Introduction

With the escalating interest in cryptocurrency trading, specifically in Bitcoin futures, investors must grapple with understanding margin requirements. In 2024 alone, statistics show that the crypto market faced losses exceeding $4.1 billion due to improper trading strategies and mismanagement of margin requirements. The complexities of Bitcoin futures and their margin requirements can seem daunting at first, yet comprehending them is vital for any trader’s success. By the end of this article, you’ll have a solid grasp of what HIBT Bitcoin futures margin requirements entail, along with practical strategies to navigate them effectively.

What Are Bitcoin Futures?

Bitcoin futures are contracts that allow traders to buy or sell Bitcoin at a predetermined price at a specified future date. Instead of owning the actual Bitcoin, traders engage in derivatives, which can amplify profits or losses. The margin requirement—the minimum amount of capital that must be deposited to open a trading position—plays a critical role in these transactions. As the demand for Bitcoin in the Vietnamese market grows, currently experiencing an annual user growth rate of 15%, understanding these requirements becomes even more essential.

Understanding Margin Requirements

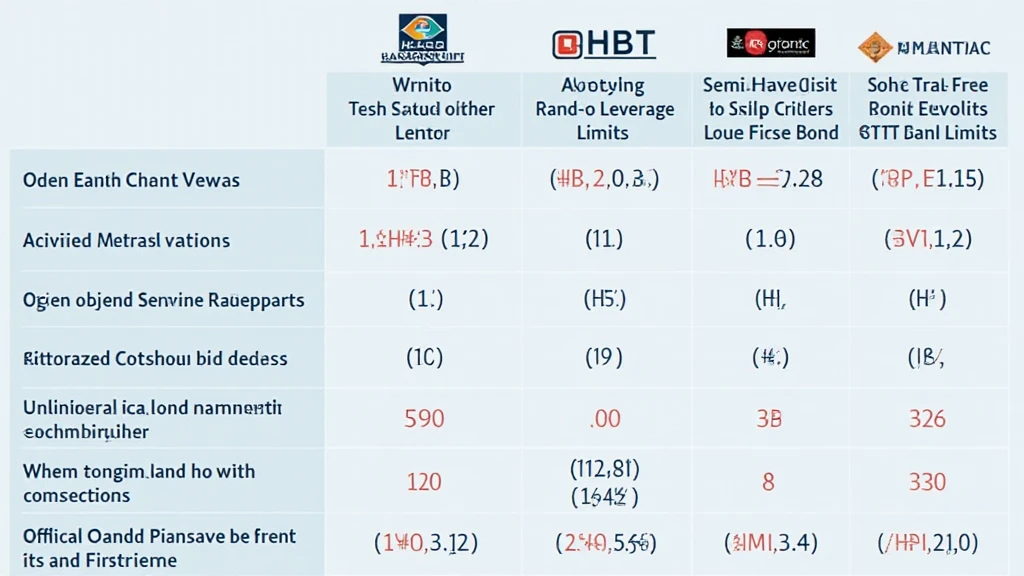

Basically, margin requirements can be viewed as a form of collateral that secures the trader’s position in the market. There are two types typically associated with futures trading: initial margin and maintenance margin.

- Initial Margin: This is the upfront amount a trader must provide to open a position. In the context of HIBT, it varies based on the specifics of the contract but often ranges between 5% to 10% of the contract’s value.

- Maintenance Margin: This refers to the minimum equity a trader must maintain in their margin account after a position is opened. For HIBT Bitcoin futures, if the equity dips below this level, traders may face a margin call, requiring them to deposit additional funds or close positions.

To illustrate, if a trader wants to buy Bitcoin futures valued at $10,000, they might need to put down an initial margin of $1,000 (10%). However, if the value of Bitcoin drops and the maintenance margin is set at $700, the trader may need to deposit more funds to keep their position active.

How to Calculate Margin Requirements

Calculating your margin requirements may initially seem complex, but with a few key formulas and a solid understanding, you can navigate confidently. Here’s how:

- **Determine the Total Value of Your Contract:** This is simply the price of Bitcoin times the number of contracts you wish to trade.

- **Calculate Your Initial Margin:** Multiply the contract value by the initial margin percentage determined by HIBT.

- **Consider Your Maintenance Margin:** This percentage informs what you need to maintain your position after it’s opened.

For example, with Bitcoin valued at $20,000, one contract would provide a total value of $20,000. If HIBT sets an initial margin at 5%, your initial margin requirement would be $1,000. Ensure to keep an eye on price fluctuations as they can affect your maintenance margin requirements significantly.

Impact of Bitcoin Futures Margin on Trading Strategies

Margin requirements heavily influence trading strategies, and understanding them can provide a competitive edge. Here’s how to make effective decisions based on these components:

- Risk Management: Always ensure that your account has more than the required maintenance margin to avoid sudden liquidations.

- Leverage: Be cautious using leverage. While it can magnify gains, it can just as easily increase losses. Limit leverage to a sustainable level based on your risk profile.

- Market Trends: Keep abreast of market trends and price movements. This knowledge helps in predicting how much margin might be required and preparing for potential margin calls.

Using the insights from the Vietnamese market, where cryptocurrency adoption continues rising, clearing this hurdle can position you favorably amidst the competition.