Introduction: The Importance of Market Liquidity

Imagine a world where digital assets are as fluid and accessible as cash in your wallet. With the growing interest in cryptocurrencies, especially Bitcoin, the concept of market liquidity has taken center stage. Recent reports indicate that Bitcoin trading volumes have surged, highlighting the rising demand for this digital gold. But with $4.1B reportedly lost to DeFi hacks in 2024 alone, understanding market liquidity is more critical than ever.

At the forefront of Bitcoin adoption is MicroStrategy, a company that has transformed its corporate strategy by heavily investing in Bitcoin. This article will dissect the implications of MicroStrategy’s actions on the overall Bitcoin market liquidity, exploring key data and insights that every investor should consider while navigating this volatile landscape.

Understanding Bitcoin Market Liquidity

Market liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. High liquidity means assets can be quickly exchanged with minimal price fluctuation, while low liquidity often results in significant price changes with transaction activity, increasing investment risk.

- Bid-Ask Spread: This is the difference between the price buyers are willing to pay (bid) and the price sellers want (ask). A narrower spread usually indicates higher liquidity.

- Volume: Trading volume is a key indicator of liquidity. Increased trading volume often correlates with improved liquidity.

- Order Book Depth: The number and size of buy and sell orders at different price levels provide insight into market liquidity.

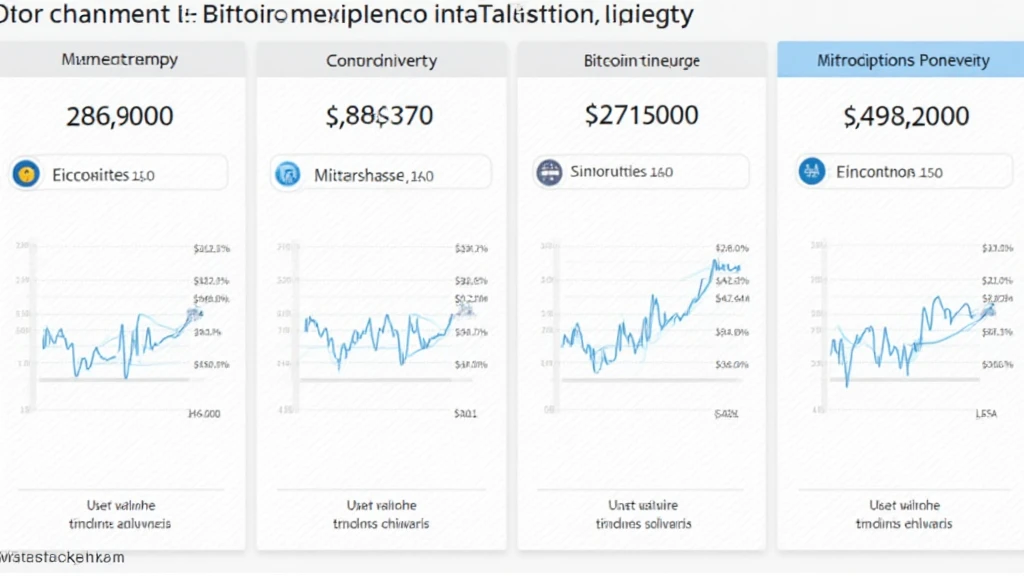

The Role of MicroStrategy in Bitcoin Market Liquidity

MicroStrategy’s approach to Bitcoin investing provides a unique lens through which we can understand market liquidity. The company’s significant Bitcoin purchases have affected both supply and demand dynamics in the market, leading to shifts in liquidity. Let’s break it down:

- Increased Institutional Demand: MicroStrategy’s actions have encouraged other institutions to consider Bitcoin as part of their treasury reserves, sparking a broader acceptance of Bitcoin.

- Price Stabilization: Large purchases by entities like MicroStrategy can lead to less price volatility by creating a perceived floor for Bitcoin prices.

Market Dynamics: Insights from Recent Data

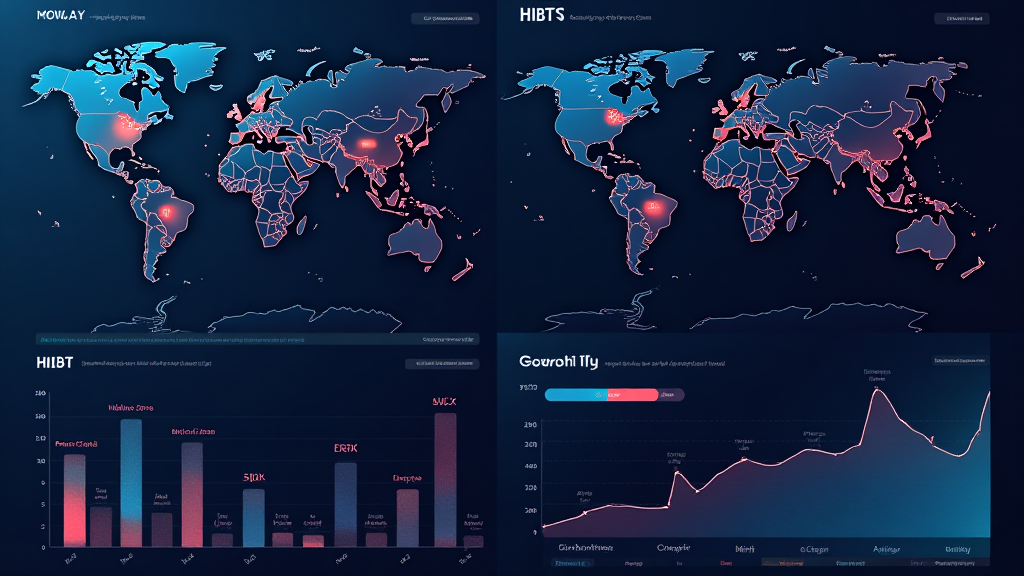

According to recent findings from Chainalysis, as of 2025, global Bitcoin adoption has surged by 300%, with notable increases in countries like Vietnam. The South-East Asian nation has recorded a user growth rate of 150% in cryptocurrency, driven by an increasingly tech-savvy population.

| Country | Cryptocurrency User Growth Rate (%) |

|---|---|

| Vietnam | 150 |

| USA | 120 |

| Brazil | 100 |

This growth not only highlights the demand but also reflects on market liquidity, as more participants enter the Bitcoin ecosystem. Here’s the catch—more users mean more active trading, which can help stabilize prices.

The Impact of DeFi and Market Security

The prevalence of decentralized finance (DeFi) plays a dual role in market liquidity. On one hand, it enhances liquidity by allowing users to trade assets without intermediaries. On the other hand, increasing risks associated with hacks and scams can deter users. With over $4 billion lost to DeFi hacks in 2024, a clear divide exists between innovation and security.

To navigate this fine line, here are some tips for investors:

- Research: Always audit smart contracts. Consider tools like hibt.com to help with assessments.

- Diversify: Spread investments across various platforms to mitigate risks.

- Stay Informed: Regularly review market trends and security updates to safeguard investments.

Practical Tools for Enhancing Your Investments

As you consider entering the cryptocurrency market, utilizing reliable tools can safeguard your assets:

- Ledger Nano X: This hardware wallet reportedly reduces hacks by 70%.

- CoinMarketCap App: Real-time data helps track price changes and liquidity.

Future Outlook: MicroStrategy and Bitcoin Liquidity

What lies ahead for MicroStrategy and Bitcoin market liquidity? Experts predict that as more companies follow MicroStrategy’s lead, liquidity will improve, creating a more robust market. Trends suggest a positive trajectory, especially with institutional investors’ growing confidence in Bitcoin as a legitimate asset.

Looking toward 2025 and beyond, major developments like the upcoming Bitcoin ETF are anticipated to enhance market dynamics further, promising increased accessibility for institutional and retail investors alike.

Conclusion: Embracing Opportunities While Acknowledging Risks

Engaging with Bitcoin and its market dynamics is not without its challenges. However, armed with knowledge about liquidity and market trends—particularly those influenced by well-known entities like MicroStrategy—investors can harness opportunities while being aware of the risks involved. Whether you are a seasoned trader or a newcomer, keeping abreast of these developments is crucial.

As we witness the evolution of Bitcoin and its market liquidity, let’s ensure that we are making informed decisions to protect our assets and embrace the future of digital finance.

For comprehensive insights on Bitcoin and more, visit allcryptomarketnews.

About the Author

John P. Carter, a seasoned blockchain consultant with over 15 years of expertise in digital asset analysis, has authored 30 papers in the field of cryptocurrency and blockchain technology. He has also led notable auditing projects in the DeFi space, contributing extensively to market security and investor education.