Bitcoin Halving Market Forecasts: What to Expect Next

With the anticipation surrounding Bitcoin halving events, the crypto community is buzzing with expectations regarding upcoming market shifts. Historically, halving events have triggered significant price increases, making it crucial for investors and enthusiasts alike to closely monitor these occurrences. As we gear up for the next Bitcoin halving, what can we foresee regarding market movements and trends? Let’s break it down.

Understanding Bitcoin Halving Events

Bitcoin halving events occur approximately every four years when the reward miners receive for adding new blocks to the blockchain is cut in half. This mechanism is encoded within the Bitcoin protocol, designed to control its supply and curb inflation.

- In 2012, the reward decreased from 50 BTC to 25 BTC.

- The second halving in 2016 reduced the reward from 25 BTC to 12.5 BTC.

- In 2020, the reward further diminished to 6.25 BTC.

The next halving, projected for 2024, will drop this reward to 3.125 BTC. These events have historically led to bull runs, but every cycle brings unique market dynamics.

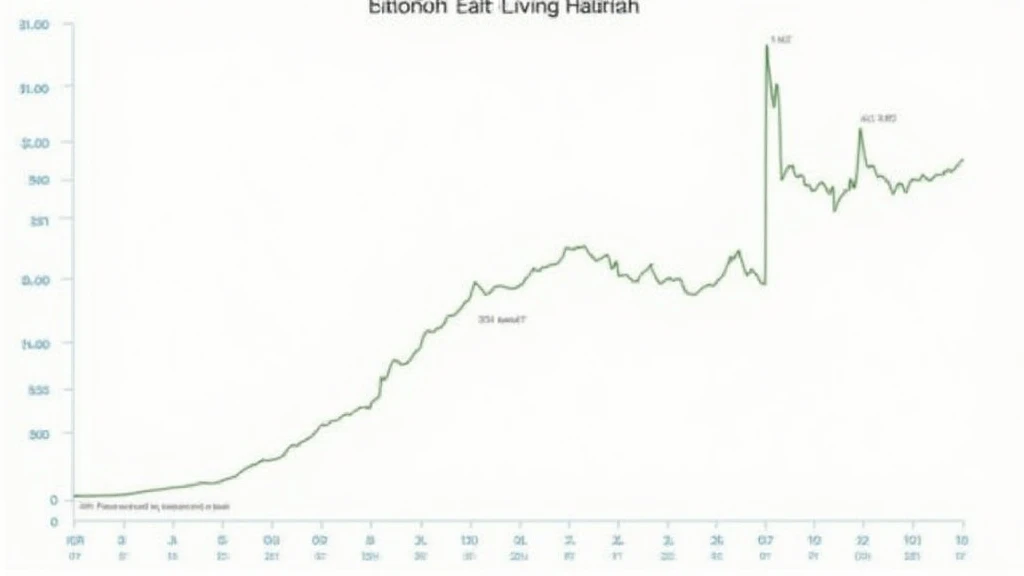

The Historical Patterns of Bitcoin Prices Post-Halving

A look back at the two most recent halving events reveals fascinating trends:

| Halving Date | Price Before Halving | Price After One Year |

|---|---|---|

| November 2012 | $12.31 | $1,153.00 |

| July 2016 | $650.00 | $2,500.00 |

| May 2020 | $8,500.00 | $64,000.00 |

As shown in the table above, Bitcoin’s price typically escalates sharply in the year following each halving event. This climb can largely be attributed to the reduced supply of new coins entering the market, combined with the growing institutional interest in Bitcoin.

What to Expect in the Upcoming Halving of 2024

Market analysts predict several outcomes based on historical trends and current data:

- Increased Institutional Adoption: Analysts like Raoul Pal expect institutional players to drive demand up as the halving approaches.

- Supply Shock: The halving will introduce a supply shock, as fewer Bitcoin will be issued to miners.

- Speculation and Volatility: Anticipation surrounding the halving could lead to speculative trading, resulting in increased market volatility.

While it’s impossible to predict exact price movements, the overall sentiment is optimistic. According to a 2023 Chainalysis report, Bitcoin’s market might see a potential increase approaching $100,000 by 2025, contingent on stable demand and acceptance.

Localized Insights: Vietnam’s Growing Crypto Market

In Vietnam, the cryptocurrency landscape is gaining momentum. As per recent reports, there has been over a 300% increase in active crypto users in Vietnam in the past year. This rapid adoption indicates a growing acceptance of cryptocurrencies as viable investments.

Local traders are also receptive to Bitcoin halving impacts, often leading to heightened trading activity within weeks of the event.

Moreover, the burgeoning Vietnamese fintech sector has seen startups focusing on blockchain technology, evident in growing initiatives around tiêu chuẩn an ninh blockchain (blockchain security standards), which aim to enhance trust and transparency in transactions.

What Experts Say About Bitcoin’s Future After Halving

Experts from various sectors weigh in on what they anticipate post-halving:

- Many traders emphasize the importance of supply and demand: “With less Bitcoin mined, prices ought to rise if demand continues.”

- Certain analysts advise caution, noting: “The market sentiment tends to push prices up, but corrections are common.”

- Investment strategies will evolve: As interest increases, diversified portfolios including cryptocurrencies might become the norm.

It’s crucial for potential and existing investors to formulate their strategies based on market conditions while staying informed about upcoming developments.

Conclusion: Preparing for Bitcoin’s Future

The upcoming Bitcoin halving in 2024 holds significant implications for the crypto market. Historical trends suggest potential price increases, driven by supply constraints and heightened institutional interest. Vietnam’s growing crypto user base further illustrates the global shift towards digital currencies.

As the crypto ecosystem continues to evolve, it is essential for investors to stay updated and engage with authentic resources, like allcryptomarketnews, to navigate this dynamic landscape successfully.

Always remember, while potential rewards can be substantial, thorough research and understanding are paramount in making informed investment decisions. Happy trading!