Hanoi Crypto Real Estate Depreciation Management

With the rapid growth of cryptocurrency adoption in Vietnam, particularly in Hanoi, the intersection of the crypto economy and real estate investment has generated significant interest. As digital currencies become a new avenue for investment, it is imperative for investors to grasp effective real estate depreciation management strategies in this evolving landscape. Here, we will delve into what this entails, supported by relevant data trends and practical approaches optimized for the Hanoi market.

The Growth of Crypto in Vietnam

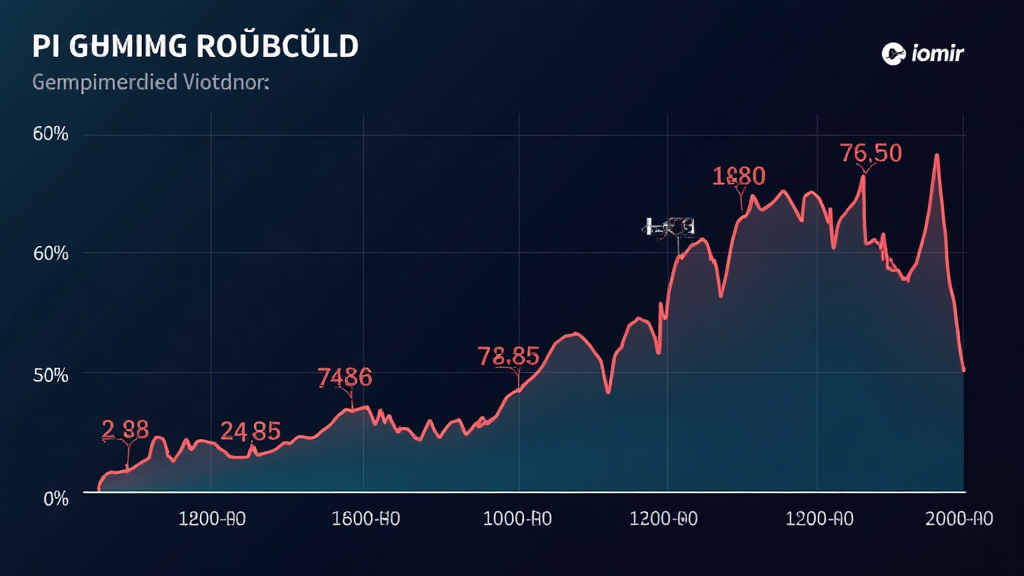

According to recent reports, Vietnam has emerged as one of the fastest-growing markets for cryptocurrency, with a 150% increase in users between 2020 and 2022. This places Vietnam in the top 10 globally for crypto adoption rates. In Hanoi, this growth is fueled by a youthful population eager to explore innovative investment opportunities.

As traditional investment vehicles like real estate are integrated with crypto, understanding the implications of depreciation becomes critical. This is especially true as the financial landscape changes dramatically with the influence of blockchain. Tiêu chuẩn an ninh blockchain is more important than ever as investors navigate these turbulent waters.

Understanding Real Estate Depreciation

Real estate depreciation refers to the reduction in value of a property over time. This decline can happen due to wear and tear, market conditions, and economic factors. In Hanoi’s burgeoning real estate market influenced by crypto, several factors contribute to depreciation:

- Market Saturation: As more investors enter the crypto real estate space, the demand may plateau, leading to potential value dips.

- Regulatory Changes: New regulations imposed by the Vietnamese government regarding cryptocurrency can affect real estate prices.

- Technological Advances: The adoption of smart contracts could streamline sales processes but also introduce volatility.

Practical Strategies for Depreciation Management

Investors in Hanoi can implement several strategies to manage real estate depreciation:

1. Regular Property Evaluation

Conducting regular property evaluations will help investors understand their asset’s worth relative to the market. Monitoring market trends and adjustments in property values can provide crucial insights into when to buy or sell.

2. Utilizing Smart Contracts

Smart contracts can automate various aspects of real estate transactions, ensuring transparency and efficiency. According to reports, using smart contracts can reduce transaction times by up to 40%. Investors should familiarize themselves with how to audit smart contracts to ensure optimal compliance and security.

3. Engaging with Local Experts

Partner with real estate professionals knowledgeable about both traditional and crypto-assets in Hanoi. These experts can provide localized insights and data-driven advice to refine investment strategies.

Impact of Blockchain on Real Estate Pricing

Blockchain technology is reshaping how real estate transactions occur. Properties may be tokenized, allowing fractional ownership and lower barriers to entry. This has potential implications for property values.

- The tokenization of assets can increase interest from smaller investors, inadvertently boosting property prices.

- The entry of international investors into the Hanoi market via blockchain can lead to increased demand, which may counteract depreciation.

Case Studies: Success Stories in Hanoi

Several projects in Hanoi have successfully integrated crypto and real estate, showcasing how to combat depreciation:

- Project A: Tokenized beachfront properties have seen a 20% increase in value, leveraging blockchain for transparency.

- Project B: Smart contracts in residential developments have automated payments, improving cash flow stability and decreasing perceived risk.

Conclusion

In conclusion, as Hanoi continues to develop as a nexus of crypto and real estate investment, effective management of depreciation becomes paramount. By leveraging technology, engaging with experts, and staying informed about market trends, investors can navigate these complexities.

Investing wisely in real estate amidst this digital transformation can yield significant returns and reduce risks associated with depreciation.

For further insights into the intersection of cryptocurrency and real estate in Vietnam, stay connected with resources like hibt.com. Not only are these insights timely, but they are also crucial for making informed decisions in a rapidly evolving market.

Author: Dr. Nguyen Van Hai, a recognized expert in blockchain integration in real estate, has published over 15 papers on the topic and led several high-profile project audits in Southeast Asia.