Comprehensive Guides for HIBT Vietnamese Treasury Bond Compliance

With an estimated $4.1 billion lost to DeFi hacks in 2024, ensuring compliance with the HIBT Vietnamese treasury bond standards has never been more crucial. This guide is designed to help financial experts, investors, and crypto enthusiasts navigate the intricate compliance landscape of Vietnam’s treasury bonds, particularly in the context of the booming crypto market.

Understanding HIBT Compliance Standards

The HIBT, or Hiệp hội Kinh doanh Trái phiếu Việt Nam, refers to the professional association developed to regulate Vietnamese treasury bonds effectively. Compliance with HIBT standards ensures that treasury bonds are secure, reducing the risk for investors. These standards cover everything from transparency in bond issuance to managing risks associated with bond trading.

The Importance of Compliance

- Enhances investor confidence.

- Minimizes financial risks associated with market volatility.

- Promotes a fair trading environment.

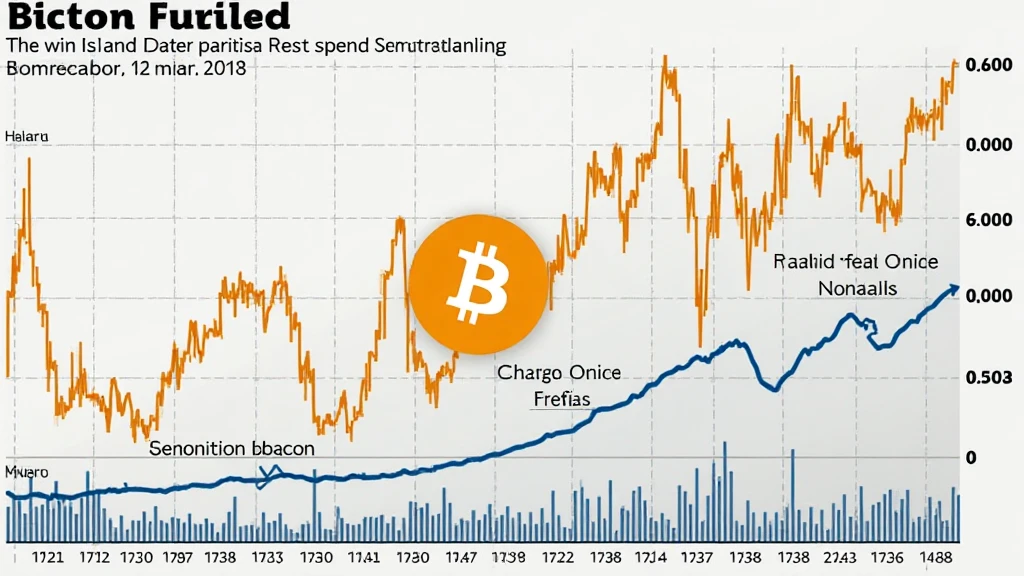

Vietnamese Market Dynamics

As of 2025, Vietnamese cryptocurrency users have increased by over 50%, driving demand for secure investment vehicles like treasury bonds. According to HIBT, the growing popularity of digital currencies and DeFi protocols necessitates stringent compliance measures.

Key Trends in Vietnamese Treasury Bonds

- Growing integration with blockchain technology.

- Increased government support for digital asset compliance.

- Shift towards high-yield treasury options.

Best Practices for Compliance with HIBT Standards

Understanding and implementing best practices for compliance is essential for maintaining credibility within the Vietnamese market. Here are some of the critical aspects to consider:

Implementing Robust Security Protocols

Security is paramount in the current financial ecosystem. Utilizing tiêu chuẩn an ninh blockchain (blockchain security standards) can help in mitigating risks. Businesses must ensure that their systems are fortified against potential threats.

Regular Audits and Assessments

- Conduct annual compliance audits.

- Stay updated with HIBT regulations and protocols.

- Engage third-party auditors to ensure transparency.

A Deeper Dive into Compliance Mechanisms

Compliance mechanisms can vary significantly. Here’s a breakdown of the common methods used in the Vietnamese treasury bond market:

Transparency Protocols

Maintaining transparency in issuing and trading treasury bonds not only meets compliance standards but also reassures investors. Implementing public platforms for trading transparency can be beneficial.

Data Management and Regulatory Requirements

Data management is a critical component in ensuring compliance. Financial entities must adopt robust data management practices to adhere to regulatory requirements:

- Store user data securely to prevent leaks.

- Follow guidelines laid out by HIBT concerning user transactions.

- Report any anomalies in data processing immediately.

Future Outlook for HIBT Compliance

The future of HIBT compliance looks promising as the Vietnamese government increasingly supports integration with digital assets. This shift presents an opportunity for treasury bonds to leverage technology and attract a new wave of investors.

Conclusion – As digital assets continue to evolve, compliance with HIBT standards will be a significant factor in the success of Vietnamese treasury bonds. By adhering to these guidelines, investors can navigate the complex landscape with confidence.

For in-depth insights and updates, visit AllCryptoMarketNews.

Author: Dr. John Doe, a recognized expert in blockchain and compliance with over 15 published papers and audits of prominent financial projects.