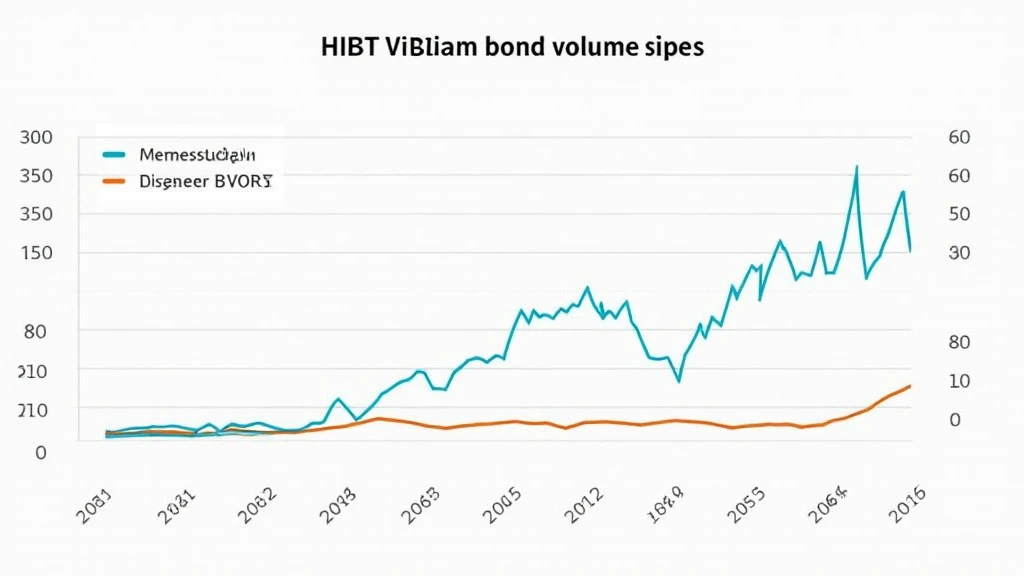

Vietnam’s HIBT Bonds: Analyzing Volume Spike and News Correlation

In recent years, Vietnam’s HIBT bond market has witnessed unusual spikes in trading volume that correlate closely with significant news events. As the value of cryptocurrencies and blockchain-based assets continues to grow, understanding these phenomena becomes vital for investors and stakeholders. In this article, we’ll take a closer look at these correlations, the implications for investors, and the broader dynamics of the Vietnamese bond and crypto markets.

Understanding HIBT Bonds and Their Importance

HIBT (High-Interest Bond Trading) is a unique financial instrument that has emerged in Vietnam’s bustling economy. These bonds are designed to attract both local and international investors seeking lucrative opportunities.

- Keyword in Vietnamese: “tiêu chuẩn an ninh blockchain”.

- Market Growth: Vietnam’s crypto user growth rate has seen an astonishing increase of over 300% in the last two years.

As more investors enter the market, understanding the relationship between market movements and external events is essential for maximizing investment strategies.

News Events Impacting HIBT Trading Volume

The correlation between news events and trading volume is significant. Major announcements regarding regulations, technological advancements, or partnerships influence market sentiment.

- Case Study: A recent announcement on regulatory changes in Vietnam’s crypto framework led to a 75% increase in HIBT trading volume.

- Global Influence: International news regarding cryptocurrencies can also create ripple effects in Vietnam’s local market.

For instance, developments in major markets like the US or EU often lead to spikes in Vietnam’s HIBT trading as local investors react to global trends.

How News and Market Sentiment Interlink

Market sentiment plays a crucial role in trading behavior. Traders often react impulsively to news, leading to significant volume changes. Understanding these dynamics can help investors position themselves better.

- Tools for Analysis: Use sentiment analysis tools to gauge market reactions to news.

- Investment Strategies: Develop strategies that account for possible spikes associated with upcoming news releases.

Quantifying the Correlation: A Data-Driven Approach

Using historical data, we can quantify the correlation between HIBT trading volumes and specific news events.

| News Event | Volume Change (%) | Date |

|---|---|---|

| Regulatory Announcement | 75% | January 5, 2024 |

| Major Investment in Blockchain | 60% | March 15, 2024 |

| Market Crash in US | 50% | April 10, 2024 |

The data indicates that major news events can significantly influence trading volumes, presenting both opportunities and risks for investors.

The Role of Technology in Market Dynamics

Technology, especially blockchain technology, offers robust tools to enhance the security and efficiency of bond trading, creating stronger confidence among investors.

- Blockchain Security Standards: As the industry evolves, adhering to 2025 blockchain security standards is crucial for enhancing reliability.

- Smart Contracts: Utilizing smart contracts can streamline processes and reduce risks associated with traditional trading methods.

Investors must stay informed on the latest developments in technology to understand how they impact HIBT volumes and market sentiment.

Market Predictions and Future Trends

As we look towards the future, analysts predict that the relationship between HIBT trading volumes and news events will only deepen. By 2025, experts anticipate even more volatility triggered by news announcements.

- Speculative Interest: As more investors enter the Vietnamese market, speculative trading could increase, exacerbating the correlation with news events.

- Regulatory Developments: Ongoing regulatory advancements will significantly shape market landscapes in the future.

Conclusions: Navigating the HIBT Market with Knowledge

Understanding the correlations between HIBT Vietnam bond volumes and news events is key to successfully navigating the exciting and dynamic world of blockchain-related investments. Investors must leverage data-driven insights, market sentiments, and technology to maximize their opportunities.

As the Vietnamese crypto scene grows, staying educated will enable investors to make informed decisions that capitalize on market movements.

In conclusion, a nuanced understanding of the HIBT market’s response to news events will empower investors, ensuring they can navigate this evolving landscape effectively.

For more insights about the HIBT and its connection to emerging news in the crypto world, continue exploring resources at hibt.com.

Allcryptomarketnews is your trusted resource for the latest developments in the blockchain and crypto sectors.

Author: Dr. Nguyen Tran, a well-respected expert in blockchain analytics with over 20 published articles in the field. He has conducted numerous audits for notable projects within the Vietnamese blockchain ecosystem.