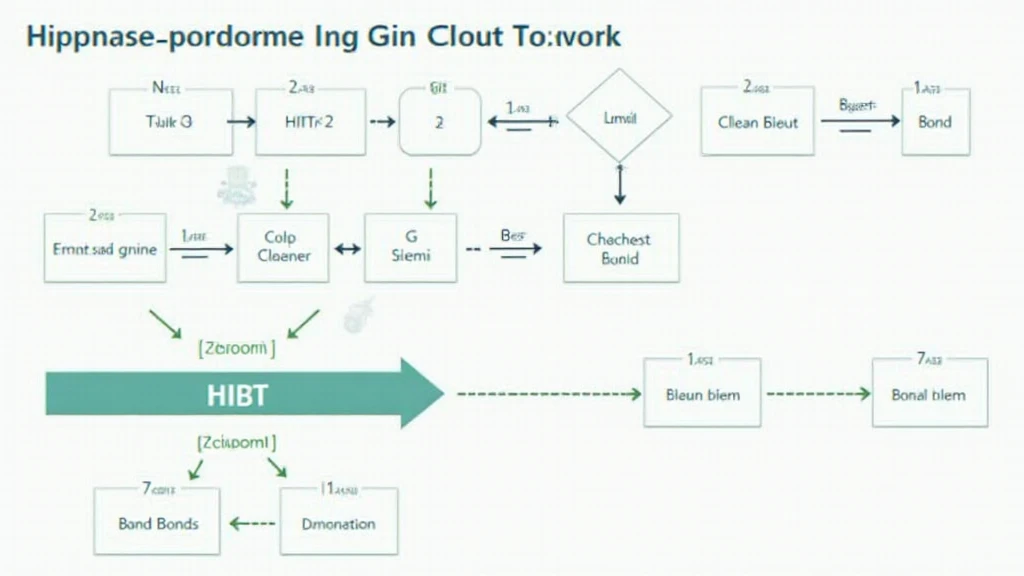

Local Context: HITB Bonds in Vietnam

HIBT has emerged as a valuable instrument in Vietnam, leveraging the favorable conditions in the market. Recent statistical data indicates a significant increase in institutional investments in HIBT bonds. Investors may consider these bonds as part of their diversified portfolios:

| Year | Bond Yield (%) | Investment Growth (%) |

|---|---|---|

| 2023 | 6.2 | 8.5 |

| 2024 | 6.7 | 10.2 |

| 2025 | 7.0 | 12.1 |

Conclusion

In conclusion, understanding the HIBT bond yield calculation formulas is crucial for investors looking to navigate Vietnam’s financial landscape effectively. As cryptocurrency continues to evolve, maintaining a balanced portfolio that includes secure bond investments alongside the crypto market is vital. Each investment choice should align with your risk appetite and financial goals.

As the market matures, staying informed, adaptable, and aware of economic conditions will empower you to make sound decisions in both traditional and digital asset investments.

For more insights, visit allcryptomarketnews. Stay informed and equipped to make the best investment choices!

Author Bio: Dr. Nguyen Tran, a financial analyst with over 15 published papers on investment strategies, has conducted audits on several high-profile projects within the cryptocurrency space.