Understanding Vietnam’s Crypto Boom: Mortgage Innovations with MBS & HIBT

With the rapid growth of the cryptocurrency market, especially in Vietnam, understanding its various facets has become more crucial. In 2023, the Vietnamese crypto user base saw a staggering growth rate of over 30%, reflecting the increasing acceptance and integration of cryptocurrencies in everyday transactions and investments. As we dive deeper into the intersection of crypto and real estate financing, the concepts of MBS (Mortgage-Backed Securities) and HIBT (HIBT Blockchain) emerge as frontrunners in reshaping how mortgages are viewed in this digital era.

The Alignment of Crypto and Real Estate

In many ways, cryptocurrencies operate similar to traditional assets. As digital currencies gain traction, the real estate industry has begun exploring how these assets can be integrated into mortgage solutions. Here’s the catch: just as traditional mortgages serve to unlock the barriers to homeownership for many, crypto-based mortgages aim to democratize this access further.

- Vietnam’s adoption of blockchain technology offers transparency and security—key values in mortgage transactions.

- Crypto as collateral transforms how we view asset liquidity.

- Mortgages can be processed faster with smart contracts, reducing costs and time for buyers.

What is MBS?

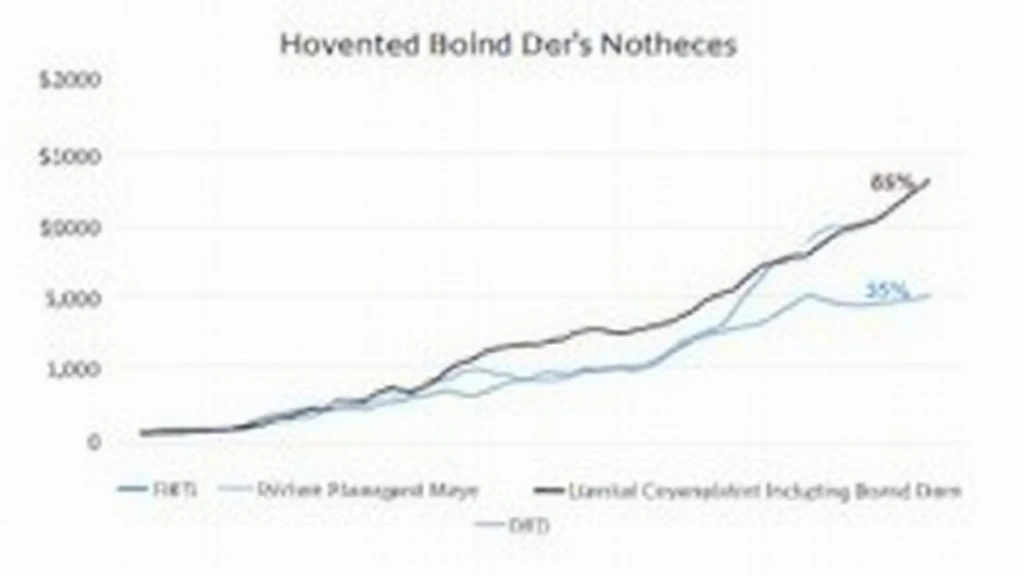

Mortgage-Backed Securities (MBS) represent a significant evolution in financing real estate. According to latest estimates from HIBT, MBS allows various assets—especially those integrated with blockchain technology—to be pooled and sold to investors. This provides liquidity to lenders and funding to borrowers with more options available.

How HIBT is Innovating the Mortgage Process

HIBT stands at the forefront of integrating blockchain into the mortgage landscape. The company’s unique approach—using blockchain for recording transactions—enhances security and reduces fraud potential. In a market where trust is paramount, innovations like HIBT offer peace of mind to both lenders and borrowers.

Vietnamese Market Dynamics

Statistics show Vietnam’s crypto market, with a user increase of over 30% in 2023, is spearheading digital transformation in Southeast Asia. A growing number of Vietnamese individuals are turning to cryptocurrencies as a viable investment alternative. Understanding the demographic trends of Vietnam’s crypto investors helps in predicting future mortgage trends.

- Age Group: A significant proportion of crypto users are aged between 18-34.

- Investment Preferences: Many seek opportunities for long-term investments in real estate using crypto.

- Tech Savviness: High engagement with tech solutions makes the population receptive to blockchain-based solutions.

Challenges Facing Crypto Mortgages

Despite the promise, several barriers need addressing for broader adoption of crypto-backed mortgages in Vietnam. Let’s break it down:

- Despite the impressive growth numbers, regulatory uncertainties continue to loom over the crypto ecosystem.

- Each party in a mortgage transaction must have a robust understanding of crypto to avoid pitfalls.

- Market volatility poses risks that traditional financial institutions consider when integrating crypto into mortgages.

Future of Hybrid Mortgages in Vietnam

The future possibilities of merging crypto with traditional financing appear vast. Institutions could explore:

- Offering MBS as a collateral option for crypto investments in real estate.

- Innovative interest rate models based on crypto market performance.

- Improved AI algorithms for credit scoring tailored for crypto investors.

Conclusion: Embracing Change in Vietnam’s Mortgage Landscape

Vietnam’s growing acceptance of cryptocurrencies creates a unique opportunity for melding digital assets with real estate financing through products like MBS and innovations like HIBT. As we observe the increasing interconnection of these spheres, the importance of understanding how to navigate these options becomes crucial.

Ultimately, the potential for crypto in Vietnamese mortgages could lead to tailored solutions for a tech-savvy population. However, advancing regulations and consumer education will play vital roles in this journey. As we look towards the future, the synergy of blockchain and traditional finance seems promising. For those interested in venturing into this space, tools such as Ledger Nano X provide security and ease of use.

To stay updated on the evolving landscape, visit allcryptomarketnews.

Written by Dr. Alex Kim, a leading blockchain expert with over 20 published papers in cryptocurrency and finance, and the advisor for numerous projects globally, specializing in the integration of blockchain technology in traditional finance.