HIBT Vietnam Crypto Tax Forms: Business Guide 2025

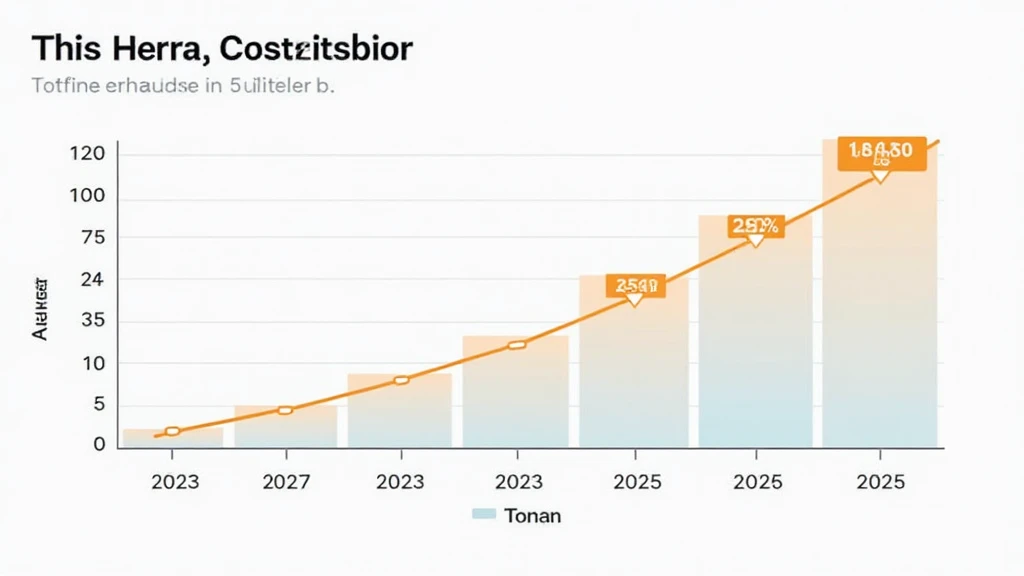

With the value of digital assets skyrocketing, crypto enthusiasts and investors in Vietnam are increasingly seeking clarity on tax obligations. In 2024 alone, approximately 1.5 million new crypto investors emerged in Vietnam, spurring a demand for relevant information. This article serves as a comprehensive guide to understanding HIBT Vietnam crypto tax forms and effectively navigating business operations related to cryptocurrencies in 2025.

The Rise of Cryptocurrency in Vietnam

Vietnam’s user growth rate for cryptocurrencies was recorded at an impressive 32% in 2023 according to Chainalysis. The increasing popularity has prompted the Vietnamese government to establish regulatory frameworks to ensure compliance, thereby instigating the need for businesses to adapt to these standards.

1. Understanding HIBT and Its Functionality

- HIBT stands for Hệ thống thông báo thông tin Blockchain, translating to “Blockchain Information Notification System.” This system enhances transparency by providing a structured method for reporting crypto transactions.

- The implementation of HIBT is crucial for businesses aiming to comply with local regulations and avoid penalties.

2. The Significance of Crypto Tax Forms in Vietnam

As Vietnam prepares for the regulatory environment in 2025, crypto tax forms will play a pivotal role. Here’s what you need to know:

- Mandatory Reporting: Each crypto transaction must be reported to the tax authority, ensuring that gains or losses are correctly assessed.

- Profit Calculations: Businesses should maintain detailed records of all transactions, including dates, amounts, and values in both local currency and cryptocurrency.

3. Steps to Complete HIBT Vietnam Crypto Tax Forms

To assist businesses, we’ve outlined a practical approach:

- Gather Data: Compile transaction history, ensuring accuracy and completeness.

- Form Completion: Use HIBT’s online platform to input and validate data.

- Submission: Ensure timely submission to avoid penalties.

4. Compliance with Local Regulations

The Vietnamese government emphasizes compliance. Here’s a breakdown of requirements:

- Legal Structure: Businesses must comply with the Law on Cybersecurity, ensuring that data protection protocols are established.

- Record-Keeping: All records should be transparent and readily available for audits.

5. Trends in the Vietnamese Cryptocurrency Market for 2025

As we look at 2025, several trends suggest significant changes in the crypto landscape:

- Increased Regulation: The government is likely to introduce more stringent regulations to ensure investor protection.

- Focus on Security: With rising security breaches, businesses are expected to prioritize tiêu chuẩn an ninh blockchain.

Recommendations for Businesses in 2025

To effectively navigate the evolving crypto landscape, consider these strategies:

- Invest in Educating Employees: Training staff on compliance will mitigate risks.

- Adopt Security Best Practices: Utilize hardware wallets such as the Ledger Nano X to enhance security.

- Consult with Experts: Regular consultations with tax advisors and legal experts will ensure adherence to regulations.

Conclusion

Understanding HIBT Vietnam crypto tax forms is essential for businesses looking to thrive in Vietnam’s burgeoning crypto landscape. With the right preparations and adherence to the guidelines laid out in this guide, businesses can navigate potential challenges in 2025 with confidence.

For detailed guidelines and resources about Vietnam’s cryptocurrency landscape, consider visiting HIBT and stay informed.

Author: Dr. Nguyen Phong, a blockchain expert, and financial consultant, has published over 10 papers on digital currency regulations and led numerous well-known project audits in Southeast Asia.