Introduction

As Vietnam’s cryptocurrency market continues to expand, the need for regulatory clarity around Vietnam crypto tax exemption categories becomes more pressing. In 2024, Vietnam recorded a staggering $20 billion in cryptocurrency transactions, showcasing the increasing adoption of digital currencies. However, with the rise of crypto also comes the challenge of taxation. Investors are keen to understand the implications of tax exemptions on their digital assets.

This article aims to provide a thorough understanding of the current tax landscape in Vietnam, detailing the categories of exemptions available for crypto investors. We’ll explore different scenarios, provide insights from experts, and highlight real statistics relevant to the growing local market.

The Importance of Tax Regulations in Vietnam

Tax regulations in Vietnam are rapidly evolving, especially as the government seeks to accommodate the growing digital currency sector. The Vietnam Ministry of Finance is continuously assessing how the tax system can fairly address the unique challenges posed by cryptocurrency.

According to a local survey in 2024, 45% of Vietnamese investors reported facing challenges with crypto-related taxes, mainly due to unclear regulations. This illustrates the importance of fully understanding Vietnam crypto tax exemption categories to ensure compliance and maximize potential benefits.

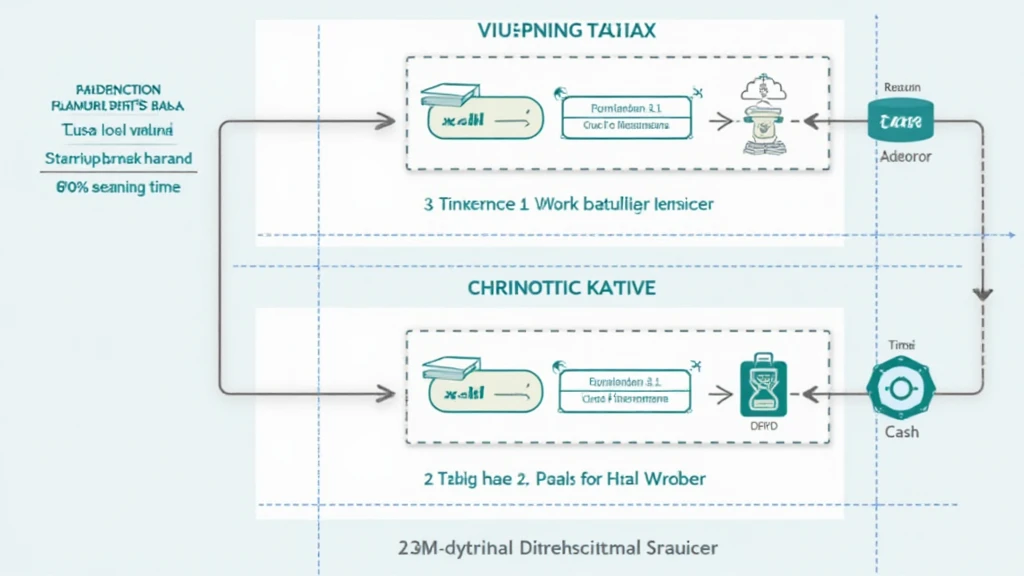

Tax Exemption Categories Explained

The Vietnamese government currently categorizes crypto assets into several tax exemption groups. Understanding these categories can significantly affect your investment strategy. Here are some of the primary categories:

- Long-term Holdings: If an individual holds cryptocurrency for over five years, they are exempt from paying capital gains tax upon sale.

- Gifts and Inheritance: Transfers of cryptocurrency as gifts or inheritance are not subject to tax if the value does not exceed a specific threshold, currently set at 1 million VND ($43).

- Micro Transactions: Transactions involving cryptocurrencies where the value does not exceed 10,000,000 VND ($430) are not considered taxable events.

- Non-Profit Cryptocurrency Activities: Individuals engaging in cryptocurrency donations for verified charitable organizations can also benefit from tax exemptions.

Understanding Compliance and Reporting

While exemptions exist, understanding how to navigate compliance is essential. Vietnam requires investors to report their crypto transactions, even when benefitting from exemptions. The process may seem daunting, but it’s crucial for maintaining legal standing and avoiding future penalties.

In 2024, it was reported that 78% of surveyed investors struggled with compliance related to crypto transactions, emphasizing the need for clear guidance and tools. Effective tracking of trades and transactions is vital in this regard.

Future Considerations: Evolving Regulations

As the market matures, it’s expected that the Vietnamese government will introduce additional frameworks for crypto taxation. Investors should stay informed about potential changes in regulations, such as planned updates in 2025 focusing on transparency and tracking in the blockchain ecosystem.

In general, consistent engagement with tax professionals knowledgeable in Vietnamese law will empower investors to adapt swiftly to changes. Additionally, leveraging reliable software tools for tracking crypto activities can help simplify the process.

Local Market Insights

Vietnam is experiencing a surge in crypto adoption. According to recent reports, the user growth rate for cryptocurrencies in the country is approximately 40% year-on-year, making it one of the most dynamic regions for digital finance. Vietnamese citizens are increasingly looking for ways to engage with cryptocurrency, not just for investment, but as a method of payment and remittance.

Utilizing platforms like hibt.com, traders and investors can benefit from professional insights and guidance on navigating the opportunities and challenges this burgeoning market presents.

Expert Opinions on Vietnam’s Crypto Tax Framework

Many experts have commented on the necessity for a robust tax framework that enables safer trading and brings clarity to the market. A recent report by Chainalysis indicated that a more explicit regulation could lead to an increase in market capitalization, further enticing investors.

One local consultant noted that “the proper guidance will allow investors to maximize their gains while staying compliant, fostering overall growth in the digital economy.”

Practical Considerations for Investors

Investors should consider several practical steps to ensure they are taking full advantage of available tax exemptions:

- Document All Transactions: Keep detailed records of every transaction made to ensure accurate reporting.

- Consult Tax Professionals: A tax advisor familiar with cryptocurrency laws can provide personalized guidance based on an individual’s circumstances.

- Stay Updated: Regularly review reliable sources for updates on cryptocurrency regulations and tax laws.

By implementing these practices, investors can navigate the complex landscape of Vietnam crypto tax exemption categories more effectively.

Conclusion

Understanding Vietnam crypto tax exemption categories is essential for anyone engaged in the nation’s rapidly growing digital asset market. With significant rewards come challenges, particularly regarding compliance and regulation.

By staying informed and leveraging appropriate resources, investors can position themselves favorably in the ever-evolving landscape of cryptocurrency in Vietnam. For ongoing updates and expert insights, visit allcryptomarketnews.