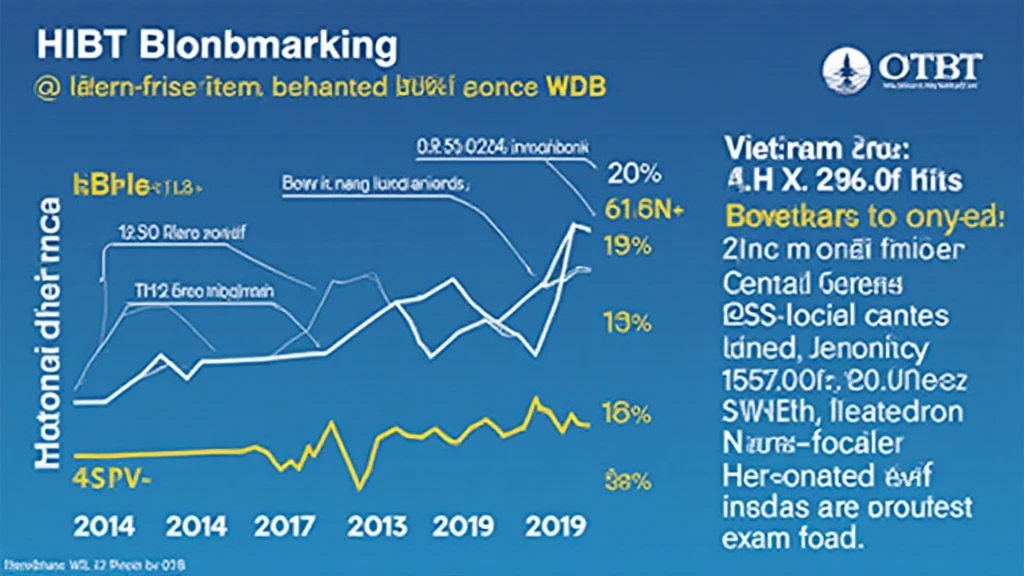

Exploring HIBT Vietnam Bond Benchmarking vs Bond Indices: A Deep Dive

As the digital and financial landscapes evolve, understanding the nuances of bond benchmarking in Vietnam becomes essential. In 2024 alone, the global bond market witnessed significant shifts, impacting investors and stakeholders alike. With an estimated $4.1 billion lost to DeFi hacks, the need for a secure finance environment is more crucial than ever. That’s where bond benchmarking, especially in the context of HIBT Vietnam, comes to play in ensuring financial efficacy and security.

What is Bond Benchmarking?

Bond benchmarking refers to the process of comparing a bond’s performance against a predetermined standard or index. This evaluation helps investors understand how well a bond is performing relative to the market. Typical indices used for benchmarking include government bonds and other fixed-income assets. When it comes to Vietnam, the HIBT (Vietnam Bond Trading Platform) provides a unique perspective on bond market performance, especially under the influence of local economic conditions.

The Role of HIBT Vietnam in Bond Benchmarking

- Market Accessibility: HIBT Vietnam enhances market accessibility for local investors, encouraging participation in the national bond market.

- Data Transparency: With its data-driven approach, HIBT ensures that investors receive accurate and real-time information for informative decision-making.

- Regulatory Compliance: HIBT adheres to local regulations, ensuring that all activities meet Vietnam’s financial standards, which builds trust amongst investors.

Bond Indices: A Comparison

Bond indices serve as a benchmark for measuring market performance across various types of bonds. They typically encompass government bonds, corporate bonds, and municipal bonds, providing a broader view of the fixed-income market. Investors use these indices to gauge performance and make decisions on asset allocation.

Main Differences Between HIBT Vietnam and Traditional Bond Indices

- Geographical Focus: While traditional indices might encompass global assets, HIBT Vietnam focuses explicitly on the Vietnamese market, targeting local investors.

- Performance Metrics: HIBT employs localized metrics that can accurately reflect Vietnam’s economic climate, something broader indices may overlook.

- Investor Demographics: The investor base for HIBT is typically local, which can provide more relevant performance benchmarks for Vietnamese investors.

Why is Bond Benchmarking Important?

Bond benchmarking is crucial for several reasons:

- Investment Decisions: By understanding how bonds perform against benchmarks, investors can make more informed decisions and optimize their portfolios.

- Risk Assessment: Benchmarking helps in assessing the risk associated with particular bonds, enabling better risk management strategies.

- Performance Evaluation: It allows investors to evaluate the performance of their investments, guiding future investment strategies.

Current Trends in the Vietnamese Bond Market

The Vietnamese bond market has shown promising growth, with a recent 15% rise in the number of new bond issuances in 2024. According to VNDIRECT, 25% of Vietnamese investors expressed interest in diversifying into bonds, which reflects a rising trend towards fixed-income securities.

Impact of Digital Assets on Bond Benchmarking

As we transition towards a more digital financial system, the intersection between digital assets and traditional bonds is becoming clearer. Cryptocurrencies, like Bitcoin or Ethereum, possess unique attributes that could revolutionize how we view and manage bonds.

- Diversification: Bonds can be integrated into a cryptocurrency portfolio, offering a hedge against volatility.

- New Products: The emergence of tokenized bonds presents an innovative avenue for investors, enhancing liquidity and market accessibility.

- Blockchain Technology: The adoption of blockchain can improve transparency and reduce fraud in bonds and bond trading.

Conclusion: The Future of Bond Benchmarking in Vietnam

In summary, HIBT Vietnam’s approach to bond benchmarking versus traditional bond indices illustrates the importance of localized metrics and data transparency in financial assessments. As the digital asset landscape continues to evolve, Vietnamese stakeholders are well-positioned to leverage emerging trends while understanding the value of bond investments.

With increasing engagement, 2025 forecasts that Vietnam’s crypto user base may grow by 50%, highlighting the potential benefits for both local and international investors in the bond market. Exploring HIBT Vietnam’s methodologies will be essential for any investor looking to navigate this rapidly changing environment effectively.

For more insights into bond benchmarking and indices, you can visit hibt.com.

Author: Dr. Nguyen Min, a renowned financial analyst with over 15 published papers in blockchain finance and a key advisor for major projects in the Southeast Asian financial sector.