Introduction

With an estimated $4.1 billion lost to DeFi hacks in 2024, the rise of cryptocurrencies is not only a financial phenomenon but also one with profound geopolitical implications.

As nations grapple with the challenges posed by decentralized finance, it becomes increasingly imperative to understand the crypto geopolitical impact on global governance, economic policies, and regulatory frameworks. This article delves into how cryptocurrencies challenge existing geopolitical paradigms and what this means for both investors and policymakers.

Understanding the Geopolitical Landscape

The interactions between cryptocurrency and geopolitical dynamics are complex and multifaceted. Various factors contribute to the overall geopolitical impact of crypto, including:

- National Security: Cryptocurrencies can be used for illicit activities, prompting concerns from governments worldwide.

- Economic Independence: Nations seeking to reduce their reliance on the US dollar are increasingly looking to digital currencies.

- Digital Sovereignty: Countries are beginning to understand the need for national digital currencies.

National Security and Cryptocurrencies

Cryptocurrencies and blockchain technology present unique challenges to national security. Governments worry that the anonymous nature of digital currencies can facilitate smuggling, money laundering, and even terrorism financing. For example, the implementation of cryptocurrencies in regions of conflict can undermine traditional financial systems.

Economic Independence

Nations like Venezuela and Iran, facing sanctions and economic turmoil, have turned to cryptocurrencies to provide their citizens with financial alternatives. For instance, during economic crises, the usage of Bitcoin has surged, allowing citizens to bypass dwindling local currencies.

Digital Sovereignty and the Rise of CBDCs

Countries are increasingly contemplating Central Bank Digital Currencies (CBDCs) as a way to retain control over their financial systems in the face of unregulated cryptocurrencies. A report by the Bank for International Settlements (BIS) states that nearly 80% of central banks are researching or piloting CBDC projects.

The Role of Cryptocurrency in Global Trade

One of the most significant geopolitical impacts of crypto is its potential to redefine global trade. Cryptocurrency can facilitate quicker and more secure transactions, particularly in regions with underdeveloped banking infrastructures. With the rise in blockchain technology, trade contracts can now be automated using smart contracts, leading to more efficient trade processes.

Cross-Border Transactions

Cryptocurrency enables businesses to negotiate and transact across borders without the complications of traditional banking. For instance, Ethereum’s smart contracts can streamline trade agreements by automating and enforcing the terms of the contracts.

Cultural Implications

The adoption of cryptocurrencies is affecting cultural norms and values in many societies. In places like Vietnam, the user growth rate for cryptocurrency platforms has grown by an astonishing 40% over the last year. This not only reflects a shift in investment strategies but also impacts how individuals view and interact with money.

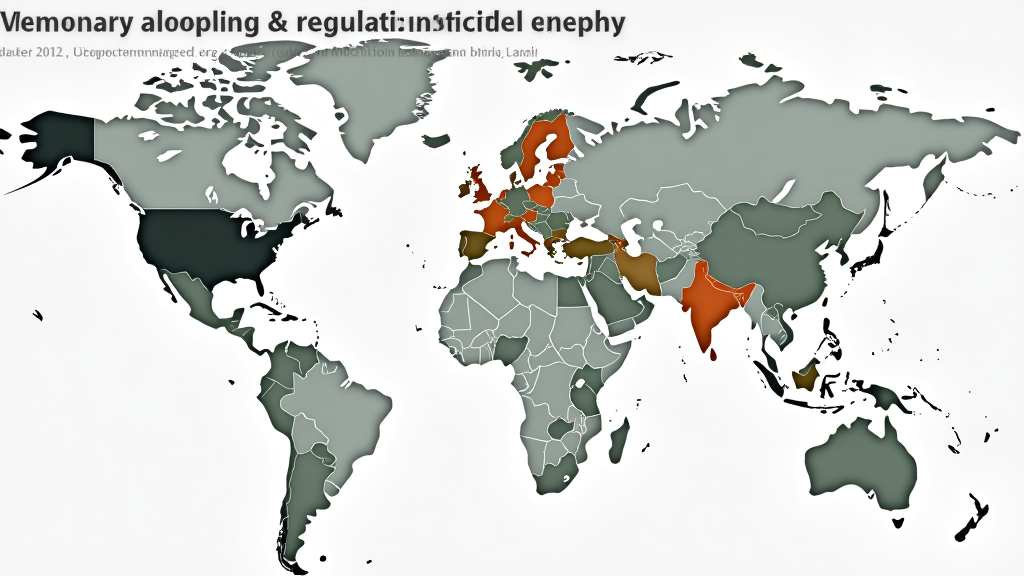

The Regulatory Framework for Crypto around the World

As the crypto market continues to evolve, regulatory frameworks struggle to keep pace, leading to a scenario laden with inconsistencies. Here are some key regulatory considerations:

- Scope of Regulations: Different countries have adopted varying approaches to cryptocurrency regulations, leading to confusion.

- International Collaboration: There is a pressing need for global cooperation among regulatory bodies.

- Taxation Policies: The taxation landscape is uneven, with some countries promoting crypto while others enforce strict regulations.

Scope of Regulations

Countries like China have imposed strict bans on cryptocurrency trading, while places like Switzerland have embraced it by creating favorable regulatory environments.

Taxation Policies

In Vietnam, the government is working on regulations that offer clarity on cryptocurrency taxation, which currently lacks a comprehensive framework.

Case Studies: Countries Leading the Charge

Several countries are setting the tone for cryptocurrency regulations and innovations. For example, El Salvador made headlines by becoming the first country to adopt Bitcoin as legal tender. Conversely, China has taken an opposite approach with its ban on cryptocurrency exchanges.

El Salvador’s Bitcoin Adoption

Since adopting Bitcoin, El Salvador has seen both challenges and opportunities emerge. While this forward-thinking move has attracted foreign investments, it has also drawn skepticism due to the volatility of cryptocurrency.

China’s Regulatory Crackdown

Conversely, China’s crackdown on cryptocurrencies demonstrates the risks invasive regulation poses on innovation. Such measures can push talent and technology to more favorable jurisdictions such as Singapore or Switzerland.

Future Trends in Cryptocurrency and Geo-Politics

Looking ahead, it is crucial to consider how the crypto geopolitical impact will continue to evolve. Some of the notable trends to watch for include:

- Increased Collaboration: As cryptocurrencies gain traction, nations will need to work together to develop a cohesive regulatory framework.

- Climate Considerations: With the environmental footprint of cryptocurrencies under scrutiny, the future may see more eco-friendly mining solutions.

- Emergence of New Crypto Economies: Countries may start to establish unique digital economies that cater to local needs and values.

Increased Collaboration for a Global Framework

There is a growing consensus that the future of cryptocurrency regulation will necessitate collaboration among governments to establish a unified approach, reducing risks associated with legislative fragmentation.

Adapting to Environmental Demands

As climate change continues to be a pressing issue, the cryptocurrency sector is facing pressure for sustainable practices, leading to the development of green cryptocurrencies and mining practices focusing on renewable energy.

Conclusion

The crypto geopolitical impact is undeniable, reshaping the intricate dynamics of global politics and economies. As more countries navigate their approach toward cryptocurrencies, the broader implications for national security, economic independence, and international trade will become increasingly evident.

In conclusion, the evolving relationship between cryptocurrency and geopolitics should prompt investors, businesses, and policymakers to stay informed and adaptable in this fast-paced financial landscape. This journey will ultimately require thoughtful dialogue and cooperation among nations to harness the benefits while mitigating associated risks.

For further information about navigating the complexities of cryptocurrencies, visit allcryptomarketnews.

Author: Dr. Anna Nguyen, a renowned expert in blockchain technologies, with over 15 published papers in digital currencies and the leader of multiple successful crypto auditing projects.