HIBT Bitcoin Futures Spread Analysis

With the crypto market seeing an influx of $4.1 billion lost in 2024 due to various factors, understanding the HIBT Bitcoin futures spread becomes essential for anyone looking to navigate this volatile ecosystem. The Bitcoin futures market, particularly through HIBT, offers traders unique insights that can drive profitable decisions.

Understanding Bitcoin Futures

Bitcoin futures allow investors to speculate on the price movement of Bitcoin. Essentially, they are contracts to buy or sell Bitcoin at a predetermined price on a set date in the future. The trading of these futures can lead to significant profit opportunities but also carries its own risks.

- Price Discovery: The futures market can be seen as a barometer for the Bitcoin spot price, influencing it significantly.

- Hedging: Futures can be used by investors to hedge against price fluctuations, protecting their underlying assets.

- Leverage: Trading futures often requires a smaller capital outlay, enabling traders to leverage their positions.

What is the HIBT Bitcoin Futures Spread?

The HIBT Bitcoin futures spread is the price difference between different future contracts. Monitoring this spread is crucial for traders aiming to gain an edge in the market.

- Bullish Spread: Indicates market confidence, where the price of future contracts is rising.

- Bearish Spread: A declining spread can denote market pessimism.

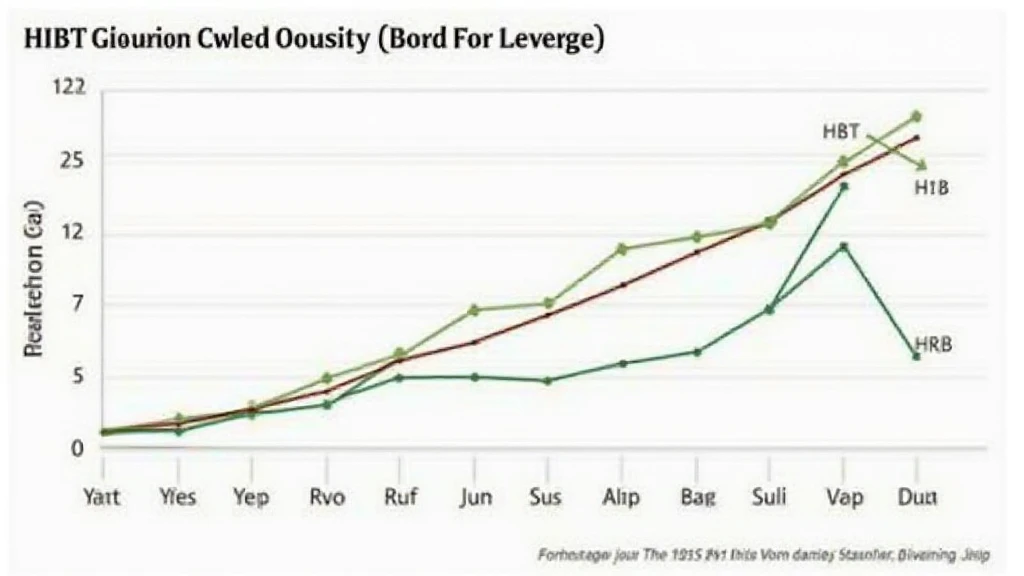

Analyzing the HIBT Bitcoin Futures Spread

To conduct an effective analysis of the HIBT Bitcoin futures spread, one must look at historical spread data, considering factors such as market volatility, trading volume, and open interest.

Historical Performance and Volatility

Bitcoin has often been likened to digital gold. Nonetheless, its trading history is filled with significant peaks and troughs. For example, Bitcoin’s volatility in the past year has mainly stemmed from regulatory shifts and market sentiment.

| Month | Price ($) | Spread ($) |

|---|---|---|

| January | 40,000 | 500 |

| February | 42,000 | 450 |

| March | 38,500 | 700 |

Strategies for Trading HIBT Futures

Whether you are a novice trader or seasoned investor, understanding effective strategies for trading HIBT Bitcoin futures is paramount.

- Technical Analysis: Using charts and historical data to forecast future price movements.

- Fundamental Analysis: Keeping abreast of news regarding Bitcoin regulations, exchange updates, and market trends.

- Sentiment Analysis: Gauging market sentiment through social media and trading forums to detect trends.

Vietnam’s Growing Crypto Market

Vietnam has seen a remarkable increase in cryptocurrency adoption. In recent years, the user growth rate has surged by 250%, indicating a strong trend among younger investors in the region.

As the Vietnamese government begins to regulate digital assets more effectively, the HIBT Bitcoin futures market can become a tool for traders in this growing market.

Conclusion

In summation, understanding the HIBT Bitcoin futures spread can provide traders with significant insights for making savvy investment decisions. As the landscape evolves, keeping up-to-date with market data and historical trends becomes crucial. With Bitcoin futures becoming increasingly relevant in trading strategies, now is the perfect time to engage in detailed analyses.

For more insights into Bitcoin futures and trading strategies, check out HIBT’s detailed analyses and resources on HIBT.

As market dynamics shift, it is wise to remain well-informed and ready to adapt to the changes.

Author: Dr. Tran Minh, a blockchain technology expert with over 20 published papers in the field and a lead advisor for major audit projects in the cryptocurrency space.