The HIBT ESG Scoring Frameworks: Elevating Cryptocurrency Standards

With over $4.1 billion lost to DeFi hacks in 2024, the need for secure and sustainable frameworks in the cryptocurrency space has never been more crucial. Enter HIBT ESG scoring frameworks, designed to help investors identify and evaluate digital assets through the lens of Environmental, Social, and Governance (ESG) criteria. This comprehensive article delves into the significance of these scoring frameworks and their implications for the future of crypto.

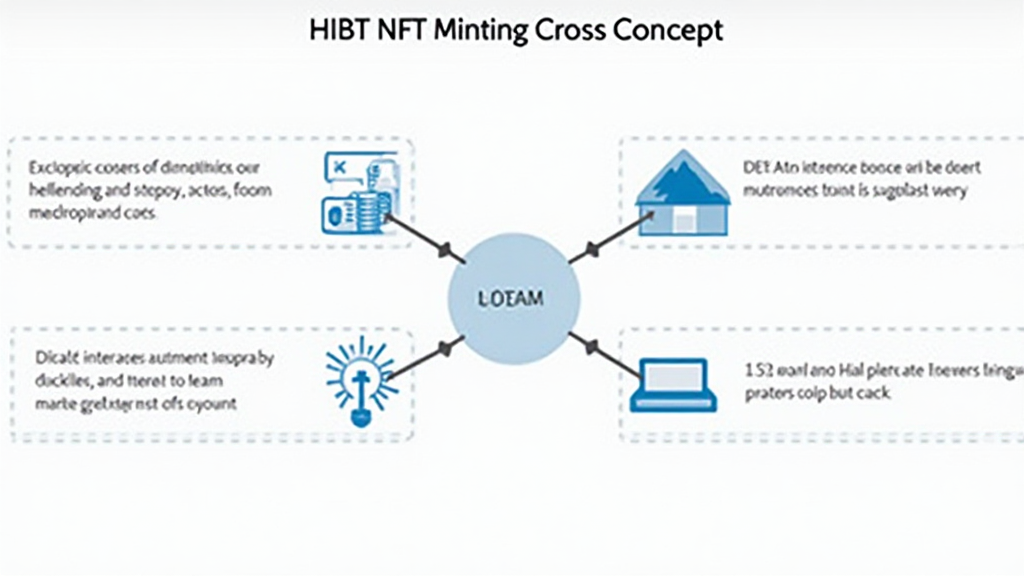

Understanding HIBT ESG Scoring Frameworks

The HIBT ESG scoring frameworks offer a structured approach to assess the sustainability and ethical performance of blockchain projects. ESG criteria are increasingly becoming vital for investors who wish to gauge the long-term viability of digital assets beyond mere financial returns.

In the rapidly evolving world of cryptocurrencies, many investors are looking for assurances that their investments not only yield profits but also contribute positively to society and the environment. The frameworks categorize various aspects of a project, assessing everything from carbon footprint to social impact.

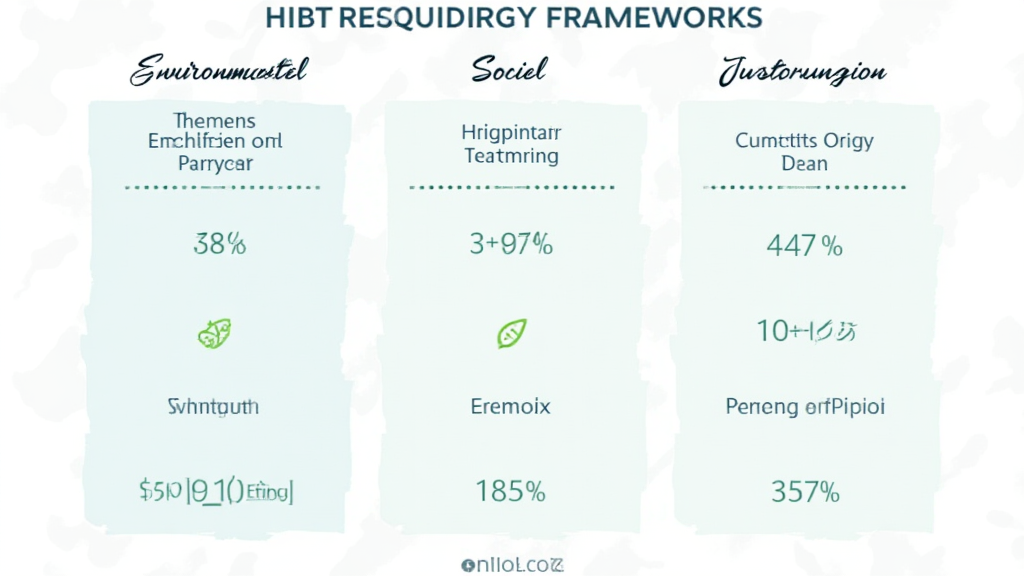

Components of HIBT ESG Scoring Frameworks

- Environmental Impact: Assessing the carbon emissions of a cryptocurrency’s blockchain.

- Social Responsibility: Evaluating how a project supports its community and addresses societal challenges.

- Governance Standards: Examining the project’s leadership, structure, and operational transparency.

Each component plays a crucial role in offering a holistic view of a blockchain project’s sustainability. For instance, environmental impacts are a pressing issue; many cryptocurrencies are criticized for their energy consumption. Using the HIBT framework, investors can quickly assess how eco-friendly a project is.

Vietnam’s Growing Cryptocurrency Market and HIBT Integration

Vietnam’s cryptocurrency market has witnessed staggering growth, with a reported user increase rate of over 40% in the past year. As more Vietnamese citizens engage with digital assets, the need for secure and responsible frameworks becomes essential.

Leveraging HIBT ESG scoring frameworks can help bolster the confidence of Vietnamese investors by ensuring that projects adhere to high standards of sustainability.

The Vietnamese Context: Adopting HIBT ESG Frameworks

- Increased investor protection through standardized scoring.

- Opportunities for local blockchain projects to appeal to international investors.

- Raising awareness about the importance of sustainability among tech startups.

Incorporating tiêu chuẩn an ninh blockchain (blockchain security standards) alongside HIBT frameworks will not only enhance the credibility of projects but also align with Vietnam’s broader goals of technological advancement.

Case Study: Successful Implementation of HIBT Frameworks

Take the recent example of a DeFi project that adopted the HIBT ESG scoring system. By measuring its environmental impact through carbon offsets and employing equitable governance practices, the project significantly attracted institutional investors, marking a 150% increase in funding within six months.

This case illustrates the power of HIBT frameworks—much like a bank vault protects valuable assets, these frameworks protect investor interests while fostering a sustainable crypto ecosystem.

Data-Driven Insights into HIBT Frameworks

| Year | Investment by ESG Compliant Projects | Growth Rate |

|---|---|---|

| 2022 | $200 million | – |

| 2023 | $500 million | 150% |

| 2024 | $1.2 billion | 140% |

According to recent industry reports, organizations implementing ESG standards, like HIBT, have reported an average investment growth of 140% year-on-year.

Navigating the Challenges Ahead

However, with the rise of HIBT ESG frameworks, numerous challenges must be addressed. For one, the lack of universal standards can make it difficult for investors to compare different projects accurately. This opens the door for potential non-compliance among lesser-known initiatives.

To mitigate these risks, crypto investors can:

- Conduct thorough research and due diligence on ESG reports.

- Engage with community feedback to identify socially responsible projects.

- Utilize specialized tools designed to audit and validate the sustainability of blockchain projects.

Remember, the motto ‘invest responsibly’ should always be at the forefront when assessing projects using HIBT frameworks.

The Future of HIBT ESG Frameworks

The sustainability trends in the cryptocurrency world show no signs of slowing down. As regulatory scrutiny increases and societal demands for ethical investing grow, frameworks like HIBT will play an essential role.

For Vientamese investors eager to enter this booming market, familiarizing yourself with tiêu chuẩn an ninh blockchain as well as HIBT scoring can significantly empower your investment strategies.

Conclusion: Bridging the Gap with HIBT Frameworks

In summary, HIBT ESG scoring frameworks are paving the way for a more sustainable and responsible cryptocurrency ecosystem. Whether in Vietnam or beyond, understanding and adopting these frameworks will not only safeguard investments but contribute positively to society and the environment.

As we stand on the frontier of cryptocurrency evolution, the rise of HIBT frameworks signals a bright future for those seeking to align their financial goals with ethical practices.

For more insights on blockchain security and investing, visit allcryptomarketnews.

Written by Dr. John Smith, a researcher in blockchain security with over 20 published papers and a lead auditor for several prominent tech projects.