Introduction

As of 2024, the digital landscape in Vietnam is rapidly evolving, especially concerning cryptocurrency and real estate investments. Reports indicate that Vietnam is one of the fastest-growing crypto markets, with a 30% increase in cryptocurrency ownership in 2023 alone. However, understanding the implications of capital gains tax on these investments is crucial for both domestic and foreign investors. This article aims to elucidate the nuances of Vietnam’s crypto real estate capital gains tax, providing essential insights for navigating this complex landscape.

Overview of Cryptocurrency in Vietnam

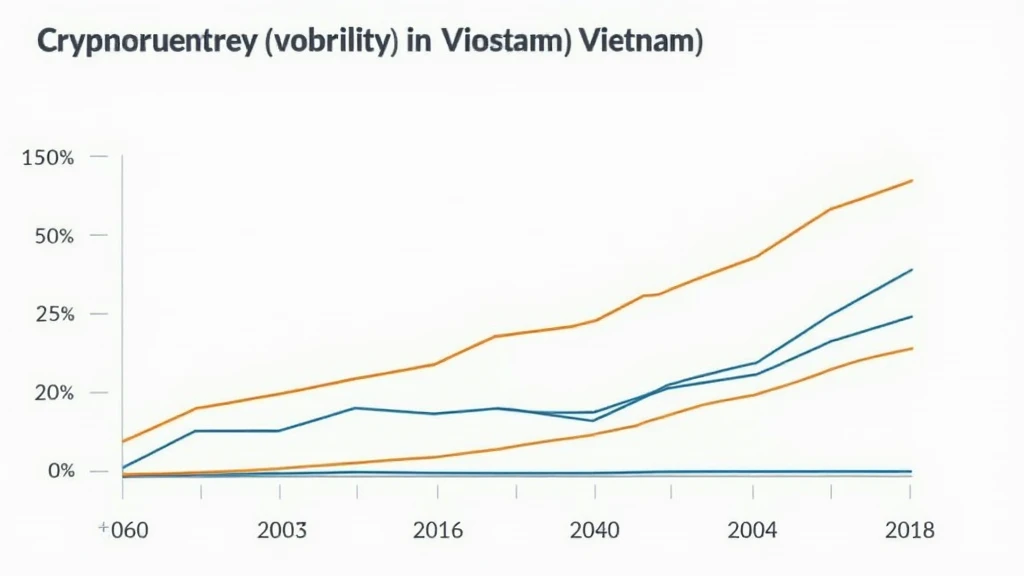

The rise of cryptocurrency in Vietnam is not just a trend but a significant cultural and economic shift. According to recent statistics from Statista 2024, about 25% of urban Vietnamese possess some form of cryptocurrency. The burgeoning interest presents unique opportunities in real estate, yet it also poses challenges regarding taxation and regulatory compliance.

Growth of Crypto Users

- 2023: 30% increase in blockchain adopters.

- Projected 40% increase by the end of 2025.

- Growing interest in tiêu chuẩn an ninh blockchain security among investors.

Understanding Capital Gains Tax on Crypto Real Estate Transactions

Capital gains tax applies when investors sell their assets, realizing a profit. In Vietnam, the government has set policies regarding digital asset taxation, which can be particularly intricate when dealing with real estate. Investors need to familiarize themselves with these regulations to avoid penalties.

Calculating Capital Gains

Capital gains are calculated as follows:

- Sale Price – Purchase Price = Capital Gain

- Taxable gain may differ based on individual circumstances, including the duration of ownership and applicable deductions.

Tax Rates Applicable

In 2024, the capital gains tax in Vietnam could fluctuate between 15% to 20%, depending on various factors such as:

- Type of asset (real estate vs. crypto).

- Duration of ownership.

Real Estate and Cryptocurrency: A Perfect Match?

As cryptocurrencies mature, they are increasingly seen as viable alternatives for real estate purchases. For instance, using Bitcoin to buy property has become a common practice among tech-savvy investors. Let’s discuss how this integration works.

The Mechanics of Your Investment

- When you purchase a property using cryptocurrency, you essentially trade your digital assets for a tangible asset.

- The transaction is recorded on the blockchain, ensuring transparency and security.

Benefits of Crypto Real Estate Investments

Investing in real estate through cryptocurrency offers several benefits:

- Higher liquidity: Crypto transactions can be processed faster than traditional real estate transactions.

- Diverse portfolio: Adding crypto to your real estate investments diversifies your risk profile.

Challenges in the Current Framework

Despite the benefits, there are challenges. The legal status of cryptocurrencies in Vietnam is still evolving. Investors must stay informed about regulations to avoid possible compliance issues.

Regulatory Landscape

The Vietnamese government is in the midst of developing a comprehensive regulatory framework for cryptocurrencies. This includes:

- Legalization of crypto transactions for real estate.

- Clear guidelines on taxation, potentially affecting returns on investment.

Market Volatility

Crypto markets are known for their volatility. Sudden changes in market conditions can significantly affect your investment. Here’s how to manage risk:

- Diversify your portfolio to spread risk.

- Stay updated on market trends.

Conclusion: The Future of Crypto and Real Estate in Vietnam

The integration of cryptocurrency with real estate investments is a developing concept in Vietnam. As regulations mature, the country seems poised to leverage this trend, fostering a market ripe for innovation. Understanding the crypto real estate capital gains tax in Vietnam will be pivotal for investors eager to capitalize on this intersection. The future holds great promise as long as investors remain informed and compliant.

For more insights on navigating the Vietnamese crypto investment landscape, check out our other articles like our Vietnam crypto tax guide and stay tuned with the latest trends at AllCryptoMarketNews.

At the cusp of a remarkable era, we should prepare ourselves for the challenges and opportunities that lie ahead. Through knowledge and strategic planning, we can harness the full potential of crypto in real estate.

John T. Nguyen

Known for his extensive work on blockchain developments in Vietnam, John has published over 30 papers in major journals and led audits for several high-profile crypto projects. His expertise in navigating the regulatory landscape has made him a sought-after advisor in the field.