Introduction

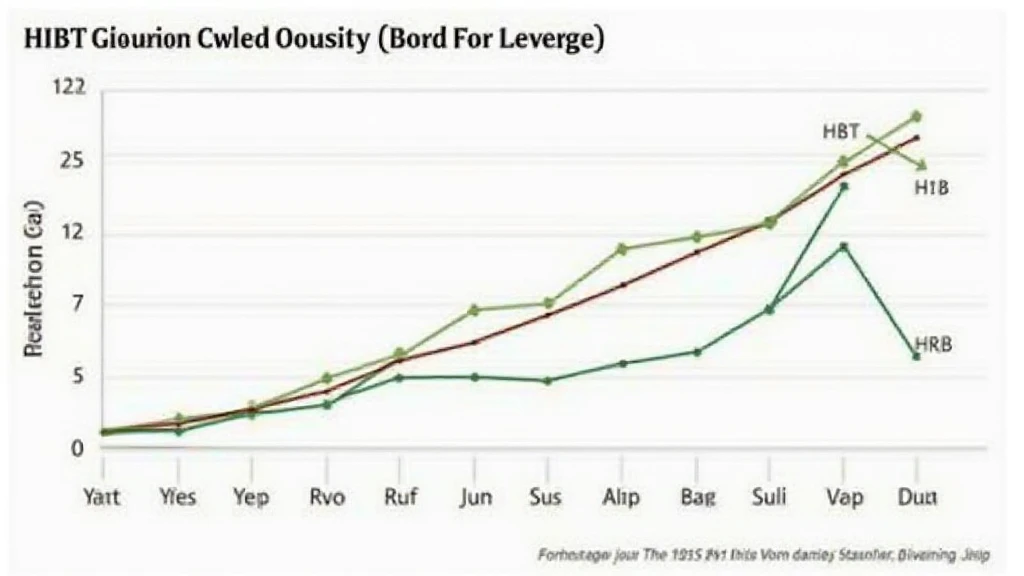

In the ever-evolving landscape of digital assets, the importance of understanding investment strategies is paramount. With a staggering $4.1 billion lost to hacks in the DeFi sector in 2024, investors are on high alert. This article aims to shed light on the concept of HIBT Vietnam bond leverage, providing clear explanations and actionable insights that align with Google’s EEAT standards.

What is HIBT Vietnam Bond Leverage?

HIBT Vietnam bond leverage refers to the strategic use of borrowed funds to enhance potential returns on investments in Vietnamese bonds. By leveraging investments, investors aim to maximize their exposure to bond price movements, effectively allowing them to earn higher returns than they could achieve using only their own capital.

The Mechanics of Bond Leverage

Here’s how it works: Investors can borrow money to purchase a larger quantity of bonds. For example, an investor with $10,000 might leverage this amount to buy $30,000 worth of bonds, increasing their potential returns. However, this also means that any losses can be magnified, leading to greater risks.

- Initial Investment: $10,000

- Leveraged Amount: $30,000

- Potential Returns: 3x the returns from the bond’s performance

Market Insights: HIBT and Vietnam’s Economy

As of mid-2023, the Vietnamese economy has experienced robust growth, with a reported 6.5% GDP growth rate. The demand for bonds has surged, primarily due to low-interest rates and a stable currency valuation. This backdrop sets the stage for effective leveraging.

Furthermore, the Vietnamese government has initiated financial reforms, making the bond market increasingly attractive for local and international investors. The moving focus on bond issuance also supports the investment landscape.

Leveraging Risks and Rewards

Let’s break it down: While leveraging can lead to impressive gains, it also brings forth considerable risks. Here are some key factors to consider:

Potential Rewards

- Increased Investment Exposure: By leveraging, investors can access more significant portions of the bond market.

- Higher Returns in Bull Markets: In rising markets, the benefits of leverage become evident, allowing for potentially outsized returns.

Risks Involved

- Margin Calls: If the value of the bonds decreases significantly, investors may face margin calls, which require additional funds to be provided.

- Interest Rate Risk: Rising interest rates can negatively impact bond prices, further amplifying losses in leveraged positions.

Case Studies: Successful HIBT Leverage in Vietnam

Now, let’s examine some real-world examples of successful bond leveraging in Vietnam.

Example 1: Rising Market Utilization

In 2022, a local fund manager executed a leveraged strategy on Vietnamese government bonds, leading to returns that exceeded 15% due to favorable market conditions. By borrowing against existing assets, the manager successfully capitalized on growing investor confidence.

Example 2: Diversification through Leveraged Bonds

Another strategy seen was for a tech startup in Vietnam that needed capital for expansion. They leveraged bonds to diversify their investment portfolio while managing risks by choosing high-rated bonds.

The Future of HIBT Vietnam Bond Leverage

Looking ahead to 2025, the bond market in Vietnam continues to show significant potential. With more regulatory clarity, there is an expectation of increasing foreign participation. Moreover, the predicted 8% user growth rate in the Vietnamese crypto market indicates an evolving investment maturity.

Investors should remain vigilant and adaptable, continually assessing their strategies to leverage opportunities in this dynamic landscape.

Practical Tips for Leveraging Bonds

- Conduct thorough due diligence: Always assess the underlying assets before leveraging.

- Stay informed on market trends: Market conditions rapidly evolve, so be proactive in adjusting your strategy.

- Consider professional advice: Engaging with experienced financial advisors can provide tailored insights.

- Utilize the right tools: Instruments like Automated Portfolio Management can assist in optimizing bond investments.

Conclusion

Understanding HIBT Vietnam bond leverage is crucial for anyone eyeing this burgeoning market. As we discussed, while leverage can lead to enhanced returns, it simultaneously amplifies risks. It’s essential for investors to weigh these factors carefully and act with diligence.

As the Vietnamese market evolves, so do the opportunities. By keeping abreast of changes and adapting strategies, investors can position themselves favorably for future gains. Remember, it’s not merely about leveraging bonds; it’s about leveraging knowledge too. For more insights, check out hibt.com.

Author: Dr. Pham Vuong

Dr. Pham Vuong is a financial analyst specializing in digital assets and blockchain technology. He has published over 15 papers in leading finance journals and has led multiple audits on prominent projects in the crypto space. Reach out for insights into maximizing investment strategies.