Bitcoin Mining Profitability: HIBT vs Vietnamese Savings Accounts

In recent years, Bitcoin mining has gained significant traction as a profitable venture. According to the latest data from the HIBT, the profitability of Bitcoin mining remains an intriguing subject, especially when compared to traditional savings accounts in Vietnam. In 2024, significant losses amounting to $4.1 billion were attributed to DeFi hacks, underlining the importance of understanding where to put your money safely. So, is Bitcoin mining still a better option than the conventional savings account in Vietnam?

Understanding Bitcoin Mining

Bitcoin mining refers to the process of validating and recording transactions on the Bitcoin blockchain. Miners use powerful computers to solve complex mathematical problems that enable them to add blocks to the blockchain. As a reward for their services, miners receive a certain amount of Bitcoin.

- Energy Consumption: Mining requires substantial energy and can be resource-intensive.

- Hardware Costs: Initially, setting up mining rigs involves significant investment.

- Market Volatility: The price of Bitcoin can fluctuate widely, impacting profitability.

Profitability Metrics for Bitcoin Mining

To evaluate Bitcoin mining profitability, you must consider several factors that influence earning potential:

- Mining Difficulty: This adjusts every two weeks, impacting how many blocks are mined.

- Power Costs: The cost of electricity in your region can substantially affect overall profitability.

- Bitcoin Price: Market price directly translates to revenue from mining.

Vietnamese Savings Accounts: An Alternative

In Vietnam, traditional savings accounts offer a different type of financial security. With the Vietnamese economy experiencing a user growth rate of over 20% in digital finance, many turn to banks for savings:

- Stable Returns: Interest rates for savings accounts typically range from 4% to 8% per annum.

- Government Insurance: Savings are often insured, providing a safety net for depositors.

- Liquidity: Easy access to funds can be appealing over long-term commitments.

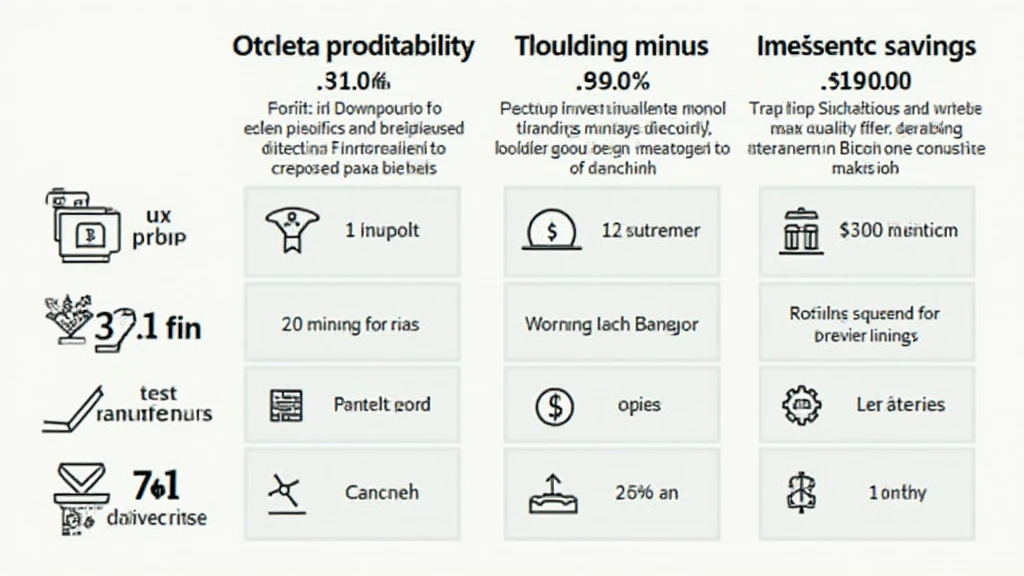

Comparing Profitability: HIBT vs Vietnamese Accounts

Let’s break it down further by comparing the potential profitability of Bitcoin mining using HIBT against traditional Vietnamese savings accounts:

| Aspect | Bitcoin Mining (HIBT) | Vietnamese Savings Account |

|---|---|---|

| Initial Investment | High (Mining rigs and setup) | Low (Initial deposit) |

| Return on Investment | Variable (Depends on Bitcoin price) | Stable (4-8% annually) |

| Risk Level | High (Market volatility) | Low (Government-backed) |

Long-Term Considerations

When considering the potential for Bitcoin mining versus traditional savings, it’s crucial to assess your risk tolerance and investment objectives. Bitcoin mining can yield high returns, yet it comes with higher risks; conversely, a Vietnamese savings account offers a safer, though less lucrative path.

The Future of Bitcoin Mining

As regulations around cryptocurrencies tighten and environmental concerns around energy consumption grow, future Bitcoin mining profitability may fluctuate further. According to HIBT, adopting innovations such as renewable energy sources may help mitigate costs and impact profitability positively.

Conclusion

Weighing Bitcoin mining profitability against traditional Vietnamese savings accounts involves more than just numbers. It requires understanding market trends, weighing risks, and contemplating your financial future. Both avenues have their unique advantages and disadvantages. For instance, while Bitcoin offers potentially higher returns, it’s crucial to engage with regulatory bodies regarding compliance, especially in rapidly evolving markets.

Ultimately, if you’re considering diving into the world of Bitcoin mining, ensure that you stay informed on market trends, continuously analyze your strategies, and explore reliable platforms such as HIBT for guidance. Whether you lean towards resilient savings or adventurous mining, a well-informed decision should always be your primary strategy.

As we move forward, the landscape of investment opportunities continues to evolve, and understanding both Bitcoin mining profitability and conventional savings will equip you better for the financial future ahead.

Remember, this information isn’t financial advice; it’s crucial to consult with local regulators and industry experts before making any significant financial decisions.