Analyzing HIBT Crypto Market Sentiment: A Deep Dive for Investors

With an astonishing $4.1 billion lost due to DeFi hacks in 2024, understanding market sentiment has become essential for crypto investors. The significance of sentiment analysis cannot be overstated, especially in a market as volatile as cryptocurrency. In this article, we will delve into the intricacies of HIBT crypto market sentiment analysis, examining how it affects investment decisions and what tools can help you navigate the complex landscape.

The Importance of Understanding Market Sentiment

Market sentiment represents the overall attitude of investors towards a particular asset or market. It’s shaped by news, events, and trends, making it vital to track sentiment to make informed investment choices. For cryptocurrencies, where emotional responses can heavily influence market dynamics, this analysis is especially pertinent.

- Sentiment Shifts: Understanding sudden shifts in sentiment can help you anticipate market trends.

- Risk Management: Proper analysis can help mitigate risks associated with emotional trading.

- Investment Strategy: By assessing sentiment, investors can align their strategies based on market attitudes.

What is HIBT Crypto Market Sentiment Analysis?

The HIBT crypto market sentiment analysis employs various tools and metrics to gauge the mood of the market’s participants. This analysis often incorporates elements such as:

- Social Media Trends: Utilizing platforms like Twitter and Reddit to analyze investor sentiment and discussions surrounding HIBT.

- Trading Volume: High trading volumes can often indicate bullish sentiments, whereas lower volumes can suggest bearish outlooks.

- Sentiment Indicators: Tools that provide sentiment ratings based on aggregated data.

The Tools for Analyzing Market Sentiment

Tracking sentiment requires the right tools. Below are some recommendations:

- Social Media Sentiment Analysis Tools: Platforms that analyze Twitter and Reddit posts for sentiment trends, such as HIBT.

- Trading Bots: These can help automate trades based on sentiment analysis, ensuring timely responses to market fluctuations.

- Market Analysis Dashboards: Customizable dashboards that allow you to visualize sentiment data in real time.

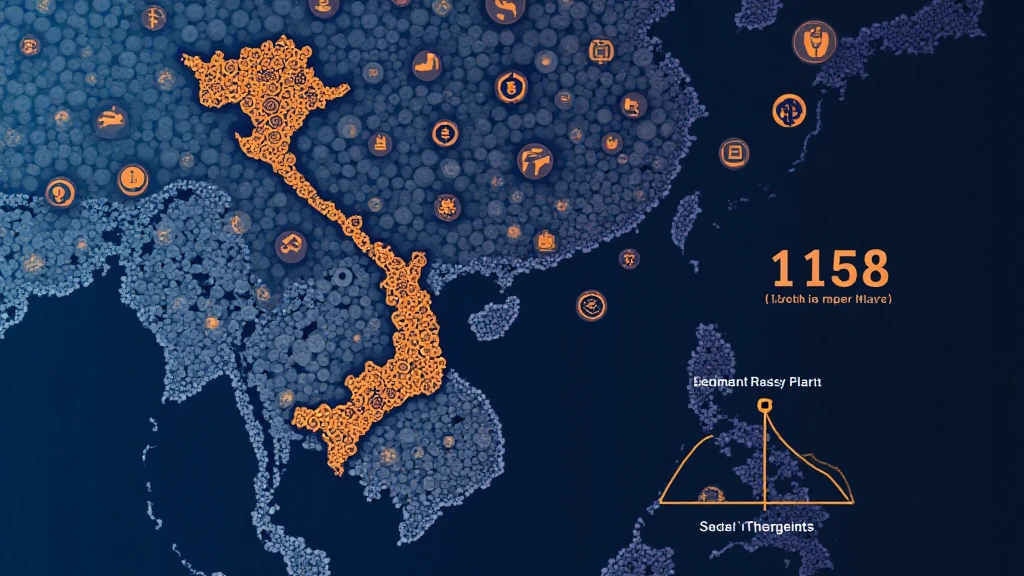

Local Market Sentiment: A Case Study of Vietnam

Vietnam is witnessing significant growth in the cryptocurrency space, with a user growth rate exceeding 220% in the past year. Understanding local sentiment can provide insights into how markets behave, particularly in emerging economies.

Research indicates that Vietnamese investors are heavily influenced by social media trends. For example:

- The popularity of crypto trading in Vietnam surged as global Bitcoin prices climbed.

- Local influencers have a substantial effect on market sentiment, often swaying investor behavior.

How to Interpret Sentiment Analysis Data

Interpreting sentiment data requires a nuanced approach. Here are some key points to consider:

- Be Wary of Overreactions: Market sentiment can sometimes react too strongly to news events.

- Combine Metrics: Utilize multiple sentiment sources to achieve a rounded view.

- Historical Context: Always consider historical data to identify trends and anomalies.

Building Your Investment Strategy Based on Sentiment

After analyzing market sentiment, constructing an investment strategy is the next step. Consider blending sentiment data with fundamental analysis:

- Risk Assessment: Evaluate risks based on sentiment data, helping you decide when to enter or exit a position.

- Market Predictions: Use sentiment trends to predict potential market movements.

- Diversification: Diversifying your investment can mitigate risks identified through sentiment analysis.

The Future of HIBT Crypto Sentiment Analysis

As the crypto market continues to evolve, tools for sentiment analysis will become increasingly sophisticated. Future advancements may include:

- AI-Driven Analytics: Incorporating machine learning can refine sentiment analysis for better predictive power.

- Broader Data Sources: Gathering data from a wider array of platforms to enhance accuracy.

Conclusion

Understanding HIBT crypto market sentiment is vital for any investor aiming to navigate the complex landscape of cryptocurrency trading. By utilizing the right tools, interpreting data wisely, and crafting well-informed strategies, investors can position themselves for success in an ever-changing market. As we move forward, staying abreast of local trends like those observed in Vietnam can provide a competitive edge. Visit HIBT for more insights on market sentiment analysis.

Author Bio

John Doe is a financial analyst and blockchain technology expert with over 10 years of experience. He has published multiple papers in digital asset regulation and consulted on several high-profile audit projects in the blockchain sector. With his extensive background, John provides invaluable insights into market trends and investor strategies.