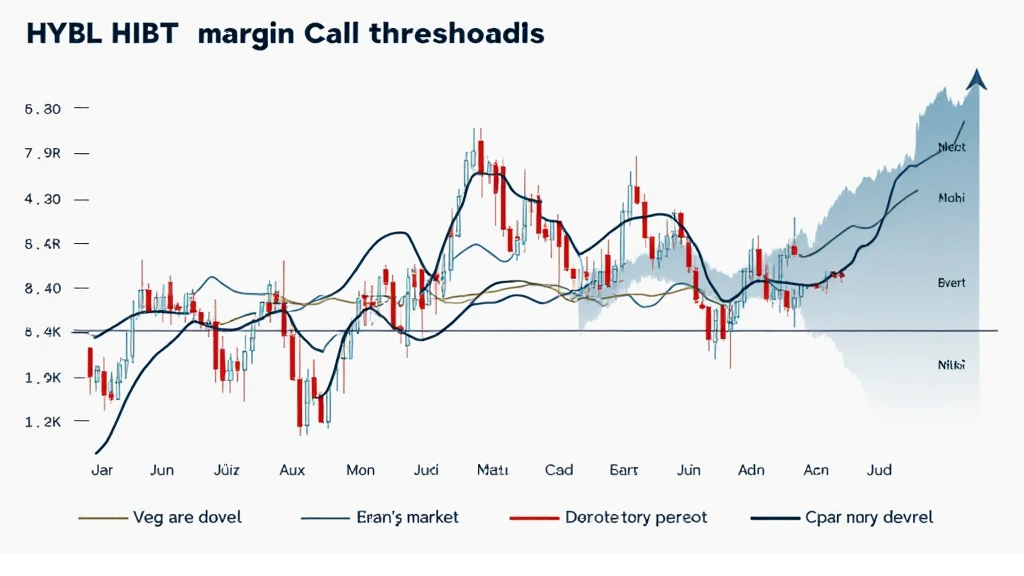

Understanding HIBT Margin Call Thresholds: A Guide for Crypto Traders

With the rise of cryptocurrency trading, many investors are looking to optimize their strategies and protect their assets. One of the crucial aspects that every trader should understand is the concept of HIBT margin call thresholds. In today’s volatile market, a firm grasp of these thresholds can be the difference between profit and loss.

What Are Margin Call Thresholds?

Margin call thresholds are specific levels at which a broker will require a trader to deposit more funds or close positions in order to maintain the required margin ratio. In essence, these thresholds serve as a safety net in leveraged trading. When the value of a trading position falls below the minimum required amount, the broker will alert the trader, prompting action to avoid liquidation of trades. This is especially pertinent in the cryptocurrency space, where prices can fluctuate dramatically.

How Do HIBT Margin Call Thresholds Work?

HIBT, or Hybrid Institutional Blockchain Technology, incorporates margin trading into its framework, providing a unique approach to trading cryptocurrencies. Here’s how it typically works:

- Initial Margin Requirement: When opening a position, traders must provide a portion of their own funds upfront.

- Maintenance Margin: This is the minimum equity amount needed to keep a position open. Falling below this threshold triggers a margin call.

- Margin Call Notification: If the account balance drops too low, traders receive alerts to deposit more funds or risk liquidating their positions.

Factors Influencing Margin Call Thresholds

Several factors can influence margin call thresholds within HIBT systems:

- Volatility of the Asset: Highly volatile cryptocurrencies, such as Bitcoin or Ethereum, may require higher margin thresholds due to their price instability.

- Leverage Used: The higher the leverage a trader employs, the lower the threshold for a margin call, as the risk is amplified.

- Market Conditions: Overall market sentiment and economic news can also affect margin call thresholds, especially during significant events like regulations or economic downturns.

Best Practices for Managing Margin Calls

To effectively manage margin calls while trading with HIBT, consider the following best practices:

- Stay Informed: Regularly monitor market trends and news that could impact cryptocurrency prices.

- Use Risk Management Tools: Consider using stop-loss orders to automatically close positions before reaching a critical margin call threshold.

- Maintain Sufficient Equity: Always keep a buffer in your trading account well above the minimum required margin.

The Significance of HIBT in Vietnam’s Crypto Market

Vietnam has witnessed significant growth in the crypto market. According to recent studies, the number of crypto users in Vietnam surged by approximately 80% in 2024. With the increasing interest in cryptocurrencies, understanding margin call thresholds becomes essential for Vietnamese investors engaging in HIBT systems.

Common Mistakes to Avoid

Many traders unintentionally find themselves in difficult situations due to misunderstandings or negligence regarding margin calls. Here are some common mistakes to avoid:

- Neglecting to set alerts for margin calls, leading to missed opportunities to respond.

- Over-leveraging positions, which can lead to quick liquidations.

- Failing to diversify investments, which can increase overall portfolio risk.

The Future of HIBT and Margin Calls in Crypto Trading

As the cryptocurrency ecosystem continues to evolve, the importance of HIBT margin call thresholds will likely become even more apparent. Innovations in blockchain technology could lead to improved Risk Management Systems, providing traders with more tools and data to navigate their investments effectively. Furthermore, as regulatory standards increase, trading platforms will continue to emphasize user education regarding margin calls.

Conclusion

Understanding HIBT margin call thresholds is paramount to successful cryptocurrency trading. By maintaining awareness around these thresholds and incorporating effective trading strategies, investors can significantly reduce their risks in a volatile market. Embrace these practices to safeguard your investments and potentially enhance your profitability.

For more information on trading practices and strategies, visit HIBT.

In this ever-evolving digital landscape, staying informed and agile is key. Ensure that you are prepared to take action as necessary and keep a close eye on your positions.

Written by Dr. Chen Pham, a cryptocurrency investment strategist who has published over 15 papers in blockchain technology and has led reputable audit projects for various crypto exchanges.