Introduction: The Evolution of HIBT Crypto Stock Portfolios

In the rapidly growing cryptocurrency space, managing your HIBT crypto stock portfolio effectively is crucial. With an estimated $4.1 billion lost to DeFi hacks in 2024, investors need robust strategies to protect their investments. This article will address the essential components of HIBT crypto stock portfolio management, offering insights backed by data and research.

The Importance of Portfolio Management

Effective portfolio management is like having a safeguard for your assets, akin to a bank vault. As the crypto landscape evolves, investors must understand how to navigate risks and opportunities. The first component of portfolio management involves diversification, which helps spread risk across various crypto assets.

1. Understanding HIBT Crypto Stocks

HIBT crypto stocks represent a category of investments that are based on blockchain technology. These stocks allow investors exposure to companies that are heavily involved in the cryptocurrency sector. With the increasing popularity of digital assets in Vietnam, where user growth rates have surged by 30% annually, understanding these stocks becomes even more pivotal.

2. Diversifying Within Your Portfolio

Diversification is the cornerstone of any successful investment strategy. Incorporating different types of HIBT crypto stocks can mitigate risks. Here are some tips on how to diversify:

- Invest in a mix of established and emerging cryptocurrencies.

- Consider geographical diversification, including Vietnamese market options.

- Engage in sector diversification, investing in blockchain companies, fintech, and DeFi projects.

3. Risk Management Strategies

Managing risk is essential in the volatile world of cryptocurrency. One could liken it to ensuring a solid foundation before building a skyscraper. Here are some effective risk management strategies for your HIBT crypto portfolio:

- Set clear investment goals based on risk tolerance.

- Regularly assess your portfolio to rebalance and adjust based on market conditions.

- Utilize stop-loss orders to cut losses when necessary.

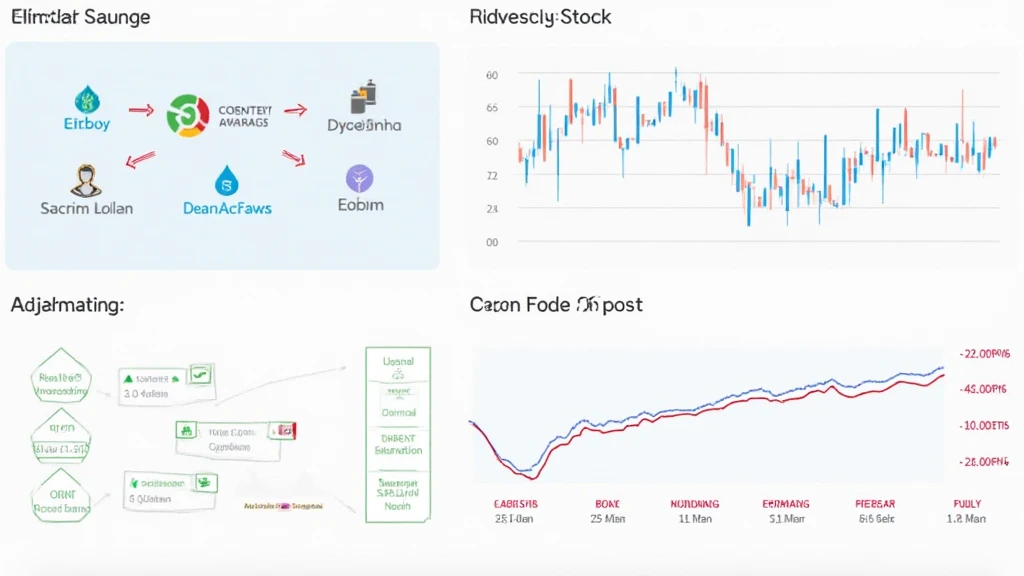

4. The Role of Data-Driven Decisions

Leveraging data analytics can significantly enhance your investment outcomes. Just like a pilot relies on flight data, investors should utilize market data to inform their decisions. A comprehensive analysis of past performance, market trends, and emerging technologies can guide your investment choices. For instance:

- Track key performance indicators (KPIs) within your crypto portfolio.

- Review sector performance metrics to identify growth opportunities.

- Stay informed about regulatory changes impacting crypto markets in Vietnam.

Integrating Blockchains and Smart Contracts

As investors expand their HIBT crypto stock portfolios, understanding blockchain technology and smart contracts becomes essential. The integration of these technologies can provide investors with transparent, efficient, and secure transaction processes.

5. Auditing Smart Contracts: Ensuring Security

With the rise of decentralized finance, auditing smart contracts has become paramount. According to industry reports in 2023, smart contract vulnerabilities accounted for 55% of total hacks. Here’s how to approach smart contract audits:

- Conduct thorough reviews of smart contracts before engaging with them.

- Utilize reputable auditing firms that specialize in blockchain technology.

- Stay educated on common vulnerabilities and recent exploits.

Building a Sustainable Investment Strategy

Creating a sustainable investment strategy is akin to nurturing a garden. It requires consistent attention and proper care. Follow these principles to ensure your HIBT crypto stock portfolio remains healthy and profitable:

- Adopt a long-term investment mindset to withstand market volatility.

- Regularly update your knowledge about market trends and new blockchain innovations.

- Engage with the crypto community through forums and social media platforms.

Conclusion: Navigating the Future of HIBT Crypto Stock Management

In conclusion, managing your HIBT crypto stock portfolio is an evolving process that demands continuous education and strategic planning. By focusing on diversification, risk management, data-driven decisions, smart contract audits, and sustainable investment practices, investors can potentially safeguard their assets and maximize returns in today’s volatile market. The Vietnamese cryptocurrency market continues to grow, providing abundant opportunities for savvy investors ready to adapt.

For further insights and tools to enhance your portfolio management techniques, explore resources at hibt.com.

Written by Dr. Minh Nguyen, a blockchain expert with over a decade of experience, authoring more than 20 papers in financial technology, and overseeing significant audits for leading blockchain projects.